Buy A House For $213,000 If You Can Because Prices Will Only Go Up From Here

2014 Jun 23, 3:04am 29,636 views 61 comments

« First « Previous Comments 8 - 47 of 61 Next » Last » Search these comments

Sadly, I had to make do with a less expensive area.

But you won't hear be complain.

You just complained when you said "sadly".

I was hoping no one would notice.

Any salesman who says prices are going up believes they are really going down. If you could sell your house for 10% more by waiting two months, wouldn't you take your house off the market until then?

The more the seller says prices are going up, the more he believes the opposite. The seller is motivated to sell now if prices are dropping and to sell later if prices are rising.

By the way, when was the last time anyone in the press said prices are going to drop?

So young families should move to Modesto when they work in the SFBA? This is not a very good answer.

Why are home prices growing at double digits when wages are flat? There is no reason outside deliberate manipulations of the supply and credit. Forcing young families to live in tiny apartments? Is that the great, bright plan for the future?

Nice questions. I'll try my best to answer.

High priced areas are not dependent on wages. Home prices in these areas are more susceptible to the wealth effect from stock prices and foreign investment, and in the case of the Bay Area tech companies going public. Once the rich start buying the rest of us will get crowded out. If a very affluent family is willing to pay $1 million in the BA for a house that can be purchased for $200,000 in Modesto what recourse do you have? You either move or live in a tiny apartment. You can't force sellers to sell it to you for $200,000.

Why is expensive housing a requirement for the economy to grow? Young families having large mortgages is not good news for future growth.

Why is "wealth effect" leading families to spend money they don't have generally seen as good news? It is obviously bad news, for these families and for the economy.

Why does the press relay stupid people: happy and gloating about how life necessities are becoming so expensive?

I'll say it again, the entire housing policies is stupid and evil.

Higher home prices are necessary because the crash of 2008 made it impossible for home builders to compete with foreclosures. Housing is the largest sector of the economy where millions are hired. If home prices are too low they wont build - if they don't build, no one gets hired - if no one gets hired we don't have a recovery. Housing dragged the economy into a recession, and it is housing that will take us out of the recession.

My own children will one day be buying their own homes, and I worry how they will afford to buy the same homes that I purchased. There is nothing anyone can do except downgrade or move. What else can I say.

The more the seller says prices are going up, the more he believes the opposite. The seller is motivated to sell now if prices are dropping and to sell later if prices are rising.

Most sellers are moving up. They are selling so they can buy something more expensive. It's entirely possible they believe prices are going up even though they are selling.

By the way, when was the last time anyone in the press said prices are going to drop?

They seldom ever go down. We are tuned to believe prices only go up.

If home prices are too low they wont build

No. The median price for new homes in the US is around $250K.

The median price for ALL houses in CA is higher than that... I don't think we can say low prices are a barrier to more building. They are not.

There are other very deliberate barriers to new building.

Housing is the largest sector of the economy where millions are hired

Then limitations on new constructions are causing unemployment.

Higher home prices are necessary because the crash of 2008 made it impossible for home builders to compete with foreclosures.

Let's not forget these expensive housing policies created the huge mortgage debt hence the foreclosures that followed. In any case hopefully most of the foreclosures are behind us now. So this is not really an argument. There is no reason why perpetually increasing, expensive housing prices are needed. They aren't.

My best guess is that authorities are using housing and education as ways to force people to take debt, because they figure this is how to grow the money that gets spent.

Except without corresponding wage growth it makes the economy unstable and put people in very bad situations. Everything that is gain this way will be lost later. There is no gain, just bad effects. Stupid and evil.

If home prices are too low they wont build

No. The median price for new homes in the US is around $250K.

The median price for ALL houses in CA is higher than that... I don't think we can say low prices are a barrier to more building. They are not.

There are other very deliberate barriers to new building.

Here's what I mean:

Lets say a new house costs $500,000 to build. The same model home built 5 years ago in the same area is available for $400,000. You, as a rational buyer will consider the $500,000 home as overpriced because there is hardly any difference compared to the $400,000.

Builders won't build in that scenario because their cost of construction is lets say $450,000, with no one willing to pay $500,000, the minimum price they need to make a reasonable return.

My best guess is that authorities are using housing and education as ways to force people to take debt, because they figure this is how to grow the money that gets spent.

Not at all. If anything, it's tough to get a loan these days, especially for first time buyers. It was the investors with lots of cash who swooped in to buy because they saw home prices well below construction costs, knowing they could only go up.

