patrick.net

An Antidote to Corporate Media

1,261,134 comments by 15,056 users - HANrongli, WookieMan online now

« First « Previous Comments 106 - 145 of 241 Next » Last » Search these comments

http://finance.yahoo.com/video/apple-shares-could-dip-below-170100918.html

Apple Shares Could Dip Below $500

This is either the buying opportunity of a lifetime, or a major paradigm shift for Apple.

$480B market cap.

$200B in assets at the close of this quarter.

2% dividend yield currently.

wish I hadn't sold at $12.50, sigh.

Another thing to consider, the knowledge of Apple's future growth has been baked into the price. What new information will cause the stock price to go up? A smaller iPhone? A bigger iPhone? A smaller AND bigger iPhone?

Other than that, it is all psychological.

In my view, Apple's only competitive moat was steve jobs because you cannot just buy Vision in the market.

And I remember him as a sushi eater.

I saw him several times in different sushi restaurants. That we have in common.

Vision is reflexive. Did Steve Jobs create the vision? Or did people call something a vision because it came from Steve Jobs? Or was it a feedback loop?

When will people start associate missteps to the beginning of the downfall? It is a nonlinear system.

It has nothing to do with technology or vision.

The ability to visualize a product as being important and valuable for customers is the "vision" i am talking about.Even customers didn't agree that they will like Ipad until they started using them..now thats called vision.

Yes, but then how many more customers "like" the product only because other people like it? A trend is a feedback loop.

The Apple Newton was even more "visionary." Yet it was a flop.

Try using Ipad for some time and see if serves a purpose for certain people and get back to me.

We have had several. We got two soon after the original launch.

Don't get me wrong, it is nice. But "vision" is really a crowd psychology thing.

apple newton was visionary but the end product didn't meet the vision.

But whether is was visionary could only be determined after the fact. If it were successful it would have been called a "vision."

Another thing...

Can one count on having new visions time after time?

Good companies sell good products. Great companies sell crap.

A person who "consistently" comes with new products which sell like hot cakes and are way ahead of the competition is visionary...period.

It was a self-reinforcing trend. And that person is no longer with us. What is the future of that trend?

Thats the whole point. since that person is no longer there, the future is bleak.

We will see. I am NOT an Apple fan, yet we have pretty much iEverything. ;-)

http://finance.yahoo.com/news/stock-index-futures-signal-lower-100247769.html

Apple (AAPL) fell for the third day in a row as the biggest drag on both the S&P 500 and Nasdaq 100 after reports on Monday of cuts to orders for iPhone parts. Apple was down nearly 3 percent at $487.50 after hitting a session low of $485.60, its lowest level since February.

It is always cyclical. The Apple stock goes up after the new product is announced. And it takes a dive after. I am always on the short sale after the new product announcement. And buy back later. I have never lost on this position yet. My gain this time is more than 20% in 4 months. I sold it at $700. I bought it back at $500. If it goes down even more, that's unrealized gain. I don't care.

Waiting for a bounce to put on a short. Am I too late?

Just wait til Apple announces a new exciting product like low cost iPhone. I am so sure that market is going to go wild bucking bull. After they blow their wad, you know what happens. Or are you going to buy now and take a chance that Apple is going to announce a new exciting product. Nah, I wait til they do. And I see how the market reacts and short sale.

Apple needs to make a real impressionable product this time. Unfortunately, no amount of investment can develop a talent like Steve Jobs and his visions. The talent is indeed scarce.

Apple Could Fall to $350

Looking forward, the money manager and blogger says Apple could fall to as low as $350 based strictly on technical indicators.

The Apple stock goes up after the new product is announced. And it takes a dive after.

Their latest new "product" appears to be an installment plan in China:

The share price jumped significantly on the news, but has begun settling back.

I remember when Nokia was the big star, then Motorola. Mass producing tech companies can achieve huge economies of scale for a while, but the party tends to move on eventually, to somewhere else.

Oh fuck, I LOL'ed.

Earnings are are coming up right quick. Anyone making bets? My gut tells me to lay down some Feb 10 calls at $530. The iPhone 5 and iPad Mini sold like heroin-infused hotcakes over the holiday season. For some reason, I expect record earnings as a result. Now, last quarter they announced record earnings and the stock tanked because investors wanted "RECORD record earnings" but I think that the market overreacted. When Apple reports solid growth this quarter, there may be a mad rush back in, and I expect AAPL to close over $600 in the next month.

I am not a financial adviser and this is not investing advice. Rather, it is wild speculation that is probably about as useful as telling you to go put all of your money down on red. It's the internet, where bullshit is FUN!

Yep, it was only a matter of time, especially when you consider direct Apple Competitors make crucial iPhone components, like Samsung.

