patrick.net

An Antidote to Corporate Media

1,262,432 comments by 15,079 users - Al_Sharpton_for_President, Blue, Ceffer, Maga_Chaos_Monkey, Tenpoundbass online now

Comments 1 - 27 of 27 Search these comments

Of course it doesn't work!

I know. It's obvious to me, but it's not obvious to a lot of people. The article is from a mainstream economics point of view as to why QE doesn't work.

I still don't quite understand it well enough to know whether it should work or not.

I think the main problem is that the mortgage banking system realized that creating debt is pretty much the same thing as creating money, at least until the debt gets defaulted on or paid back, when the new money is destroyed.

So vast amounts of unsustainable mortgage debt were created, and that is actually when the money supply increased. We lived through a period of hyper-inflation, but did not recognize it as such because the increased mortgage debt made many people feel wealthier even though nothing new was created.

Now as that debt is being defaulted on, money is being destroyed, which is deflationary. So the Fed is trying to buy up as much of that bad debt as possible, at public expense, with newly printed dollars to try to stop the deflation and protect the banks from eroding balance sheets (the Fed exists mainly to protect the biggest banks from responsibility for their own decisions).

I don't think their printing can really make much difference because it's limited by the bond market, but I'm not sure about that.

I don't think their printing can really make much difference because it's limited by the bond market, but I'm not sure about that.

I've been wondering about that too. Martin Weiss's 2003 book Crash Profits predicted that it wouldn't work and that even the suggestion or hint of it would cause bond rates to rise, forcing the government to back off. But, with Bubbles Ben printing $ to buy bonds, bond rates are actually down. Now the Fed has forsaken its official mandate of price stability and instead expressly promotes positive inflation (they say 2% inflation, but a third of CPI consists of housing, so that means they are deliberately inflating other prices to restore a normal asset/consumer price ratio). I hadn't expected them to get away with punishing savers and retirees, but evidently the banks are much more powerful, partly because the people (sheeple) are so deeply divided. It seems to be delivering the results that the Fed bankers wanted, so I guess it will continue.

So vast amounts of unsustainable mortgage debt were created, and that is actually when the money supply increased. We lived through a period of hyper-inflation, but did not recognize it as such because the increased mortgage debt made many people feel wealthier even though nothing new was created.

This is precisely correct.

There's too much of the future consumption which a lot of people in the private sector have brought to the present. Which means adjust to a harsher reality going forward.

I don't think their printing can really make much difference because it's limited by the bond market, but I'm not sure about that.

To extend your thought exercise further,

What is the limit on the bond market issuance? Answer: really depends on fiscal policy.

Can Congress let Bush tax cuts expire? (revenue increase)

Can Congress meaningfully agree on where to cut? (I am sure there are avenues to cut, there's complete lack of political agreement to cut anywhere though).

Can Congress kick the can down the road and do nothing? Absolutely, which would mean Congress thinks their power to issue bonds is unlimited.

We can be reasonably certain that China and Japan (our largest bond buyers) won't go dump their bonds. That would be a suicide on their part.

But if Congress keeps contributing to the outlook that the future remains bleak, then the future will remain bleak and there are real catasrophe risks.

Now the Fed has forsaken its official mandate of price stability and instead expressly promotes positive inflation (they say 2% inflation, but a third of CPI consists of housing, so that means they are deliberately inflating other prices to restore a normal asset/consumer price ratio).

Here's the thing though: They can't easily control velocity. Velocity of money is related to human behavior and we all know that can be very irrational.

You can count on reactionary policies if inflation does take hold, which means it'll be too late for them to do anything meaningful without tanking the economy.

Central banking is playing with fire.

Can Congress kick the can down the road and do nothing? Absolutely, which would mean Congress thinks their power to issue bonds is unlimited.

Yes, huge deficits are now bipartisan, and Republicans have followed Cheney's lead in saying "deficits don't matter." This gives them the delusion of unlimited power to cut taxes and increase spending. It seems amazing that they could fool themselves into thinking they are the first to discover the printing press, but reality can't compete with unlimited free money.

