« First « Previous Comments 7 - 45 of 45 Search these comments

not only ZERO but also negative in some cases. E.g. at least one bank has plowed homes under. So, that cost them money. Lots of people have homes which are worth zero or negative. Same as having an option out of the money. you might just buy that option if you think things will change. Just like an option, time will kill you. houses rot. options time out.

I agree with pkowen. In many areas homes will be worth zero. Not sure what the number is now but was like 20M vacant homes... and they are still building you know. Who wants an old shirt? Who wants an old car? Who wants an old house?

Well, mine's used so I'm throwing it away. There's an empty one up the street with granite countertops we can hide under during the apocolypse.

I think the Fed will be more than happy to directly fund home loans should it come to that.

They already own $760B of agency securities, adding that amount annually would cover most of the market.

Japan’s home finance agency is funding 35 year loans (~1% for the first 10 years, ~2% thereafter).

We could do that : )

Then again who knows if Japan’s borrowing is sustainable. They may be more f—-ed than us.

I think Japan has been screwed for a long time exactly due to that. When an average person spends most of their income on healthcare/housing (and now gasoline) they can't exactly spend a penny elsewhere to grow economy.

I see that everywhere, and I really think that until the government gets out of the mortgage backing of the rich peoples gambling (FN/FR) we won't have much of economic recovery.

how many here (if any) feel that a certain percentage of housing could go to zero?

Some homes that never should have been built in the first place may become nearly valueless. Some tracts in the the far flung deserts of NV and AZ and swamps of FL are already essentially worthless.

However, homes in desirable areas near employment centers will always have value. In other words, if you think that you are going to get a free house on the SF peninsula, you’ve got another thing coming.

I think you misquoted there but anyway - I don't think I'm getting "a free house on the peninsula", and never implied that I would. However, there are some real dumps even on this blessed stretch of land, in parts of San Mateo, Redwood City, even San Carlos and Belmont (not to mention EPA) that you couldn't pay me to live in. I am sure they will never be "zero" but people are still buying dumps for $400k plus.

I basically agree with you, except I would add that it ain't just NV, AZ and FL that have houses that shouldn't have been built. I agree they are the biggest hotspots. ""Exurbs", feh. I haven't driven out to Sac-o-tomatoes in a while but even two-three years ago I saw developments in the middle of nowhere that were clearly not going to make it.

soshokukei danshi (Ojo-man) ; )

Hannah, what's an Ojo-man? What language is that? (I though Americans called soshokukei danshi "herbivores".)

soshokukei danshi (Ojo-man) ; )

Hannah, what’s an Ojo-man? What language is that? (I though Americans called soshokukei danshi “herbivoresâ€.)

japanese slang....herbivores and ojo-man are the same thing....

'A 2007 survey by a major toilet-seat maker found that half of Japanese men sit on the toilet to urinate, while bras designed for men have been selling briskly since they hit the market last November.'

( http://search.japantimes.co.jp/cgi-bin/fl20090510x1.html )

i love japanese culture but i cant say i even begin to understand it......

China will probably surpass our economy in the next 20 years if this continues. These backward thinking fuckwads like Barney Frank really put us up shit creek.

Didn't Japan go through the same kind of housing bubble which eventually crashed for basically the same reasons that ours did (just on a much bigger domestic scale)?

There is a good article on this:

http://timandjulieharris.com/2008/12/29/zero-percent-100-year-mortgages-coming-in-2009100-year-loans-realtor-coaching-and-training-future/

I like the quote from it:

Creative financing wins over most unsophisticated borrowers in the end as they consider only the monthly payments with no regard for longer term considerations. But a few savvy consumers will make better choices. And in most parts of the country, the wiser choice is still building equity through renting. The equity comes from investing and compounding all the additional disposable income you keep from not buying inflated assets!

soshokukei danshi (Ojo-man) ; )

Hannah, what’s an Ojo-man? What language is that? (I though Americans called soshokukei danshi “herbivoresâ€.)

japanese slang….herbivores and ojo-man are the same thing….