Now who is going to buy all the run down 1200sqft shacks in Cupertino? We just lots a boat load of greater fools in one quarterly report. Doh

Now who is going to buy all the run down 1200sqft shacks in Cupertino? We just lots a boat load of greater fools in one quarterly report. Doh

yeah, $13 billion in profits in 12 weeks... Apple is really slacking.. only earning $6.5 MILLION an hour is gonna put them out of business real soon.

How much did Amazon earn in profits last quarter.. how bout Netflix?

Now who is going to buy all the run down 1200sqft shacks in Cupertino? We just lots a boat load of greater fools in one quarterly report. Doh

yeah, $13 billion in profits in 12 weeks... Apple is really slacking.. only earning $6.5 MILLION an hour is gonna put them out of business real soon.

How much did Amazon earn in profits last quarter.. how bout Netflix?

Apple is definitely doing well, but companies can change quickly. That's what "prediction" is all about. If everybody based their investment decisions entirely on past results, nobody would make money investing.

I don't see Apple "changing quickly". Worst case scenario its growth stalls.. which is happening to a degree. If growth stalls.. they will still bring in $40 Billion a year in profit.. so by 2020.. their cash hoard will be around $430 Billion....

Meaning the opening price of Apple stock tomorrow morning will roughly EQUAL it's cash hoard. It currently has about 30% of it's stock price in cold hard cash.

People are fearing Apple will become Microsoft... but Apple has larger margins and more marketshare to gain. They'll probably cede some marketshare in IPAD space... but they were very quick to come out with the IPAD mini to combat Samsung iterations.

Samsung can't be making much profit on their machines... They are falling into the Amazon trap of Revenue over profits.

I don't see Apple "changing quickly".

You could have said the same thing in 2004 in the opposite direction. Things change very quickly in this space. Where was Samsung prior to 2010? What happend to Nokia and RIM?

This isn't to say that I'd make any predictions of things going badly for Apple any time soon. They're a very well run company, even without Jobs. But they've failed to produce anything new and exciting since Jobs passed away, and the only entirely new product that they've unveiled since that event was met with scorn and derision.

They might be able to keep milking the iphone and ipad for years to come, or sentiment could turn against them overnight. Lots of companies (see: RIM and Nokia) thought that they were unassailable with loyal customers until they weren't.

The real test for Apple is to prove that they can produce new, great products without Steve Jobs. So far, they have failed to do that.

Worst case scenario its growth stalls..

No, the worst-case scenario is a massive, sudden drop in sales. Ask Nokia.

If growth stalls.. they will still bring in $40 Billion a year in profit.. so by 2020.. their cash hoard will be around $430 Billion....

They'd never sit on that much cash. With growth slowing, they'll start paying out dividends to keep shareholders pacified, and doing stock buybacks. There's no point in keeping that much cash, because the only companies that they could buy with it that make any sense would trigger anti trust issues (and Apple wouldn't want them anyway).

Apple is essentially Microsoft...

A company floundering to stay relevant, hemmoraging what talent it has left, and watching its core business gradually decay? That doesn't sound like Apple at all, actually.

but with larger magins and more marketshare to gain.

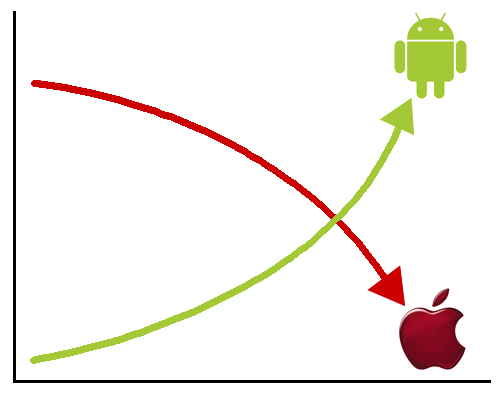

Apple has a larger share of the operating system market than Microsoft (Microsoft is now down to 18% of all personal computing devices, compared to Google's 51% and Apple's 25%). So not really.

They'll probably cede some marketshare in IPAD space... but they were very quick to come out with the IPAD mini to combat Samsung iterations.

I dunno about 'very quick' since they introduced it two years after Samsung came out with the galaxy tab. The ipad mini was clearly a response to the Nexus 7, not the galaxy tab.

Samsung can't be making much profit on their machines... They are falling into the Amazon trap of Revenue over profits.

Samsung is bringing in about $20B / year on their mobile business on revenues of $50B. It's the bulk (70%) of the company's profits. They're nothing like amazon.

Amazon didn't "fall into" anything. They're a retailer...retailers have very low margins.

Samsung made 25b last year and growing fast. Mobile is 70%. For all intent and purpose, Samsung is the most formidable tech company in the world.

I agree, Samsung will crush them all. They have been making cheap but good enough products and are to Apple what linux servers were to Sun servers - the ultimate commoditizers.