Lets say a new house costs $500,000 to build. The same model home built 5 years ago in the same area is available for $400,000. You, as a rational buyer will consider the $500,000 home as overpriced because there is hardly any difference compared to the $400,000.

Builders won't build in that scenario because their cost of construction is lets say $450,000, with no one willing to pay $500,000, the minimum price they need to make a reasonable return.

You could alternatively address why it costs $500K to build a new house -- i.e. increase supply of land available by loosening artificial restrictions on growth, lower permitting costs, have less restricting planning regulations, allow upzoning in combination with joining lots, etc.

You could alternatively address why it costs $500K to build a new house -- i.e. increase supply of land available by loosening artificial restrictions on growth,

Land is the number one cost in Coastal California.

Increasing supply by loosening restrictions on growth is a losing proposition by environmental conscious Californians. Like me.

lower permitting costs, have less restricting planning regulations, allow upzoning in combination with joining lots, etc.

That could work, but if they lower permit costs the pensions of the bureaucrats could get jeopardized.

Lets say a new house costs $500,000 to build. The same model home built 5 years ago in the same area is available for $400,000. You, as a rational buyer will consider the $500,000 home as overpriced because there is hardly any difference compared to the $400,000.

No, it's not the competition from existing houses because there aren't enough of those compared to the population growth. Builders are building less $500K houses because there simply aren't that many people who can afford them. Instead they should build massively at a much lower price, which obviously is possible since the MEDIAN price of a new home is $250K. But this isn't happening, and so kids are staying with parents, or taking roommates, since they are denied a house at a reasonable price.

Housing has been artificially made into a luxury item and most of the population standard of living has gone down dramatically as a result.

If anything, it's tough to get a loan these days

I don't believe it is. 30 yrs ago you couldn't get a loan without 20% down. Today you can get FHA loans with 3.5% down. Loans get all sorts of subsidies, government guaranties, etc...

The problem is NOT the availability of loans.

The problem is the price is too damn high.

It's really that simple.

Not at all.

Really? you can look at all actions the government take: they are all aimed at increasing household debts: direct subsidies on interest rates, government guaranties on debt, supply restrictions, tax breaks, etc, etc.... And that's true of housing, education, cars... pretty much any big spending people do.

If someone REALLY wanted to increase home-ownership, why not increase housing supply?

I can't thing of a single measure designed to increase the supply of housing.

They seldom ever go down.

Oh boy....

Glad you got the memo.

It's a good thing prices have only gone UP in past history, and no one has ever lost money on their "investment" any time in the past....

*

*

Oops... maybe not...

Where did I say prices only go up Call Crazy? I said "They seldom ever go down"

Which is true because prices are a lot lot higher then 20 years ago, 30 years ago, and in most places 2 years ago.

Give people longer time to pay (30 years vs. 10 years), artificially hold down mortgage rates and decrease down payments to 3.5% instead of 20%, and you get the housing market you have now...

What you are saying is that the way the mortgages are designed now are made to hide the real cost, and so allows people to buy at high prices.

This is true but the fact that there is (some) demand at these prices doesn't explain why there aren't more supply keep prices lower.

As it is, a lot of people are simply priced out.

You have like 6 months supply out in the marketplace now.... How much more do you need??