‘A 2007 survey by a major toilet-seat maker found that half of Japanese men sit on the toilet to urinate, while bras designed for men have been selling briskly since they hit the market last November.’( http://search.japantimes.co.jp/cgi-bin/fl20090510×1.html )

i love japanese culture but i cant say i even begin to understand it……

And I hear they are making a phone that is tactile like a human face or some crap. So you can feel closer to people when talking to them.

Didn’t Japan go through the same kind of housing bubble which eventually crashed for basically the same reasons that ours did (just on a much bigger domestic scale)?

There is a good article on this:

I can't wait until 2009 comes, and we see if these guys are right about their prediction of 100 year mortgages. Err...ummm...???

Didn’t Japan go through the same kind of housing bubble which eventually crashed for basically the same reasons that ours did (just on a much bigger domestic scale)?

http://en.wikipedia.org/wiki/Japanese_asset_price_bubble

http://en.wikipedia.org/wiki/Japan_deflation#In_Japan

Systemic reasons for deflation in Japan can be said to include:

Tight monetary conditions. The Bank of Japan has kept monetary policy loose only when inflation has been below zero, tightening whenever deflation ends.[20]

Unfavorable demographics. Japan has an aging population (22.6% over age 65) that is not growing and will soon start a long decline. The Japanese death rate recently exceeded the birth rate.

Fallen asset prices. In the case of Japan asset price deflation was a mean reversion or correction back to the price level that prevailed before the asset bubble. There was a rather large price bubble in equities and especially real estate in Japan in the 1980s (peaking in late 1989).

Insolvent companies: Banks lent to companies and individuals that invested in real estate. When real estate values dropped, these loans could not be paid. The banks could try to collect on the collateral (land), but this wouldn't pay off the loan. Banks delayed that decision, hoping asset prices would improve. These delays were allowed by national banking regulators. Some banks made even more loans to these companies that are used to service the debt they already had. This continuing process is known as maintaining an "unrealized loss", and until the assets are completely revalued and/or sold off (and the loss realized), it will continue to be a deflationary force in the economy. Improving bankruptcy law, land transfer law, and tax law have been suggested (by The Economist) as methods to speed this process and thus end the deflation.

Insolvent banks: Banks with a larger percentage of their loans which are "non-performing", that is to say, they are not receiving payments on them, but have not yet written them off, cannot lend more money; they must increase their cash reserves to cover the bad loans.

Fear of insolvent banks: Japanese people are afraid that banks will collapse so they prefer to buy (United States or Japanese) Treasury bonds instead of saving their money in a bank account. This likewise means the money is not available for lending and therefore economic growth. This means that the savings rate depresses consumption, but does not appear in the economy in an efficient form to spur new investment. People also save by owning real estate, further slowing growth, since it inflates land prices.

Imported deflation: Japan imports Chinese and other countries' inexpensive consumable goods (due to lower wages and fast growth in those countries) and inexpensive raw materials, many of which reached all time real price minimums in the early 2000s. Thus, prices of imported products are decreasing. Domestic producers must match these prices in order to remain competitive. This decreases prices for many things in the economy, and thus is deflationary.

When an average person spends most of their income on healthcare/housing (and now gasoline)

Hierarchy of needs. Shelter is pretty high up there, as is health, and substitute goods are pretty minimal, either you have a place to live and your health or you don't.

Gasoline is also important, at least if you want to get to work, but is not quite a dominant expense like shelter is.

Thing is, both health care and gasoline have current production costs. Already-built housing does not, its production cost is a sunk cost from long ago. Housing call fall a lot farther from here if other costs go up.

It's no accident that housing sucks up every last dollar of ours, and it's not really due to government intervention, either (housing payments would still suck up all our money at higher interest rates and lower prices).

Real estate is just a treadmill. The richer we get, the more housing costs when the supply is constrained. This was seen from the Iron Triangle in Richmond to the wonderful sunny properties of Laguna Beach 2003-2007.

If you want affordable real estate, you have to increase the housing supply such that competition for land is reduced enough to remove the demand pressure. The Japanese actually have done a pretty good job of that, density in eg. Tokyo is just insane, but in a good way.