But if Congress keeps contributing to the outlook that the future remains bleak, then the future will remain bleak and there are real catasrophe risks.

Yes, and it's funny to hear certain politicians say they need to "restore confidence" by cutting taxes, when of course deficits have exactly the opposite effect. Sound fiscal and monetary policy promote confidence, the way solid ground encourages people to lay foundations and build upon them. Huge deficits and reckless monetary policy undermine confidence, causing investors to flee into commodities, which in turn drives up commodity prices and weakens the real economy.

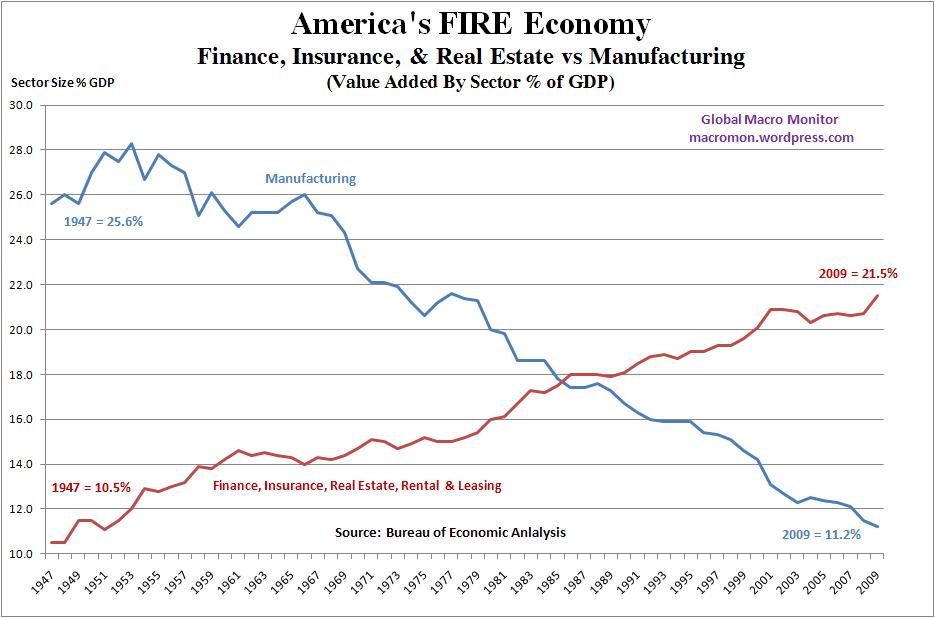

For example, if people see a high risk of increasing oil prices, they put their $ into oil futures (itself a dark market that needs transparency and regulation and tracking investments that don't become self-fulling prophecies). Currently that becomes a self-fulling prophecy, so oil prices go up and airlines go bankrupt and cut back capacity laying off all the associated workers. If people see sound fiscal and monetary policy they are more likely to invest in airlines and building planes, which means hiring a lot of people to staff the airlines and build the planes. Deficits and Fed policy are sacrificing the real economy to bail out the FIRE lobbyists; it "works" from the lobbyists' POV but nobody else's.

What is the limit on the bond market issuance?

That is the question for sure, both public (Treasury bonds) and private (corporate and mortgage-backed bonds).

At some point, the public just isn't going to want to buy them unless interest rates are higher. So the Fed steps in and buys up bonds to drive down rates, but how long can that go on?

In the long run, it looks like bond sellers will skip the public and all bonds will just be issued directly to the Federal Reserve, which will buy up even toilet paper with new dollars, making new dollars seem a lot like toilet paper itself.

OK, lets say the Fed buys all bonds on earth to keep interest rates down. Even then, those bonds will mature and the borrowers who created the bond will have to pay back into the black hole of the Fed, and that money will all be destroyed -- and then some, because the borrowers have to pay interest as well.

It's a weird time-dependent game and I just can't grok it.

Deficits and Fed policy are sacrificing the real economy to bail out the FIRE lobbyists; it "works" from the lobbyists' POV but nobody else's.