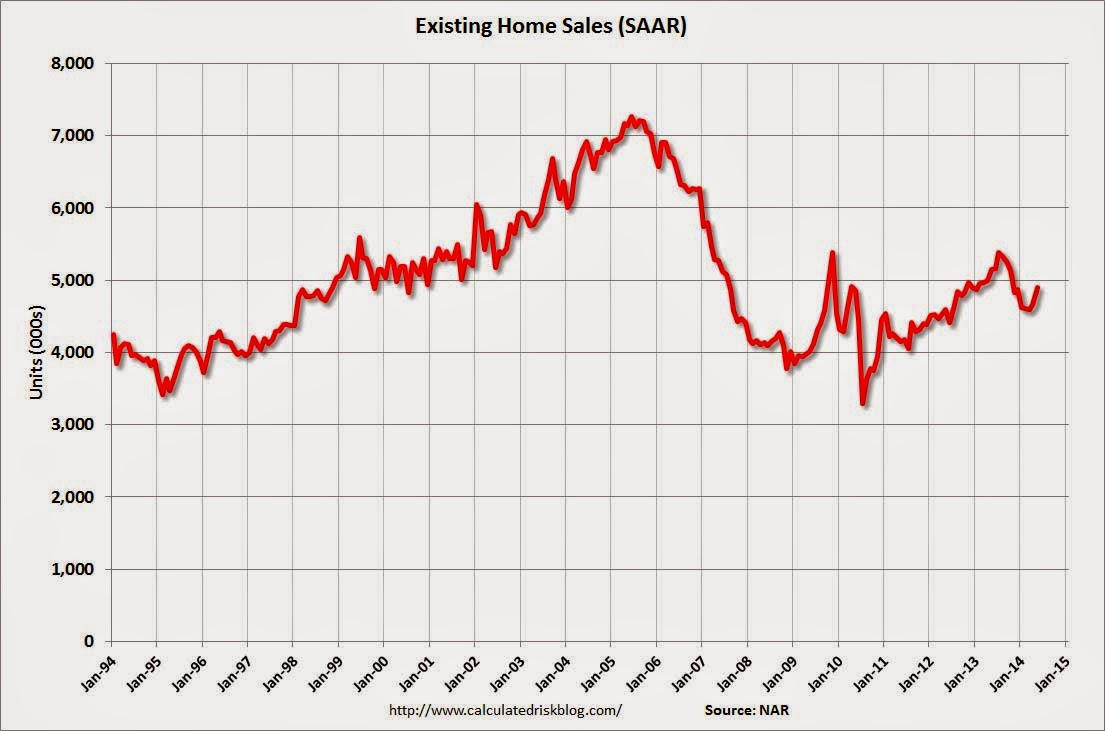

Sales of existing home are lower today than they were in 1999. That's 6 months of these low sales.

But with sales levels back to where they were in 1999, it appears that the additional inventory now has no effect....

More supplies means lower prices.

Obviously there would be more sales at lower prices.

Young people are not living with their parents because they like it.

There's another reason why houses aren't selling and it's not because we need more supply...

So why are rents going up?

There's another reason why houses aren't selling and it's not because we need more supply...

So why are rents going up?

Can't afford to buy or refuse to buy, so rent. Many out-of-state manage to get jobs in SFBA. Btw, I notice inventory for most cities in SFBA has been increasing (at a rate faster than similar period last year) since Jan.

Young people are not living with their parents because they like it.

They're living with their parents because:

They are carrying large student loans.

Their credit scores suck because they don't pay their bills on time.

They have no money saved for a down payment.

They have a crappy work and employment history which keeps them from getting approved for a mortgage.

They don't have the income to afford a mortgage

The current 6 months supply of houses or lack of inventory isn't the reason why they are living with mom....

You forgot they need jobs.

There's another reason why houses aren't selling and it's not because we need more supply...

So why are rents going up?

Because they can, as landlords know their tenants don't have the cash to buy a house... it's a captive audience, that is, unless you want to live in mom's basement or a refrigerator box under a bridge...

Or a tiny house. Its six one way half dozen the other.

They are plastering San Francisco financial district/south beach area right now with cheaply built condos in record time. The traffic is already collapsing, throw in a giants game and it's gridlock, just in time for cannibal anarchy.

Call it Crazy,

I think that AF talked about house prices should be at 1974 levels.

If one carries the latest C/S points level back in time they hit around 1974.I carry the points back to ~1893.

Damn me,I've been talking about offering 10% of list.If one uses the 1893 point,then I'm one of the idiots that would overpay.LOL

Young people are not living with their parents because they like it.

They're living with their parents because:

They are carrying large student loans.

Their credit scores suck because they don't pay their bills on time.

They have no money saved for a down payment.

They have a crappy work and employment history which keeps them from getting approved for a mortgage.

They don't have the income to afford a mortgageThe current 6 months supply of houses or lack of inventory isn't the reason why they are living with mom....

The lack inventory also cause rents to be higher than normal.

They can't buy. They can't rent. Better stay in that high-school room.

The only thing that made housing unaffordable are "payments".

Your presumption is it's all leverage but this is not that simple.

Free market works: given a supply of labor with stagnant wages that can build houses, and if there was no other restrictions, higher prices would just lead to more construction, at prices relatively aligned with labor wages. I.e. this would automatically realign prices with wages level.

This is in essence what happened in 2007 with the bust in the US: a lot of construction happened and prices fell.

This is not happening now. Housing went up faster than wages. This has to be because supply is constrained in some ways.

And this is consistent also with the fact that rents went up.

If anything, it's tough to get a loan these days

I don't believe it is. 30 yrs ago you couldn't get a loan without 20% down. Today you can get FHA loans with 3.5% down. Loans get all sorts of subsidies, government guaranties, etc...

30 years ago, you could save up for 2.5 years and buy the house outright with dad's salary while mom stayed home and raised the kids.