As for the Japanese asset bubble, the Japanese went from stimulating their economy to slamming on the brakes.

Plenty of leveraged gambling was going on and the receding tide just wiped out everyone who had borrowed their way to prosperity.

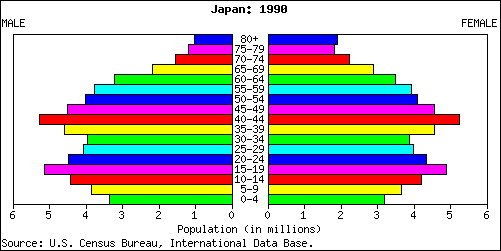

There was also maximal stress on housing, as the baby boom was aged 35-39 in 1985:

their baby boom echo was entering their teenage years and everyone needed bigger houses. . .

Didn’t Japan go through the same kind of housing bubble which eventually crashed for basically the same reasons that ours did (just on a much bigger domestic scale)?

There is a good article on this:

http://timandjulieharris.com/2008/12/29/zero-percent-100-year-mortgages-coming-in-2009100-year-loans-realtor-coaching-and-training-future/I can’t wait until 2009 comes, and we see if these guys are right about their prediction of 100 year mortgages. Err…ummm…???

we dont have to wait...the japanese have had multi-gen loans for 20 years now......what is a home worth with 70years left on a mortgage. what would that do to the mortgage market.....?

how many people on this forum still live in the first home they purchased...? everyone acts like if you already own a home you are immune to the ravages of the housing collapse....heck...when they have to sell, there wont be problem with their house selling...!...right....?..but but wait...my home is in the 'right part of town'....?

JAPAN'S 100-YEAR BANK LOANS

By Susan Moffat

May 21, 1990

(FORTUNE Magazine) – The Japanese, famous for saving, are now loading their future generations with debt. Nippon Mortgage and Japan Housing Loan, two big home lenders, are offering 99- and 100-year multigeneration loans with interest rates from 8.9% to 9.9%. Borrowers put up their homes as collateral. Such deals represent sound fiscal planning for some families, especially the very wealthy living in Tokyo who, perversely, can almost not afford to inherit a house: Japan's graduated inheritance tax can take up to 70% of a family's assets, including its home. Under the 100-year loan plan, a second generation can move into a deceased parent's home and pay inheritance taxes on only a fraction of the house's value.

Hannah, I thought ojo-man was something in Spanish; I had no idea it was supposed to be Japanese! (ãŠå¬¢ãƒžãƒ³: "[rich/elite/upper-class] girl man") SÅshoku-kei is a word you hear all the time; I'd never ehard the other one.

I disagree that people who own homes are affected so much by falling housing prices. If you plan to stay in your home until the day you die, you *are* immune to housing price collapse, and in fact benefit from it as your property taxes will drop correspondingly. Where you'll suffer will be if falling prices force your neighbors our of their homes, and local businesses that you depend on start closing up shop because there aren't enough customers around. Even then, if prices fall back to affordability, you should be seeing new neighbors who can fill those spots.

E-man and Troy, here's another idea for fair property taxes: tax only land area that is owned but not lived in. If you have a 1000-sf house (one story, let's say, to keep things simple) on a 5000-sf lot, you're depriving up to four more people of having the same home you've got, because you're letting four-fifths of your land sit unused. Those people should be paying for the damage they do to society by living that way!

High density residential areas are the key to everything: affordable housing (obviously), short commutes (businesses are close by), transportation (you can live without a car), oil dependence and environmental sustainability (ditto), convenience (supermarket within walking distance), and quality of social life (you've got neighbors; no alienation and malaise).

City zoning laws that mandate low density are the culprit here. Any initiative tosupport higher-density housing, I agree; tell the NIMBY folks to get over it.

