patrick.net

An Antidote to Corporate Media

1,360,114 comments by 15,747 users - goofus, Misc, Tenpoundbass online now

Financial markets may be underestimating threats to the global economy

2014 Apr 3, 3:17pm 4,691 views 10 comments

Comments 1 - 10 of 10 Search these comments

Dude - what do you need horses and bayonets, spears and lances?

The cold war is over - didn't you hear Obama? Hes the Pres - has he ever misled US?

Dude - what do you need horses and bayonets, spears and lances?

The cold war is over - didn't you hear Obama? Hes the Pres - has he ever misled US?

Dude - what do you need horses and bayonets, spears and lances?

The cold war is over - didn't you hear Obama? Hes the Pres - has he ever misled US?

Ayyyyyyyyyy...YEAAAH

This guy did too!

The risk of a hard landing in China has been present for quite a long time, and it should be in the list of the "main risks a year ago".

Bond yields to hit fresh lows as world recovery wilts, growls Saxo bear

By Ambrose Evans-Pritchard

If you thought I was gloomy about the state of the global economy, try Steen Jakobsen from Saxo Bank. There will be no further recovery. We have already enjoyed the good times for this cycle. It is downhill from now on, or at least very soon.

The rise in average 1-year rates from 1.50pc to 1.95pc in the G10 economies over the last year has already been enough to push the whole fragile edifice over the edge once again – albeit with a lag. “The world is in depression. There is no way it can survive higher rates,†he said.

http://www.-yblvWycttA&feature=player_embedded

US 10-year Treasury yields will soon roll over and slowly drop to all-time lows beneath 1.50pc by mid-2015.

The S&P 500 index of stocks on Wall Street will give up all of the QE3 gains, sliding down by almost a quarter to 1,400 in a year-long bear market.

As you can see from this chart, US margin debt is flashing the same sort of top seen shortly before the dotcom crash and the Lehman crisis.

Mr Jakobsen advises clients to take shelter in fixed income. “There will be nowhere else to go,†he said.

The rise in the euro to almost $1.40 will scupper Europe’s very weak recovery – if you can call it that – and push even Germany to the brink of recession by the end of the year. A perfect currency storm is coming as Europe and the US pull in different directions, with the of ECB opening the door to QE while the Fed is turns off its liquidity spigot. “We have the biggest sell-signal for the euro since the start of monetary union,†he said. Target $1.25 by early 2015.

Don’t count on Abenomics in Japan to help (his view, not yet mine). The Topix in Tokyo is already back to where it was fourteen months ago, as if the whole great experiment were a mirage.

As you can see from this chart, the Japan Economy Watchers Survey has dropped to levels below the worst days of the 2008-2009 crash. Somebody is worried about the jump in sales tax from 5pc to 8pc, even if the Bank of Japan keeps up a good front.

There will be no quick rescue from the US Federal Reserve this time. The hawks are determined to press ahead with bond tapering. The pretence that this is not monetary tightening is unlikely to gull markets for much longer.

Janet Yellen may be a dove but this can be misunderstood. Mr Jakobsen says her disgust over rising inequality trumps all else. She too is suspicious of QE-driven asset bubbles that concentrate wealth yet further.

It is worth noting that her old home – the San Francisco Fed – is leading the revisionist charge on QE, questioning whether it does much good once you move beyond an immediate liquidity crisis.

My own view is that critics of QE misdirected their fire for five years. They kept warning that it must inevitably lead to an inflationary blow-up, and they still do. (I was sent a Zimbabwe bank note with a face value of one hundred trillion dollars this week as a rebuke for my pro-QE heresies).

Instead it we are now closer to deflation in the Western world than at any time since the 1930s. The critics confused the monetary base with the money supply. Chalk and cheese.

However, there are two very good reasons to ask whether QE has been a dangerous gamble.

1) 1) It has played a key part in driving inequality to obscene extremes. You don’t have to be a Leftist to see that this is a danger to social cohesion. Any Burkean conservative worth his salt must see the danger as well.

Burke justified inequality that stemmed from “the nature of things†but what is happening now is of an entirely different character. It is not supporting a civilised order of mutually binding obligations, it is polluting society and poses a slow threat to democracy.

2) 2) As the Bank for International Settlements has warned, QE is creating yet another speculative house of cards that sits precariously on a dysfunctional global economy that has never fully recovered. (Due to excess capacity, the China effect).

If and when it bursts, we may find that the deflationary wave has grown even larger and will come crashing down on our heads with yet greater ferocity.

You can draw on your own conclusion. Like many others – notably ex-FSA chief Adair (Lord) Turner – I have been wondering for the last two years whether QE should not be deployed in entirely different way if we need it again, this time to fight chronic structural deflation.

