patrick.net

An Antidote to Corporate Media

1,364,663 comments by 15,735 users - Al_Sharpton_for_President, SouthMtn online now

Comments 1 - 22 of 22 Search these comments

Sales will go down because nobody is selling, but when they do, there is plenty of demand.

House prices are TAN(90)

Sales will go down because nobody is selling, but when they do, there is plenty of demand.

House prices are TAN(90)

Inventory is up on all metrics this year and in some places a lot while sales are down 10-25% YOY

This is a growth story, there isn't enough demand to pull through the higher inventory levels to get to 5.10 Million in sales this year.

Of course, how can those 92 million people out of the workforce buy a house?

Of course, how can those 92 million people out of the workforce buy a house?

They won't ... Work force coming in and leaving are one thing. Demographics favor housing but the young will rent and this is why we have seen such aggressive multifamily building in America today.

Housing prices won't end up mattering because only institutions will buy them with the goal of renting them out. Whether they buy for $1,000,000 or $1,500,000 won't matter since they'll rent forever and eventually get their money back either from rent checks or by selling to another investor. If it takes twenty years to return principle or thirty, it doesn't matter, they'll eventually be paid back.

Rental prices will go as high as they can (in line with incomes), but rental prices and home prices do not need to correlate anymore since the people living in homes won't be able to buy them.

We will tell stories to our grandchildren about how people used to buy the homes they lived in, but "That's not how things are done anymore."

The young can't buy because they don't have saved capital for the 20% down payment.

Then add the up to $10K in fees to buy you're talking money that young people don't have jingling in their jeans.

The young can't buy because they don't have saved capital for the 20% down payment.

It's worse, because all they need is 3.5% down payment for a first time home buyer and that isn't easy anymore.

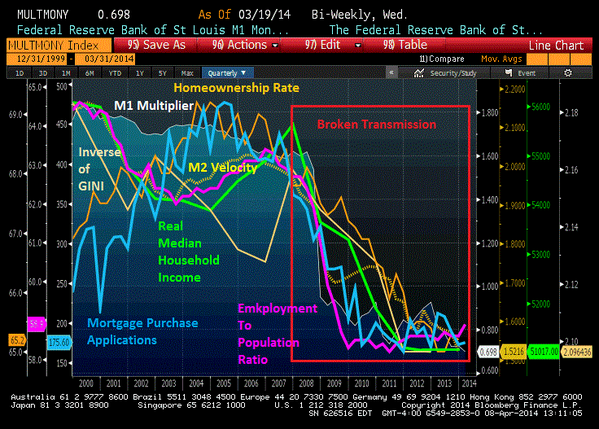

I worked with Bloomberg Financial article specifically on the first time home buyers problems

http://loganmohtashami.com/2014/03/05/first-time-home-buyer-whats-that/

The young can't buy because they don't have saved capital for the 20% down payment.

Then add the up to $10K in fees to buy you're talking money that young people don't have jingling in their jeans.

It's just like how people used to grow their own food. Now you realistically can't, so you have to buy it from the big corporations.

We'll never go back to having our own farms just like we'll never go back to owning our own homes.

Before it's all over, we won't own anything.

LM,

"..just simple facts and data.."

We'll be having none of that,here. lol

When will the banks have to release all the vacant & occupied foreclosures to the market? Or,how long can they kick the can & then realize that they have waited too long & everyone's broke & unemployed or holding low paying jobs & no down payment funds?

Increasing foreclosures might make for more excitement.

When will the banks have to release all the vacant & occupied foreclosures to the market?

Per the last report recently

• 1,749,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,242,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 1,115,000 loans in foreclosure process.

As you can see we have more loans in delinquency than vacant foreclosed homes. Problem with a lot of these homes is that they are in bad economic areas as well.

Some states take up to 3 years to foreclose on a home as well. The legal courts just strings this process out

It's just like how people used to grow their own food.

I'm not on board with going back to growing our own food, since that's pre-Adam Smith stuff, before the division of labor.

Division of labor made everyone so much wealthier that a rewind to before those days would mean mass starvation, including most or all of us on this forum.

we won't own anything.

except debt

Well at least you can't take it with you!

So where in the hell is all that money going, if unemployment is low and rosy, and consumer confidence is at an all time meh, and RE has managed to climb back to bubble ville?

There's just this huge black hole sucking from 2009 to now, and it never stopped for a minute. It's still sucking... hear that sound? That's the sound Bush blowing in for eight years, and that noise on the other side, is Obama Sucking it all in...

Whhhhoooooossssssshhhhhhhhhhhhh(they don't even pause here to gasp real hard)hhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhh

LM, what's your prediction for Bay Area ?

A major revolt against the tech buses

Bay area is in a league of its own, housing inflation RIP

Rent

Interest rates

Prices

Will make it hard for lower end middle class and under to live comfortably unless they have good job with stock options.

However, high end areas like San Francisco and New York really do well when equity boom is live and well.

The tech boom has brought new fresh money there so as long as the Stock Market does well and Tech IPO's are doing well they should be able to hold.

It's just so expensive there to live ( own and rent) that its insane

I believe the only other place where rent is more expense is North Dakota because of the energy boom.

I know they're building that Mega commercial tower there so the business cycle is good enough for now. I went to a commercial real estate conference last year and they show cased some nice properties there

So where in the hell is all that money going

A lot QE went to excess reserve heaven

As always this impacts first time home buyers. However, move up buyers do have this issue as well.

s that tapering I see at the end of the Fed balance sheet line?

Split between MBS and treasuries is there so they on nominal basis buying less but still buying so the growth of balance sheet would slow down but still in there.

At this point if you're looking at the first rate hike toward the end of 2015 or start of 2016

Comments 1 - 22 of 22 Search these comments

Miss Housing Nirvana Cries Uncle

http://loganmohtashami.com/2014/04/11/miss-housing-nirvana-crys-uncle/

The biggest housing bull and the so called Queen of Real Estate that everyone in the media puts on top of the list finally threw in the towel today. Not just for this year but for next few years

2014 at 4.8M (vs earlier 5.4M);

2015 at at 4.9M (vs 5.7M);

2016 at 5.0M (vs 5.9M).

The economic charts I have in my article are just simple facts and data make your own views based on data.

#housing