Read through the news headlines Patrick has for today. Toast. If "bad mortgages" are being put in another dump pile and we already know the bank cartel-absorbed a Fresh Kills sized mortgage dump pile and other such dump piles exist. So, these are mortgage dead ends. Those houses are worth zero in a sense because the people simply don't have to pay anymore. Nobody is going to foreclose when the mortgage is a paper asset with no real market. Its just bureaucratic trash. Zero. Toast. So, the house you sell will be of course dragged down by the tens of thousands or more who have zero housing; courtesy of "The System". So many other examples of "The System" driving housing prices to zero. E.g. in my neighborhood if you make under $70K or something then you get a zero down FHA mortgage. Towards zero. So, those who work hard and save get screwed. To hell with government.

Do you have kids Michinaga? It's a lot nicer to be able to tell your kids, "Go play in the backyard while I clean the house," than bundling them up to go to the park everyday. We do go to parks, but it's one reason I was so happy to move out of Brooklyn, back to CA, and get even a tiny patio in our rental. Kids need to be outside, but I have chores I need to do as well. Backyards do help with kids.

How about housing that is worth less than zero? When the costs of taxes, insurance, maintenance and HOA dues (some homeowners pay as many as 4 levels of HOA dues on one house!) exceed the rental value of the place, it is essentially worth less than nothing! Negative return on equity means that you have to pay someone to take the burden off of your hands. This situation exists on many properties here in Florida.

There's a bank-owned house for sale in Portland Oregon area that has a pond the prior "owners" created without the necessary permit from the county.

The county is fining $100/day until the necessary permits/reviews/remediation/bribes are taken care of. Oddly, that isn't disclosed in the MLS notes.

There's a property that could definitely be worth less than 0 by the time it is sold or handed back to the county.

There will always be those who pursue houses as their greatest purpose in life with no more thought than a salmon fighting its way up river. They work, work, battle, and then... Ah, emm, like Mutley the cartoon dog getting his treat, they reach nirvana. They are a satisfied house debter. And don't worry if the the house goes to zero value, they can always chop up the granite counter tops to make themselves a pretty handsome headstone.

Housing stock (houses) becomes worth zero when there is less money then n available in an economy for such purchases. A deflation in other words.

The only question is to speculation as to where that tipping point is and the velocity with which we find ourselves hurtling towards the oblivion it represents.

Adverse possession will eliminate the properties tied in legal limbo.

All States have these laws in place - just different waiting periods.

So squat and own after 5 years in California - but you are on the hook for perpetual property taxes.

An interest only loan is INFINITE. Thus a 100 year loan is conservative in comparison.

Ok now what about neg - am/option arm? negative gearing, principal goes up every month. Did the japanese ever do that?

I am sure that some homes may see a 100% loss in value, but more broadly I think that MOST US homes will see at least an 80% drop from peak values by the time we hit bottom.

Most prognosticators seem to think that at most we will see an additional 10% or 20% in average US home prices from current levels. Unfortunately, I think it is going to be FAR more substantial than that, and that this process might drag on for a decade or more.

The simple problem is that there is SO much unserviceable debt (corporate and private) that has to be written off that the economy just can't recover until that happens. So far everyone has been doing their best to kick the can down the road. Most loan modifications don't adjust the principal, and use tricks to extend the life of the mortgage, etc. Commercial loans are just being rewritten to defer payments for several more years.

We are going to experience a prolonged deflation of asset values similar to what Japan has been experiencing for 20 years. By the time this is over average US home prices won't just have reverted to trend, they will have fallen far below the trend. During bubbles asset prices rise far more than historical trends support. In depressions asset prices fall far below the historical trend-lines. At this point US home prices have barely hit 2002 levels. I suspect this won't be truly over till home prices are back at 1983 levels.

When housing goes to $0, be sure to let me know, I would like to buy a hundred.

At this point US home prices have barely hit 2002 levels. I suspect this won’t be truly over till home prices are back at 1983 levels.

You’re too optimistic. I was told that home prices will go back to 1975 level. So renting is your best bet for the next 20 years

1975 Level? What is the 1975 level in 2011 dollars? 1983 in 2011 dollars?

I agree 100% with prop.ms, but will go the step beyond that back to 1975 levels also. That is in my view the last time residential housing was appropriately and accurately priced to the dollar in terms of real honest value. All housing from that point afterwards has been a wicked game played to just rip people off and hold them in slavery, sad part is many fell for it. I was not one of them.