Samsung made 25b last year and growing fast. Mobile is 70%. For all intent and purpose, Samsung is the most formidable tech company in the world.

I agree, Samsung will crush them all. They have been making cheap but good enough products and are to Apple what linux servers were to Sun servers - the ultimate commoditizers.

Samsung is doing well right now, but I'd be cautious there too. They are great commoditizers, but that just means that they'll drive the margins on these devices into the ground, like what happened with PCs.

Margins on devices are already starting to decay. Look at the race to the bottom happening already: The Nexus 4 is the best android smartphone there is, and you can buy it for $300 without a subsidy. The Nexus 7 is the best android tablet there is, and you can buy it for $200 without a subsidy.

To me, it seems that the remaining profits are going to go to whoever owns the service and content ecosystems. Hardware will return to its natural low margin state. This doesn't just mean the platform owners like Apple and Google, but also service providers like Netflix and Amazon.

but that just means that they'll drive the margins on these devices into the ground, like what happened with PCs.

"Wintel" drove margins on PC's into the ground. There were plenty of profits to be made in the PC, Intel and Microsoft took most of it, leaving 5-10% to IBM, HP and Dell.

More reasons why Apple and Samsung will never go back to those days.

I dunno. The ipad mini was clearly designed as a price competitor. Samsung is already lowering the prices on their tablets in the wake of the N7 and various competitors from ASUS, Archos, and LG.

Whatever tablet margins are left will disappear over the next year. Apple may decide to copy their approach to PCs here, and remain a high margin, low market share player.

High end handsets are supported in large part by subsidies in the US (just compare sales numbers by country; high end phones don't sell well in countries without subsidies). All 4 major US carriers have indicated that they want to end the subsidy model.

Apple had a hard time selling iphones until they started getting subsidies for them. Nobody wanted to pay $700 for a phone. Once they could get it for $200-300 from AT&T, they started selling like hot cakes.

The nature of hardware is commoditization. Samsung and Apple can fight all they want, but there will always be somebody willing to go lower. Consumers are overwhelmingly willing to buy a lower quality product for a significant price cut.

I wouldn't be at all surprised if, 5-10 years from now, Apple makes a larger profit from the app store / itunes than they do on hardware.

Samsung won't allow anybody else to get the hardware profits on their devices, but that doesn't mean that they won't be willing to accept a 5% margin over all. After all, that would still be better than every other industry that they are in with the exception of financial services.

The interesting thing this time around is that there isn't anybody making a direct profit on software. Google's money comes from ads, digital content, and services. Microsoft is trying to give windows phone away for free (or even pay people to use it / sue them into using it) but doesn't seem to have any backup plan.

If Apple is a bad investment at its current price, then Samsung is an even worse investment.

Samsung has lower margins, and no premium pricing power.

Samsung doesnt control its OS... Google does.

Samsung has yet to innovate, just copied Apple.... Or made slight variations like increasing or decreasing Screen sizes.

What is going to drive growth in Samsung that wont also drive growth in Apple?

If subsidies to smartphones went away it would hurt Samsung just as much or more than Apple... Atleast Apple has some brand cache.

Buy American, buy Apple.

If Apple is a bad investment at its current price, then Samsung is an even worse investment.

Samsung has lower margins, and no premium pricing power.

Samsung doesnt control its OS... Google does.

Samsung has yet to innovate, just copied Apple.... Or made slight variations like increasing or decreasing Screen sizes.

None of these things really tells us whether Samsung is a good investment or not. Samsung is a highly diversified conglomerate. Apple makes a relatively tiny number of products. They're very different companies. Samsung was a huge (bigger than Apple at the time), profitable company long before they produced a single smartphone.

Note that, by revenue, samsung electronics (just one part of the company) is as big of a company as Apple.

What is going to drive growth in Samsung that wont also drive growth in Apple?

Processors, memory chips, hard drives, televisions, refrigerators, nuclear reactors, ship engines, financial services, insurance, heavy machinery, farm equipment, civil engineering, IT consulting, shipbuilding, construction, theme parks, advertising, airplane engines, cameras, stereos, networking equipment, clothing, chemicals, pharmaceuticals, hotels, mining, energy, water purification, and health care.

Take your pick?

If subsidies to smartphones went away it would hurt Samsung just as much or more than Apple... Atleast Apple has some brand cache.

Nope. In countries that don't have subsidies, Samsung outsells Apple by more than they do in the US. They make cheaper hardware, and only a small segment of the population is willing to pay more money for brand (nevermind quality...people make poor decisions)

Buy American, buy Apple.

How about Motorola, Vizio, or Dell?

I don't think it has anything to do with components as Apple can outsource that plus these arrangements are long term that benefits both sides.

They already outsource: iPhone chips are made by Samsung. There is no ready substitute if Samsung has issues, or decides to prioritize their Galaxies over supply Apple.

