« First « Previous Comments 127 - 132 of 132 Search these comments

As someone who has been trying to find a good lot to build on for months, I'm going to have to disagree about land near big cities.

With cities poised to go bankrupt all through the U.S. you can bet that re-zoning will be done in metro areas. I didn't say the land was accessible right now, but it will be. Look around, it is everywhere. The one thing this country has is land.

If you can see, and quantify the shadow inventory, it's no longer a shadow.

The investers are buying these up as fast as they can because they think that they can rent them back to the defaulters for more than the defaulters were paying in mortgage.

This makes roughly zero sense. If they can afford a higher rent payment, they wouldn't be in default on the loan.

I don't think anybody is that dumb. They're buying the properties because they can make a decent rental profit, not because they're delusional.

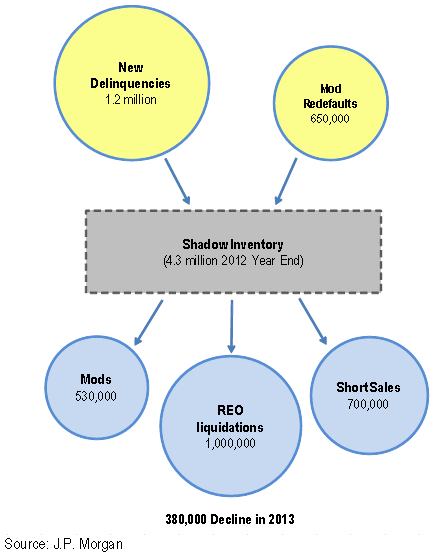

Even the biggest of Ponzi enablers, JP Morgan Chase, doesn't claim there isn't any "shadow inventory":

People just disagree on the numbers, and how it will have an effect on the market. But the homes aren't really in the shadows.

It looks like the outflow exceeds the inflow. We should be out of the housing mess within a couple of years.

I think at minimum, 3-4 years. That's assuming the fundementals such as unemployment, growth, etc correct as well.

If unemployment remains high, and we continually hit debt ceilings, I think all bets are off.

One thing is for sure, we're not out of the woods quite yet.

« First « Previous Comments 127 - 132 of 132 Search these comments

According to Foreclosureradar.com, there is no shadow inventory, so good luck to those waiting for a flood of houses to go on the market...

http://www.contracostatimes.com/ci_21312143/bay-area-foreclosures-jump-july

#housing