OK, lets say the Fed buys all bonds on earth to keep interest rates down. Even then, those bonds will mature and the borrowers who created the bond will have to pay back into the black hole of the Fed, and that money will all be destroyed -- and then some, because the borrowers have to pay interest as well.

The borrowers simply refinance by issuing new bonds. To paraphrase Leona Helmsley, only the little people pay interest; crony capitalists and lemon socialists can borrow trillions at ZIRP. I don't know how long it can continue, but at some point the world's reserve currency becomes toilet paper. Perhaps some intervening event will be the catalyst, and will get blamed as if it were the cause. For example, 9/11 became the pretext for the so-called "Patriot Act" and the Iraq War, both of which were pre-determined policies. (Remember W saying of Saddam, "We're taking him out.") The printing press keeps working until it doesn't, and if that moment coincides with a natural disaster or war or plague, politicians can shift the blame onto that event. People used to save for a rainy day, but now the Fed and FIRE industry borrow for a rainy day, so they can have an excuse to monetize the debt and continue the cycle.

It's a weird time-dependent game and I just can't grok it.

I have some idea on what could happen, but it is still not very clear, primarily because the future paths are nonlinear.

I think if the future continues to remain bleak, then the dollar will soar as final defense. All that money sitting in different durations will want to move to the shortest duration (T-bills) so we can see negative rates on the shortest term bills.

Cash will become very dear.

But if the policy response is going to be non-stop printing even then (to save the debts), then it can exponentially spiral into hyperinflation.

The printing press keeps working until it doesn't, and if that moment coincides with a natural disaster or war or plague, politicians can shift the blame onto that event.

http://www.youtube.com/embed/HGgm1pJYXs8

"All the hyperinflations upto now have happened in the context of a war, where stockpiles of commodities were destroyed or used up, where production facilities were destroyed. We don't have that now, there will be a squeeze on producers, producers will go bankrupt but until shortages appear --- I don't see hyperinflation."

"All the hyperinflations upto now have happened in the context of a war, where stockpiles of commodities were destroyed or used up, where production facilities were destroyed. We don't have that now, there will be a squeeze on producers, producers will go bankrupt but until shortages appear --- I don't see hyperinflation."

Interesting - this reminds me of George Orwell in 1984, who said the war was really about destroying surplus production in a way that was psychologically acceptable to the population, to keep them laboring to produce more. I think the same may be true of the otherwise astonishing waste in the medical-industrial complex, on which ObamneyCare will require us to spend even more. Production facilities aren't destroyed per se, they are merely re-purposed to the production of psychologically acceptable waste. More $ for toxic pills produces more hospital admissions which produces more nosocomial infections which produces longer hospital stays which produces more "jobs".

Obviously No.

Of course it doesn't work!

I still don't quite understand it well enough to know whether it should work or not.

You guys are missing the important question. The real question isn't "Does QE work?" but rather "For whom is QE intended to work?".

QE does not improve the economy, help the middle class, create jobs, or mitigate the wealth destruction experienced by peak buyers of housing or housing stocks.

What QE does is silently and without accountability transfers massive amounts of purchasing power from the middle class, particularly savers, to the banks. QE does work, it works for the banks! And it does exactly what the big banks want it to do. QE transfers the loses of bad loans that are in default from the banks that knowingly issued those fraudulent loans to the public, particularly savers.

QE does this flawlessly.

So often the real problem is that people think the intention of an organization is to look after the interests of X when really it is to exploit X. This is why people think that the leaders of the organization are idiots, when in fact, they are doing what's perfectly rational an in their best self-interests. The mistake is thinking that their self-interests and yours are the same.

Interesting - this reminds me of George Orwell in 1984, who said the war was really about destroying surplus production in a way that was psychologically acceptable to the population, to keep them laboring to produce more.

There is no such thing as surplus production, only overpriced products and services. All production will be consumed if prices right.

Housing is a perfect example. There are not enough houses built to handle the full demand of every renter, ever married couple that wants to get divorced, every young adult who is still living with his parents to save cash. If priced right, not only will every house for sale be sold in a day, but there would be sufficient demand for a hell of a lot of house building.