Instead of buying bonds or assets, central banks could fund the construction of roads, houses, power stations, or even pay for scientific research. Takahashi Korekiyo forced the Bank of Japan to fund government spending directly in the 1930s until the real economy – not the stock market – had achieved “escape velocity†and broken free of the slump. Central banks hate this of course. It is damned as “fiscal dominanceâ€. But this is a controversy for another day.

Mr Jakobsen has a different view. He thinks the world economy will touch bottom in 2015. But then it will be fully healed, ready for a wonderful secular boom.

“Everybody will be fighting deflation by then and this is going to be the next big mistake by central banks. The best macro-policy is usually to do absolutely nothing,†he said.

Artificially reducing the price of money, which I believe is what the intention of QE was, will generally result in painful future financial dislocations. There are many bubbles around the world waiting to be popped. US equity markets, especially tech stocks, emerging markets' bonds, currencies, stocks, and real estate, commodities, Canadian condos, the euro, junk bonds, and more. A reset is likely soon.

Putting the pending disaster behind us for a moment and trying to think about the aftermath, it's clear that Keynes and his work is dangerously seductive for progressive economists and corrupt idiot politicians.

The temptation to buy votes by loading up the non-voting unborn with debt is simply irresistible.

So once this all comes crashing down we need to make sure that the Keynes zombie is really dead, lest it lurch back into life when the next generation of idiot politicians and bearded leftie technocrats take the helm of whatever we manage to reconstruct from the wreckage.

The Keynes zombie must be destroyed utterly.

We must be very clear on WHY macroeconomics is not a thing.

WHY aggregate demand is unwise to manipulate.

WHY deferred purchasing is largely a myth.

Most importantly, we must destroy the idea that inflation benefits the consumer.

Repeat it again and again - INFLATION IS THEFT.

Even if you take the position that an ever increasing supply of money is required (which I don't personally ...) then QE is not the only way to achieve it. The government for example could create new "sound" money which it used to fund public services, this way private institutions such as banks don't get to make free money by charging interest on the new money and wealth gets (re)distributed to where its needed most.

http://www.marketwatch.com/story/risks-in-china-stimulus-2014-04-06

By Craig Stephen

HONG KONG (MarketWatch) - The catchall response to worries about China’s credit-bloated economy is don’t worry, the government controls the money, and with it, the ability to fix or patch-up any problems. That means talk of a Lehman-style financial crisis, a Minsky moment or a property implosion are all rather far-fetched, as Beijing simply won’t allow it.

Indeed, last week it was very much business as usual as a mini-stimulus was announced to shore up flagging growth. This will see more affordable housing being built, more railways, as well as a tax cut for small businesses.

At the same time, guidance from China’s central bank was unequivocally reassuring. The People’s Bank of China (PBOC) released a brief statement after its quarterly policy meeting saying economic conditions are in a “reasonable range,†though the economy faced complicated situations. It also reaffirmed a commitment to keep the exchange rate at an “appropriate level,†while adding that domestic price levels are basically steady.

This sanguine outlook is a contrast to red flags at various agencies, from the IMF to the Bank of International settlements, about China’s dangerous build-up of credit, now estimated at over 200% of GDP.

Such warnings are nothing new perhaps, but the difference this time is that the PBOC no longer controls all the money.

It has become increasingly clear just how much foreign capital China has borrowed, despite its closed capital account. And this foreign capital is getting edgy as the yuan USDCNY -0.07% weakens and markets brace for further Fed tapering.

According to one estimate by the Bank of International Settlements (BIS), foreign credit to China has more than tripled over four years, rising from $270 billion to $880 billion in March 2013. Much of that lending has come through Hong Kong and Singapore. Brokerage Jefferies estimates that Hong Kong’s financial system has become linked to an “invisible carry trade†with a parabolic surge in lending to mainland China. Since 2009 Hong Kong banks have lent almost $400 billion.

China finds itself in this seemingly exposed situation as an unintended consequence of a piecemeal approach to financial reform: In parallel with pushing yuan internationalization with foreign deposit accumulation and trade finance, China also effectively deregulated interest rates at home by allowing the shadow-banking sector to explode.

At a time of aggressive quantitative easing in the U.S., China proved a hugely popular destination for global liquidity seeking yield enhancement and a stable currency. This has given birth to a yuan carry trade, with everyone from Chinese corporates to exporters and investors joining in.

p>The upshot is that China’s investment boom has become a function of external dollar funding.

China’s central bank will find this liquidity harder to control. Its master will be market forces, be it the impact of tapering by the Fed or the risk-on/risk-off trade.

This degree of dependence on external dollar funding also means China needs to tread carefully as it experiments with greater exchange-rate flexibility.

The BIS has warned that China’s dollar borrowing has created a risk situation comparable to the Asian Financial Crisis in 1997-98, when foreign-denominated borrowing and falling currencies triggered debt implosions.

