patrick.net

An Antidote to Corporate Media

1,248,707 comments by 14,891 users - Ceffer, HANrongli, Patrick, RWSGFY online now

« First « Previous Comments 106 - 132 of 132 Search these comments

Sad isn't it that this is what it has come to..... we can't straight out believe the information the government tells us....

It is sad. Sad that you choose to believe what you want to be true and disregard all data that doesn't agree with you.

It is sad. Sad that you choose to believe what you want to be true and disregard all data that doesn't agree with you.

Aaahhhh.... the Troll shows up on this nice Friday!!

lol--your definition of troll is someone who disagrees with you? Fits your profile pretty well.

lol--your definition of troll is someone who disagrees with you? Fits your profile pretty well.

No just someone who disagrees but doesn't post any facts or data to support his claim..... just makes blind statements.... you're an expert at that!!

Pot, kettle...

lol--your definition of troll is someone who disagrees with you? Fits your profile pretty well.

No just someone who disagrees but doesn't post any facts or data to support his claim..... just makes blind statements.... you're an expert at that!!

Nice try but I post links and data to back my claims. You always choose to counter that the data is suspect. So who's the real troll?

As Keynes said, "markets can stay irrational longer than investors can stay solvent"- though it should be modified to say "markets can be rigged longer than economically sensible families looking to buy a house can hold out for sanity to return to the markets". I guess that doesn't flow as well- I'll have to work on that one.

Try: "the government can play kick-the-can longer than you can stay alive".

zesta says

In Los Angeles there aren't many more empty areas to build that are within an hour's drive of major employment centers.

Said everybody in 2006, right before the crash.

It's easy to talk about this. Do you SEE any areas where you can build?? I don't.

Done.

That's not exactly true. When proper demand exists, the building WILL take place.

There's plenty of neighborhoods in LA ready to gentrify. And don't give me that nonsense about how no one wants to live in gang wasteland. People said the same thing about Silver Lake, Echo Park, Atwater Viliage, Altadena, and Highland Park.

You're right about the neighborhoods ready to gentrify. There are plenty.

There's a big difference in buying 1000 acres of land and putting cookie-cutter housing tracts and scraping individual lots and putting up SFHs or mixed-used projects. The margins aren't the same and the additional red tape makes it exceptionally time-consuming.

Playa Vista was the last major residential development in LA's westside and it took them almost 30 years to build ~3k units.

There's probably more room to build Orange County, but gas prices are killing the exurbs and major development in LA.

Homeboy says

zesta says

In Los Angeles there aren't many more empty areas to build that are within an hour's drive of major employment centers.

Said everybody in 2006, right before the crash.

It's easy to talk about this. Do you SEE any areas where you can build?? I don't.

Done.

Miss the point much? I thought this was obvious, but:

Many people in 2006 said that L.A. was "built out", that there was a housing shortage, and that therefore prices would continue to rise.

Did prices continue to rise? No.

What can we learn from this? That it is a bogus argument. It was bogus then, and it is bogus now. I am not questioning whether there are places to build; I am saying it is not relevant.

DONE.

Oh, and to answer your question - Is there any vacant land within an hour of major employment centers in L.A.? Yes.

Homeboy says

zesta says

In Los Angeles there aren't many more empty areas to build that are within an hour's drive of major employment centers.

Said everybody in 2006, right before the crash.

It's easy to talk about this. Do you SEE any areas where you can build?? I don't.

Done.

Miss the point much? I thought this was obvious, but:

Many people in 2006 said that L.A. was "built out", that there was a housing shortage, and that therefore prices would continue to rise.

Did prices continue to rise? No.

What can we learn from this? That it is a bogus argument. It was bogus then, and it is bogus now. I am not questioning whether there are places to build; I am saying it is not relevant.

DONE.

Gas prices during the boom years were about $2-$3/gallon.

In 2007/2008 gas prices spiked to above $4 and people realized that high gas prices were a strong possibility. There's been a change in where people are willing to live, and you can see it in the fall of housing prices in the exurbs. Santa Clarita, Riverside were places that you could build housing tracts. If nobody wants to live there anymore, where else will you build?