Ocean of Cash? Are you in real estate pipe dreaming? Does anyone honestly believe there is an 'ocean of cash' out there? Really? Where is it? I am in one of the richest parts of the east coast and the untold story I see are very rich people going under left and right. You cannot give a high-end property away here. Please, look around you and look at the once monied people who have lost their make believe ocean of cash in their overpriced dumps...losing their property and vast amounts of money in the process due to bad investments. Who is left? Common sense tells anyone that deflation is already happening. People in real estate right now are in serious trouble in my view, very serious financial trouble. Someone pull the stories on banks not lending due to fear of this deflation which in some areas is already below appraised tax value. I also want confirmation on this one ... do lenders have the right on conventional loans to call due a mortgage if the underlying value falls below a certain level?

"how many here (if any) feel that a certain percentage of housing could go to zero? meaning either the home can not be sold for legal(aka MERS) reasons or that when financial markets freeze, there will be no money/credit available to lend so a home would be ‘worthless’ as a financial product."

I disagree that the MERS foreclosure moratorium is based on sound legal, at least in California since Civil Code Section 2924 clearly defines the rules of law of the non-judicial foreclosure process and includes "acting agents" or "agents acting on behalf" as an accepting entity to initiate the foreclosure process.

The property is always worth something. Just because you might not qualify doesn't mean that the property is worthless. There's always somebody willing to pay something, it might not be what you or others value it at but that is the true market value. Of course, the many anti-free market manipulations interfere with that process and allow companies to not foreclose.

"right now the federal government is financing 100% of the costs of gov with QE. when QE stops, R.E. loans stop as 98% of the securitization market is now freddie and fannie…..housing goes to zero."

Why do you think it would go from government guaranteed loans to zero? Do you have no savings? There are people that do have savings and recognize the current state of the manipulation and therefore opt not to buy. Stop with the non-sense government and Fed interference and you would know the true price, based on sound fundamentals. And it wouldn't be zero..

I dunno man,

you have responded to so many posts by calling someone "liar".

Lets say one person took out a loan and bought a house with a 100K mortgage and interest only loan in 2000 & sold it in 2005 for for $300K. The buyer in 2000 was a new buyer & took out a neg am loan & now owes $350K. How would this affect the M2 money supply?

It probably wouldn't at all. If a loan is securitized and held by an investor or pension fund etc. it doesn't show up on any money supply.

The money supply measures used are very archaic, and almost useless. Inflationista conspiracy nuts made a big deal about the Fed dropping the M3, but it was simply because it wasn't really measuring anything useful. And in an extremely low interest rate environment like we have today, all the other measures are not that useful either, even the monetary base. Today the M1/M2/M3/MZM largely just indicate the preference of the public and insititutions for how they would like the liabilities to be recorded. Checking account? Savings? Money Market? Treasury bill? It doesn't matter, because they all pay almost nothing, and underlying asset in all cases is exactly the same. And they provide almost no useful information about how likely that money is to be spent, which was the whole point of the distinction.

Really the only one relevant now (and arguably ever has been) is overal credit.

Another question. As people age and shift money from stocks to money market / laddered cds, would that lead to an increase in the M2 at the same time as it leads to deleveraging, lowered spending, and a decreased demand for housing?

There is no such thing as shifting money from stocks into money markets or anything else. You can only trade one for the other with somebody else, leaving the quantities of money and stock unchanged.

MarkInSF,

So you are saying the that M2 increase is largely money being moved from accounts that were not recorded to accounts that are recorded as M2?

I get what you are saying about stock sale / purchases & the money flow balancing. Good point.

Back to the original question. Housing will go to $0 in some limited circumstances and locations. Detroit is one of those places. Abandoned sections of the city cannot be effectively policed and serviced. No one is paying property tax, insurance, maintenance. Buildings in blighted areas will be buldozed - reduced to land value only. I can imagine similar circumstances in parts of Florida and Nevada.