This means the PBOC has to strike a balance between curbing excessive inflows and triggering mass outflows.

http://www.marketwatch.com/story/risks-in-china-stimulus-2014-04-06#

Cashless credit: China’s rising risks

As China's economy slows, companies are increasingly relying on acceptance drafts, a virtual currency, to get by.

China’s currency has now fallen about 2.8% against the dollar since February. This move may have broken the belief that the yuan was a one-way-upward bet, but now its value is under a lot more scrutiny in case of further weakness.

The PBOC is in a tight spot. If hot money flows do start heading for the exits, authorities would need to sell down foreign-exchange reserves and tighten domestic liquidity to support the currency.

This would be a difficult decision to contract liquidity when the economy is already slowing. According to Daiwa Research, if push comes to shove, authorities will let the currency weaken rather than allow liquidity to tighten.

For investors, perhaps what they need to ask is where will China’s yuan head as market forces begin to exert themselves?

The traditional trade-off with continued monetary expansion is that adjustment comes through price increases. The PBOC says in its recent commentary that prices are basically stable.

Yet it is hard to ignore the huge price increases in China in recent years. Be it commodities such as corn, sugar, wheat or iron ore, to the prices of fast food, China’s inflation is now increasingly outpacing inflation in other major markets. Hong Kong is bursting at the seams with mainland Chinese day-trippers shopping for cheaper basic necessities.

One explanation is China’s real currency value (adjusted for inflation) is now considerably too high. The question remains - how long can the credit party keep going? China’s foreign borrowing and financial deregulation means that decision will no longer just be up to its central bank.

http://www.leadingtrader.com/public/070414-2/

Are investors distorting the natural inventory cycle?

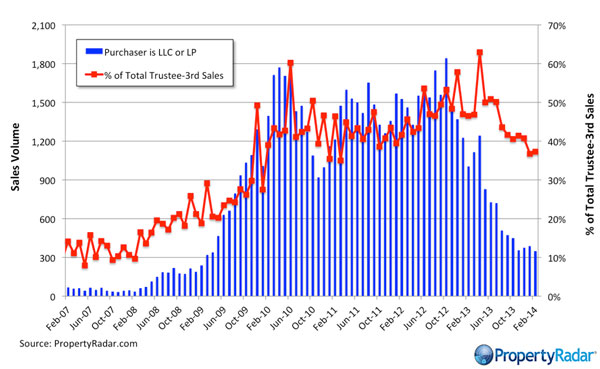

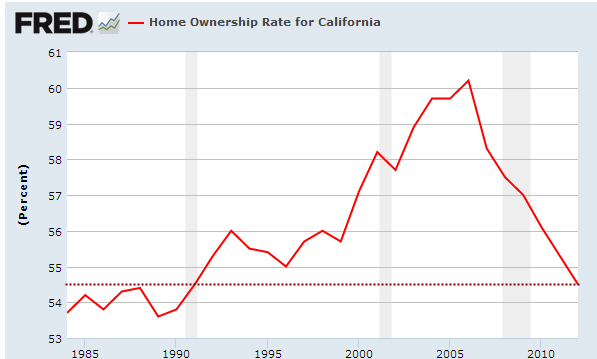

Investors have caused a unique boost in the housing market. The bigger play here since the crash was to buy homes for rentals. A modern day Wall Street landlord system. Big investors have been busy buying up distressed property in California:

Even in 2013 big investors were buying up over 60 percent of all distressed property. These are usually better priced deals. A good portion of foreclosures were bought before they even hit the MLS so those thinking they had a chance to buy at rock bottom prices are out to lunch (unless they had full financing to go to auctions and out-bid these people). Plus, many bought with “all cash†and then spent more money renovating – many house lusting households barely have enough to move in and furnish the place after they plop their 20 percent down payment. Clearly the dominant force here was the “all cash†buyers.

Don’t think that these investors will suddenly turn around and sell their properties even with this big rise in prices (or will run when prices correct):

http://www.theguardian.com/business/2014/apr/02/financial-markets-risks-to-global-economy-nouriel-roubini

Markets may be underestimating threats to the global economy

The risk of a hard landing in China, fears over tapering in the US and the ongoing tensions in Crimea show that there is no room for complacency, writes Nouriel Roubini

Ukrainian tanks near the Crimean capital of Simferopol

Ukrainian tanks near the Crimean capital of Simferopol. There is a serious risk that the current conflict in Ukraine will lead to Cold War II – and possibly even a hot war if Russia invades the east of the country. Photograph: Max Vetrov/AFP/Getty Images

The world's economic, financial, and geopolitical risks are shifting. Some risks now have a lower probability – even if they are not fully extinguished. Others are becoming more likely and important.

A year or two ago, six main risks stood at centre stage:

• A eurozone breakup (including a Greek exit and loss of access to capital markets for Italy and/or Spain).