Many components of the iPhone are other companies' proprietary IP and not readily substituted.

The must have Apple is now nice to have. Also, with a closer replacement cycle, I think consumers stopped buying the most expensive ripoff version of the Ipad/Iphone (32GB vs. 16GB anyone) which are all profits.

Yes, right on.SFace says

Apple may have topped out at 40B - 50B in earnings. I don't how much more Iphone/Ipad they can sell in the future and not eat into their owns sales/profits. Consumers are already not buying as many macs and Ipods.

Really, the worst factor is finding another hit. I don't know where's the next ipod, next Iphone, next Ipad is.

I agree. How many more rabbits can they pull out of a hat? They had some big hits in a short time, but can they keep it up? It's hard to keep topping yourself when you're at the top of the heap.

Apple designed the A5 or whatever, Samsung Manufactures them. When you go into a contract to manufacturer chips, they are structured long term with tremendous exit costs with cost certainity. In the case of Apple and Samsung, probably in the billions.

Apple did NOT design the entire A4 or A5. The architecture of the 'system on a chip' is licensed from ARM Holdings. The Design of the chip itself is a collaberation with Samsung, based on requirements by Apple; additional functionalities are licensed from other firms like Audience.

The A6 is the first chip by Apple where Samsung didn't play a development role.

This is really telling, because Apple is starting to turn away from Samsung and stop letting it's #1 competitor make it's chips. This is an indicator that there is either margin pressure or some other force at work making Apple move away to other manufacturers.

Now who is going to buy all the run down 1200sqft shacks in Cupertino? We just lots a boat load of greater fools in one quarterly report. Doh

yeah, $13 billion in profits in 12 weeks... Apple is really slacking.. only earning $6.5 MILLION an hour is gonna put them out of business real soon.

How much did Amazon earn in profits last quarter.. how bout Netflix?

Apple as a company is fine. It is just realizing that at 500B (now 400B) market cap, it really suffers like all those before it. Remember when Cisco hit 500B. Same story here.

I was more referring to all the Apple workers that are distorting the real-estate market in Cupertino because of the over-inflated Apple stock. At $700/sh, you can be sure there are more millionaires than at $450/sh. The trouble when people get access to large amounts of money quickly, is they don't respect what it says. Hence, everyone overpays for a sugar shack. Good luck to all the sugar shack owners out there. ;)

Apple only employs about 30000 people in Cupertino. Most don't live there. They don't exist in a vacuum.

AT&T has released its holiday quarter earnings data, reporting that it sold a record 10.2 million smartphones -- 8.6 million of those (84%) being iPhones. AT&T reported earlier this month that the quarter was its best ever for iPhone sales. 16% of the iPhones were on accounts new to the company.

During the same holiday quarter, Verizon activated 6.2 million iPhones, some two-thirds of its total smartphone sale. AT&T's previous best quarter was 2011's fourth quarter, when it activated a total of 9.4 million smartphones and 7.6 million iPhones -- an 80% share for the Apple device.

On Twitter, Apple watcher Sammy the Walrus calculated that 74% of smartphones sold by AT&T and Verizon were iPhones, giving the device an "iPod-like share".

***

So on the two largest telcos in the U.S... 74% of all phones sold are IPHONES.. and Wall Street panic sells?

So on the two largest telcos in the U.S... 74% of all phones sold are IPHONES.. and Wall Street panic sells?

They might be worried about the history of Nokia repeating itself. Trees don't grow to the sky. OTOH, if I had to bet on AAPL (P/E=10) or FB (PE=289), I'd bet AAPL.

Apple only employs about 30000 people in Cupertino. Most don't live there. They don't exist in a vacuum.

I never said they did. What I was insinuating was that Apple's stock has given many employees the ability to pay double or more than they should for a sugar shack in Cupertino. With this latest drop you can be sure the real estate market will suffer in that area. Back to reality sucks.

After Hours : 448.53 1.97 (0.44%) 7:46PM EST - Nasdaq Real Time Pric

http://finance.yahoo.com/news/samsung-posts-record-profit-000031770.html

Samsung posts record profit; will not reduce spending

SEOUL (Reuters) - Samsung Electronics Co reported a record quarterly profit of $8.3 billion and kept its 2013 investment plans at the previous year's level, defying expectations that it may reduce spending amid weaker demand for computer chips.

The South Korean firm said October-December operating profit increased 89 percent from a year ago to 8.84 trillion korean won ($8.3 billion), in line with its earlier estimate.

In a statement on Friday, Samsung said it would keep 2013 investment at a similar level to 2012, despite a bleak PC outlook and a move by rival Apple Inc to diversify its supplier base.

« First « Previous Comments 106 - 145 of 241 Next » Last » Search these comments

Starting my New Year with a nice bump on the AAPL I picked up last year.

Consensus on AAPL to $500? It's testing 52-week high.