There is no such thing as surplus production,

I was relying on memory; Orwell phrased it more clearly and at greater length:

"In a world in which everyone worked short hours, had enough to eat, lived in a house with a bathroom and a refrigerator, and possessed a motor-car or even an aeroplane, the most obvious and perhaps the most important form of inequality would already have disappeared. If it once became general, wealth would confer no distinction... In the long run, a hierarchical society was only possible on a basis of poverty and ignorance... In principle the war effort is always so planned as to eat up any surplus that might exist after meeting the bare needs of the population. In practice the needs of the population are always underestimated, with the result that there is a chronic shortage of half the necessities of life; but this is looked on as an advantage. It is deliberate policy to keep even the favoured groups somewhere near the brink of hardship, because a general state of scarcity increases the importance of small privileges and thus magnifies the distinction between one group and another. By the standards of the early twentieth century, even a member of the Inner Party lives an austere, laborious kind of life. Nevertheless, the few luxuries that he does enjoy—his large, well-appointed flat, the better texture of his clothes, the better quality of his food and drink and tobacco, his two or three servants, his private motor-car or helicopter—set him in a different world from a member of the Outer Party, and the members of the Outer Party have a similar advantage in comparison with the submerged masses whom we call ’the proles’. The social atmosphere is that of a besieged city, where the possession of a lump of horseflesh makes the difference between wealth and poverty. And at the same time the consciousness of being at war, and therefore in danger, makes the handing-over of all power to a small caste seem the natural, unavoidable condition of survival."

http://akamat.wordpress.com/2007/07/31/the-purpose-of-war-according-to-george-orwell-1984/

"Quantitative Easing," i.e. printing money and handing it to the crony capitalists and lemon socialists who sit nearest the Fed's printing press, rewards the Inner Party. But, most of them have worked phenomenally long hours for their chance at this privilege, and many of them continue to work phenomenally long hours to stay there. As a Wall Street veteran put it, "Work like a dog, get paid like God." Many end up divorcing wives who hate them and losing custody of kids who don't even know them. Meanwhile, the Outer Party members grab what crumbs they can, while growing numbers of proles become homeless as the Fed "helping homeowners" props up house prices. Thus the structure is maintained, the apparent "waste" and incongruities (homeless people sleeping on sidewalks in front of vacant buildings) being essential to it. As the advent of nuclear weapons has made total war impracticable, we see instead endless "low intensity conflicts" (Viet Nam, Afghanistan), the "drug war" (itself a product of the military-industrial complex, the prison-industrial complex, and the medical-industrial complex, to stop familiar remedies grown in home gardens from competing with more lucrative patent medicines sold by trained and licensed pharmacists) and of course the culture wars. Add to this the one-two punch of subsidizing HFCS and ObamneyCare, while taxing vaccines, and you get what might be called a "war on health."

I think Dan beat me to the punch.

Does QE work?

A qualified yes. BofA and Citi are still standing.

This is not all bad; California is hanging on too. Hopefully Prop 32 will help put us on firmer ground.

QE does this flawlessly.

I disagree on this part. I agree on the benefit of the banks, but there are real currency and geopolitical risks involved. So the process is certainly not flawless.

Ofcourse QE will work. The whole point is to prevent the banks and other oligarchs from suffering the losses the free market, if left to its own devices, would impose on them by slowly transfering the downside to the common people of the developed world through inflation and market manipulation of the asset clases they most commonly hold their life savings in.

Ofcourse QE will work. The whole point is to prevent the banks and other oligarchs from suffering the losses the free market, if left to its own devices, would impose on them by slowly transfering the downside to the common people of the developed world through inflation and market manipulation of the asset clases they most commonly hold their life savings in.

Indeed, propping up house prices by increasing the likelihood and degree of consumer price inflation, at a time of falling wages, results predictably in more people having to work harder for less. The proles must surrender more of their lives laboring for the basic necessities of life: food, clothing, and especially shelter. Meanwhile, the crony capitalists and lemon socialists nearest the Fed printing press can enjoy the returns of free money borrowed from the public or printed at public expense, privatizing the gains and socializing the losses, as it was in TARP, is now, and (per Bubbles Ben) ever shall be, QE without end amen.

by slowly transfering the downside to the common people of the developed world through inflation and market manipulation of the asset clases they most commonly hold their life savings in.