Back to the original question. Housing will go to $0 in some limited circumstances and locations. Detroit is one of those places. Abandoned sections of the city cannot be effectively policed and serviced. No one is paying property tax, insurance, maintenance. Buildings in blighted areas will be buldozed - reduced to land value only. I can imagine similar circumstances in parts of Florida and Nevada.

But the original point is housing going to zero, I think it should have been defined from the beginning what the definition of "housing" for this discussion. To me, housing = property + land which will always have some value. Sure, the shack on the property could be worth nothing or even have a slightly negative value due to the removal cost but I'm sure somebody is willing to pay something for that land.

Whatever happened to the Superdome that they sold for $500k? Would have made a great growing op...j/k

But the original point is housing going to zero, I think it should have been defined from the beginning what the definition of “housing†for this discussion. To me, housing = property + land which will always have some value. Sure, the shack on the property could be worth nothing or even have a slightly negative value due to the removal cost but I’m sure somebody is willing to pay something for that land.

Whatever happened to the Superdome that they sold for $500k? Would have made a great growing op…j/k

I disagree, some land *is* worth zero. There are plenty of sales of state and LG owned land (in different states across the country) where all one has to do is pay current property taxes and the title is yours. Many of these auctions and sales do not close because no one feels the land is worth the property tax. And we are talking about good sized plots, even acres of land for hundreds of dollars. There is also land that would be worth "less than zero", due to toxic waste and other problems that would require expenditure just to make it worth having.

It's an opportunity especially if you think land is always worth something. I've looked at some myself. I would just say, "buyer beware".

Not to mention land with bad houses will be subject to taxes. And to those penalties the counties give if you don't maintian the place. So, the cost is probably $1000+ per year for most any place in the USA. If you can't sell it, you now have a negative cost land.

Also, the Federal lands such as the one the Federal government allows FREE mining on for some companies. From teh miniing companies perspective the land is free. From the taxpayers perspective the land is of negative value as the state is taking on more liability as the land is disturbed and losing any inherent value the mining company removes. http://www.seattlepi.com/specials/mining/26875_mine11.shtml

OK. That would be true. In light of the liability of property tax land could be worth zero or less. This might be a good point for the Georgist land tax.

Troy, any comments?

I often marvel at how naive the regulars on this forum are but I used to be too. Most of the landlords on here are in rich areas so don't know jack about the real world it seems. What happens when the crack heads use your place for a flop house? When they bust the water pipes? Guess what: YOU get the bill. What about when some teenager falls off your roof. (Probably on purpose as everyone knows but that can never be proven). Or when the neighbors decides to sue you? Or the IRS decides its time to collect that $30K lien that's been sitting there for years (and don't think the title insurance company will pick that one up)!!!

As I found out in tax sales, there are lots of negative value properties.

not to mention gobs of waaaasted time messing with these when you could have been fishing.

BTW, there's a houses near here zoned biz that went for $300K at one point a few years ago and is now sitting REO at $119K. Got the sideboards ripped off of one wall. But its a safe area so will be Ok. But what happens when some HS kid decides to punch holes in the walls or throw rocks through all the windows? Some rain... pretty soon, worthless.

I was a bit tentative about being a landlord until I bought 5 properties and actually did it.

I'm still cowering in the corner clutching my HELOC. Are there any resources you'd recommend (besides, ya know, having inhouse counsel)?

« First « Previous Comments 7 - 45 of 45 Search these comments

how many here (if any) feel that a certain percentage of housing could go to zero? meaning either the home can not be sold for legal(aka MERS) reasons or that when financial markets freeze, there will be no money/credit available to lend so a home would be 'worthless' as a financial product.

i would hazard a guess that at least 20% and maybe closer to 40% of R.E. could have such severe MERS issues that it would be unsellable. if we have a major financial melt down i think the numbers could be 50-65% of homes that would be unsellable due to lack of funding.....

right now the federal government is financing 100% of the costs of gov with QE. when QE stops, R.E. loans stop as 98% of the securitization market is now freddie and fannie.....housing goes to zero.

...remember we bulldozed homes, shot cattle and burned crops in the 30's......but this time is different?

#housing