Gas prices during the boom years were about $2-$3/gallon.

In 2007/2008 gas prices spiked to above $4 and people realized that high gas prices were a strong possibility. There's been a change in where people are willing to live, and you can see it in the fall of housing prices in the exurbs. Santa Clarita, Riverside were places that you could build housing tracts. If nobody wants to live there anymore, where else will you build?

Well, no - prices fell because they were unsustainable. We had a bubble, and then it burst. Gas prices had nothing to do with it.

If you don't believe people commute anymore, try getting on ANY freeway during commute hours.

There's been a change in where people are willing to live, and you can see it in the fall of housing prices in the exurbs. Santa Clarita, Riverside were places that you could build housing tracts. If nobody wants to live there anymore, where else will you build?

Have you seen the 405, 91, 55, 57, 10, and 110 during rush hour? There are still a lot of people willing to commute from Santa Clarita, Corona, etc to get to job centers.

How far have housing prices fallen in the Central Valley compared to SF?

How far have housing prices fallen in the Inland Empire compared to LA?

Using traffic as a metric is ridiculous. Can I use that same metric and conclude that since there's a lot of traffic during rush hour unemployment is low?

How far have housing prices fallen in the Central Valley compared to SF?

How far have housing prices fallen in the Inland Empire compared to LA?

That will tell you nothing. You need to know how far prices ROSE during the bubble. Outlying areas are always more volatile. Prices rise AND fall more in outlying areas.

Using traffic as a metric is ridiculous. Can I use that same metric and conclude that since there's a lot of traffic during rush hour unemployment is low?

No, your analogy is ridiculous. The difference in unemployment statistics between good and bad times is going to be 5% or less. Are you telling me you think you can spot a 5% difference one way or another in traffic congestion just by looking? No, that is going to be a miniscule difference. But if people stopped commuting from outlying areas, the difference would not be miniscule.

Using traffic as a metric is ridiculous. Can I use that same metric and conclude that since there's a lot of traffic during rush hour unemployment is low?

http://www.redfin.com/city/17676/CA/Santa-Clarita

Homes sales in Santa Clarita are up 16% YOY. Who is being ridiculous now?

There is much being made about the alleged “shadow inventory†of homes being held by banks that are in some stage of foreclosure. Advocates of the “the shadow inventory is ‘out-there-lurking-and-ready-to-dump-new-inventory-on-the-market’ obviously have no idea about the disincentives for banks to do that.

In addition to the mistake of perhaps selling too soon into a rising market, banks have a very important reason not to sell their property at a loss. If a bank sells a property at a loss, they must immediately show that loss on their books and every loss affects their stock, their loss ratio and their P&L sheets. Analysts of banks look very carefully at loan loss coverage ratios and it has a major effect on the market reputation of the bank as well as how the investor community sees that bank.

This issue was seen during the financial crisis of 2008/09 when many securities held on banks' balance sheets could not be valued efficiently as the markets had disappeared from them. In April of 2009, however, the Financial Accounting Standards Board (FASB) voted on and approved new guidelines that would allow for the valuation to be based on a price that would be received in an orderly market rather than a forced liquidation. Starting in the first quarter of 2009, banks were allowed to not “mark-to-marketâ€. This ruling fixed an accounting problem which had been causing many banks to appear undercapitalized when in fact they were not.

When a bank has to write down an asset on its books, it not only has to take the loss, but also has to beef up its reserve of cash to cover its declining asset base. The net result is a black eye and less money to lend— even if the bank plans to hold the asset until indefinitely or until maturity. So basically, there is no incentive whatsoever for a bank to rush onto the market any properties subject to foreclosure. Those who fail to understand the internal workings of banks are still believing the myth of “shadow inventory†rather than the fact that the FASB accounting rules allow banks to hold troubled real estate assets without having to write down their value. Maybe these “believers†should come out of their own shadows and see the light of day.