I think QE does help the debtors by keeping asset prices elevated. How many people who own (correction: rent) a house (correction: from the bank) will complain about QE?

I think QE does help the debtors by keeping asset prices elevated. How many people who own a house will complain about QE?

Most, who have zero or negative net worth, would have been better off declaring bankruptcy, although bankruptcy reform made that more difficult for many. But, those who feel trapped in underwater mortgages, or have minimal equity, may cheer QE for the same reason hostages cheer the payment of ransom: they hope it will bring them release. In countries where the drug war has made kidnapping endemic, the payment of "first ransom" then leads to a demand of second ransom. The overpriced American medical-industrial complex operates similarly, as the payment of mandatory overpriced insurance premiums leads to the payment of co-pays, deductibles, and essential expenses not covered by insurance. The purported beneficiaries aren't really better off, but they hope so within the narrow constraints that they accept as immovable.

Or, as members of the Outer Party, indebted homeowners covet continued favor over the disfavored proles (renters and savers).

The proles must surrender more of their lives laboring for the basic necessities of life: food, clothing, and especially shelter. Meanwhile, the crony capitalists and lemon socialists nearest the Fed printing press can enjoy the returns of free money borrowed from the public or printed at public expense, privatizing the gains and socializing the losses, as it was in TARP, is now, and (per Bubbles Ben) ever shall be, QE without end amen.

Yes, as William Domhoff wrote in "Who Rules America?", it's all about control over labor.

That's also why the workweek never gets shorter even as we supposedly get "richer". All the benefits of increased productivity go to the crony capitalists and lemon socialists, not to the people actually doing the producing, because they are easily divided and conquered with emotional but irrelevant issues.

as William Domhoff wrote in "Who Rules America?", it's all about control over labor.

Yes, and thanks for pointing me to William Domhoff, who has been publishing editions of WRA since 1967. What I think is new, and inspired the 2008 Tea Party and the Occupy movement, is the 2008 collapse revealed that the emperors had no clothes. They paid themselves huge sums to ruin the institutions with which they had been entrusted. Previously, one might complain about an elite group running everything, but at least they appeared to have some idea of how to promote a growing economy. TARP and QE have propped up the one group of people we know can't run a bank, because they took charge of banks that used to be healthy and then bankrupted them. A blindfolded monkey, or a wino on Skid Row, could not have done worse. An average secretary could probably have done better. In the past, for a while, Fed policy worked for bankers who, one could argue, may possibly have been helping to build the larger economy. Now it works only for crony capitalists and lemon socialists who clearly can't successfully run banks, meaning it can only worsen the larger economy.

QE transfers the loses of bad loans that are in default from the banks that knowingly issued those fraudulent loans to the public, particularly savers.

I agree with your conclusion generally. However, even though savers are punished, it will ultimately be the taxpayer who will foot the bill. Aside from the Maiden Lane accounts (which was illegal and the FED is trying to sell), the FED has only been purchasing government agency backed paper. That is why this is really fiscal policy that they are involved in. The government is and will continue to pay the losses on loan defaults to the FED from taxes. So the deflation in housing is being born by savers, taxpayers and consumers (through inflation). So yes, the banks continue to rape the public but nobody wants to protest because everyone knows that if they stop there will be a deflationary collapse. It will happen eventually anyway, once the debt servicing costs take up too much of the USG tax revenue. But, like drug addicts, politicians will keep going back for their fix until the inevitable overdose.

As far as I can tell, it works inasmuch as "debt equals wealth." So, yeah it "works" in the short term if you don't mind the long term outcome being worse than it would have been without it.

Obviously No. but here's a detailed explanation:

http://www.creditwritedowns.com/2012/10/are-the-federal-reserve-and-other-central-banks-printing-money-to-solve-this-crisis.html

QE will end in massive loan losses from inflated asset prices and distorted investment allocation. Count on it. - Ed Harrison