• A fiscal crisis in the United States (owing to further political fights over the debt ceiling and another government shutdown).

• A public-debt crisis in Japan (as the combination of recession, deflation, and high deficits drove up the debt/GDP ratio).

• Deflation in many advanced economies.

• War between Israel and Iran over alleged Iranian nuclear proliferation.

• A wider breakdown of regional order in the Middle East.

-Efff!

These risks have now been reduced. Thanks to European Central Bank president Mario Draghi's "whatever it takes" speech, new financial facilities to stabilise distressed sovereign debtors, and the beginning of a banking union, the eurozone is no longer on the verge of collapse. In the US, President Barack Obama and Congressional Republicans have for now agreed on a truce to avoid the threat of another government shutdown over the need to raise the debt ceiling.

In Japan, the first two "arrows" of prime minister Shinzo Abe's economic strategy – monetary easing and fiscal expansion – have boosted growth and stopped deflation. Now the third arrow of "Abenomics" – structural reforms – together with the start of long-term fiscal consolidation, could lead to debt stabilisation (though the economic impact of the coming consumption-tax hike is uncertain).

Similarly, the risk of deflation worldwide has been contained via exotic and unconventional monetary policies: near-zero interest rates, quantitative easing, credit easing, and forward guidance. And the risk of a war between Israel and Iran has been reduced by the interim agreement on Iran's nuclear program concluded last November. The falling fear premium has led to a drop in oil prices, even if many doubt Iran's sincerity and worry that it is merely trying to buy time while still enriching uranium.

Though many Middle East countries remain highly unstable, none of them is systemically important in financial terms, and no conflict so far has seriously shocked global oil and gas supplies. But, of course, exacerbation of some of these crises and conflicts could lead to renewed concerns about energy security. More important, as the risks of recent years have receded, six other risks have been growing.

For starters, there is the risk of a hard landing in China. The rebalancing of growth away from fixed investment and toward private consumption is occurring too slowly, because every time annual GDP growth slows toward 7%, the authorities panic and double down on another round of credit-fueled capital investment. This then leads to more bad assets and non-performing loans, more excessive investment in real estate, infrastructure, and industrial capacity, and more public and private debt. By next year, there may be no road left down which to kick the can.

There is also the risk of policy mistakes by the US Federal Reserve as it exits monetary easing. Last year, the Fed's mere announcement that it would gradually wind down its monthly purchases of long-term financial assets triggered a "taper" tantrum in global financial markets and emerging markets. This year, tapering is priced in, but uncertainty about the timing and speed of the Fed's efforts to normalise policy interest rates is creating volatility. Some investors and governments now worry that the Fed may raise rates too soon and too fast, causing economic and financial shockwaves.

Third, the Fed may actually exit zero rates too late and too slowly (its current plan would normalize rates to 4% only by 2018), thus causing another asset-price boom – and an eventual bust. Indeed, unconventional monetary policies in the US and other advanced economies have already led to massive asset-price reflation, which in due course could cause bubbles in real estate, credit, and equity markets.

Fourth, the crises in some fragile emerging markets may worsen. Emerging markets are facing headwinds (owing to a fall in commodity prices and the risks associated with China's structural transformation and the Fed's monetary-policy shift) at a time when their own macroeconomic policies are still too loose and the lack of structural reforms has undermined potential growth. Moreover many of these emerging markets face political and electoral risks.

Fifth, there is a serious risk that the current conflict in Ukraine will lead to Cold War II – and possibly even a hot war if Russia invades the east of the country. The economic consequences of such an outcome – owing to its impact on energy supplies and investment flows, in addition to the destruction of lives and physical capital – would be immense.

Finally, there is a similar risk that Asia's terrestrial and maritime territorial disagreements (starting with the disputes between China and Japan) could escalate into outright military conflict. Such geopolitical risks – were they to materialise – would have a systemic economic and financial impact.

So far, financial markets have been sanguine about these new rising risks. Volatility has increased only modestly, while asset prices have held up. Noise about these risks has occasionally (but only briefly) shaken investors' confidence, and modest market corrections have tended to reverse themselves.

https://encrypted-tbn0.gstatic.com/images?q=tbn:ANd9GcScuoaqlfUy1UCQmAQS8xs7kKgfLeq4D0xYWlXfAtJ0YS7TktR2

Investors may be right that these risks will not materialise in their more severe form, or that loose monetary policies in advanced economies and continued recovery will contain such risks. But investors may be deluding themselves that the probability of these risks is low – and thus may be unpleasantly surprised when one or more of them materializes.

Indeed, as was the case with the global financial crisis, investors seem unable to estimate, price, and hedge such tail risks properly. Only time will tell whether their current nonchalance constitutes another failure to assess and prepare for extreme events.

• Nouriel Roubini is Chairman of Roubini Global Economics and Professor at New York University's Stern School of Business.

#politics