patrick.net

An Antidote to Corporate Media

1,364,786 comments by 15,735 users - MolotovCocktail, Patrick online now

« First « Previous Comments 12 - 22 of 22 Search these comments

It's just like how people used to grow their own food.

I'm not on board with going back to growing our own food, since that's pre-Adam Smith stuff, before the division of labor.

Division of labor made everyone so much wealthier that a rewind to before those days would mean mass starvation, including most or all of us on this forum.

we won't own anything.

except debt

Well at least you can't take it with you!

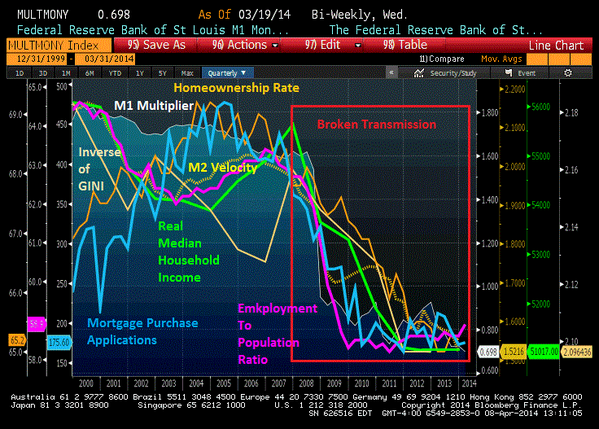

So where in the hell is all that money going, if unemployment is low and rosy, and consumer confidence is at an all time meh, and RE has managed to climb back to bubble ville?

There's just this huge black hole sucking from 2009 to now, and it never stopped for a minute. It's still sucking... hear that sound? That's the sound Bush blowing in for eight years, and that noise on the other side, is Obama Sucking it all in...

Whhhhoooooossssssshhhhhhhhhhhhh(they don't even pause here to gasp real hard)hhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhh

LM, what's your prediction for Bay Area ?

A major revolt against the tech buses

Bay area is in a league of its own, housing inflation RIP

Rent

Interest rates

Prices

Will make it hard for lower end middle class and under to live comfortably unless they have good job with stock options.

However, high end areas like San Francisco and New York really do well when equity boom is live and well.

The tech boom has brought new fresh money there so as long as the Stock Market does well and Tech IPO's are doing well they should be able to hold.

It's just so expensive there to live ( own and rent) that its insane

I believe the only other place where rent is more expense is North Dakota because of the energy boom.

I know they're building that Mega commercial tower there so the business cycle is good enough for now. I went to a commercial real estate conference last year and they show cased some nice properties there

So where in the hell is all that money going

A lot QE went to excess reserve heaven

As always this impacts first time home buyers. However, move up buyers do have this issue as well.

s that tapering I see at the end of the Fed balance sheet line?

Split between MBS and treasuries is there so they on nominal basis buying less but still buying so the growth of balance sheet would slow down but still in there.

At this point if you're looking at the first rate hike toward the end of 2015 or start of 2016

« First « Previous Comments 12 - 22 of 22 Search these comments

Miss Housing Nirvana Cries Uncle

http://loganmohtashami.com/2014/04/11/miss-housing-nirvana-crys-uncle/

The biggest housing bull and the so called Queen of Real Estate that everyone in the media puts on top of the list finally threw in the towel today. Not just for this year but for next few years

2014 at 4.8M (vs earlier 5.4M);

2015 at at 4.9M (vs 5.7M);

2016 at 5.0M (vs 5.9M).

The economic charts I have in my article are just simple facts and data make your own views based on data.

#housing