Here's your shadow inventory. Take the average number of foreclosed homes before the robosigning settlement and compare it to the average number of forclosed homes after. The difference in those averages multiplied by the time since forclosuregate is where all your shadow inventory is.

There is in West Palm Beach. I see it almost everyday while doing home inspections. Homes that are vacant, haven't been sold in years and not for sale at the present time. I get calls all the time that have recently hit the market that have mold issues from sitting vacant and improperly air conditioned for so long.

In Los Angeles there aren't many more empty areas to build that are within an hour's drive of major employment centers.

That has been always a gimmick of realtors for years. If you opened your eyes and looked around, even in L.A., you would see there is land everywhere. Yes, more than enough to meed the piddly demand that exists. Only one way to go with prices from here. Interest rates are half what they used to be in 2007 and prices are less. Not a good sign and that speaks the truth. People are extended to death and just barely hanging on. "No shadow inventory"? Reading thing like this means that the bang will then be even worst. Good luck out there.

As someone who has been trying to find a good lot to build on for months, I'm going to have to disagree about land near big cities.

Every lot I've seen is either too many expensive to build on (half of my budget or more) or unsuitable for building (slopes, wetlands, protected species, etc.)

For subdivision builders, things are not even worse since they tend yo need good plots in the 10 acre+ variety.

New construction just can't be competitive with existing inventory in the present market. When you can buy a 3000 sf home with hardwoods, granite, high end appliances, Trippe paned windows, etc. For $500k, there's no way for new construction to be competitive.

Expect future builders to focus on smaller homes and quality design to be competitive. Either that or they wait until all the mcmansions start falling apart so that they can go back to vinyl and carpet and be competitive

Maybe the govt invented an invisible cloak to cover the empty homes so nobody can see it.

As someone who has been trying to find a good lot to build on for months, I'm going to have to disagree about land near big cities.

With cities poised to go bankrupt all through the U.S. you can bet that re-zoning will be done in metro areas. I didn't say the land was accessible right now, but it will be. Look around, it is everywhere. The one thing this country has is land.

If you can see, and quantify the shadow inventory, it's no longer a shadow.

The investers are buying these up as fast as they can because they think that they can rent them back to the defaulters for more than the defaulters were paying in mortgage.

This makes roughly zero sense. If they can afford a higher rent payment, they wouldn't be in default on the loan.

I don't think anybody is that dumb. They're buying the properties because they can make a decent rental profit, not because they're delusional.

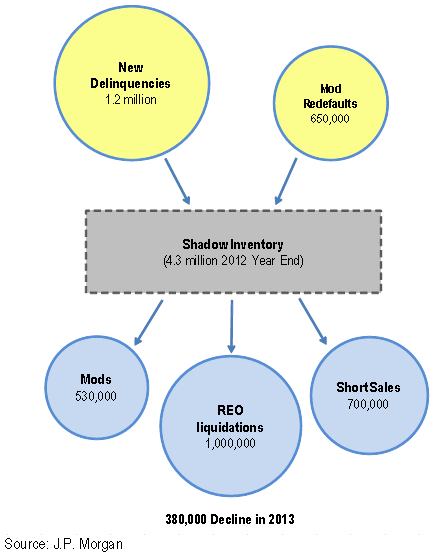

Even the biggest of Ponzi enablers, JP Morgan Chase, doesn't claim there isn't any "shadow inventory":

People just disagree on the numbers, and how it will have an effect on the market. But the homes aren't really in the shadows.

It looks like the outflow exceeds the inflow. We should be out of the housing mess within a couple of years.

I think at minimum, 3-4 years. That's assuming the fundementals such as unemployment, growth, etc correct as well.

If unemployment remains high, and we continually hit debt ceilings, I think all bets are off.

One thing is for sure, we're not out of the woods quite yet.

« First « Previous Comments 106 - 132 of 132 Search these comments

According to Foreclosureradar.com, there is no shadow inventory, so good luck to those waiting for a flood of houses to go on the market...

http://www.contracostatimes.com/ci_21312143/bay-area-foreclosures-jump-july

#housing