3.5% down, get's you the opportunity to pay $400 a month for the priveledge.

So let's do the math.

The house is a shithole, 3/2 that costs $500k.

Since you can't afford the $100k downpayment, you must pay $400 a month PMI to put $20k down.

Now you have a $500k loan (instead of a $400k loan). You also pay $400 more, so it's actually the monthly payment of a $600k loan.

That's how 'easy' it is to get a loan.

30 years ago, you could save up for 2.5 years and buy the house outright with dad's salary while mom stayed home and raised the kids.

Where was that??

30 years ago, you could save up for 2.5 years and buy the house outright with dad's salary while mom stayed home and raised the kids.

Where was that??

Most of the US including Los Angeles suburbs like Burbank and Culver City.

I actually addressed this very issue on other real estate forums when people started denying what homes actually cost in LA in the mid to late 90's. Things like a house in West LA going for under $200K in 1997 and not being an exception. Houses in Burbank at $200-250k as recently as 2001. There are sales histories to back this up as well. So say an engineer made $90k a year at that time...not an uncommon salary in the El Segundo aerospace companies....it would be very easy for him to support a family on one income AND buy a house in the area, while of course living frugally. In fact, even the DP would not be out of reach due to the lower nominal cost. Likewise condos went in the low hundreds, not out of reach for people like postmen, teachers, etc.

It used to be very easy to search histories on Redfin by simply clicking on random homes in post war neighborhoods, but for some reason many of those histories are no longer there.

Where was that??

My parents bought their house in 1974 for $10k

My neighbor bought his house in 1970 for $25k.

He said he made $400 a week at the GM plant (not Tesla) in Fremont.

He said the government gave him an interest free loan (Veteran) for ~$18k.

Where was that??

My parents bought their house in 1974 for $10k

My neighbor bought his house in 1970 for $25k.

He said he made $400 a week at the GM plant (not Tesla) in Fremont.

He said the government gave him an interest free loan (Veteran) for ~$18k.

I realize that's 40 years ago, but my neighbor was a union guy putting together cars.

My father was a mechanic, and my mom was a housewife.

I live in the bay area now. I make 92% more than all other Americans and I have no chance.

None at all.

He said he made $400 a week at the GM plant (not Tesla) in Fremont.

He must have a bad memory. Everything I can find shows autoworkers making about $4/hour or $160/week in 1970. That's before OT obviously, but nowhere near $400.

http://www.detroityes.com/mb/showthread.php?14529-automotive-wage-history

I realize that's 40 years ago, but my neighbor was a union guy putting together cars.

And it's also fiction.

He said he made $400 a week at the GM plant (not Tesla) in Fremont.

In 1974? I don't believe it. I've heard more like $250/week for 1975, so either he worked a lot of overtime or just doesn't remember correctly.

30 years ago, you could save up for 2.5 years and buy the house outright with dad's salary while mom stayed home and raised the kids.

This original claim sounds very questionable to me. 2.5 years sounds very fast if we're really talking about savings.

If you're buying with a mortgage, which is what the majority of people do, the price you pay is directly tied to what your income allows..

Assume for a minute you can produce new widgets at will for $250K.

Explain why financing and "what your income allows" can drive the price of an existing widget to $500K.

Financing is a necessary condition for prices being where they are. It is not a sufficient condition.

This is in essence what happened in 2007 with the bust in the US: a lot of construction happened and prices fell.

No, the bust happened because many people got mortgages and HELOCs that they couldn't afford

Yes and also because there was a slight bit of overbuilding around that time.

Some people who bought should never have bought and their houses should never have been built.

Assume for a minute you can produce new widgets at will for $250K.

Because you can't produce them "at will". Sure--you can build a lot of houses. But you can't build them where people want to live.

Assume for a minute you can produce new widgets at will for $250K.

Explain why financing and "what your income allows" can drive the price of an existing widget to $500K.No, the bust happened because many people got mortgages and HELOCs that they couldn't afford and there was a lot of game playing by mortgage companies...

You haven't explained why financing alone can raise the price of a readily available commodity.

geography is BS: as an example you can take a map of the SF peninsula and find lots of places that could be built and aren't.

It's not really BS. There may be some areas that are buildable, but people bid up prices on specific neighborhoods or cities because supply is limited.

Because you can't produce them "at will".

We could build them in large quantity.

Though obviously we aren't.

It's not really BS. There may be some areas that are buildable, but people bid up prices on specific neighborhoods or cities because supply is limited.

Other people would buy in more affordable neighborhood - if they were built at all.

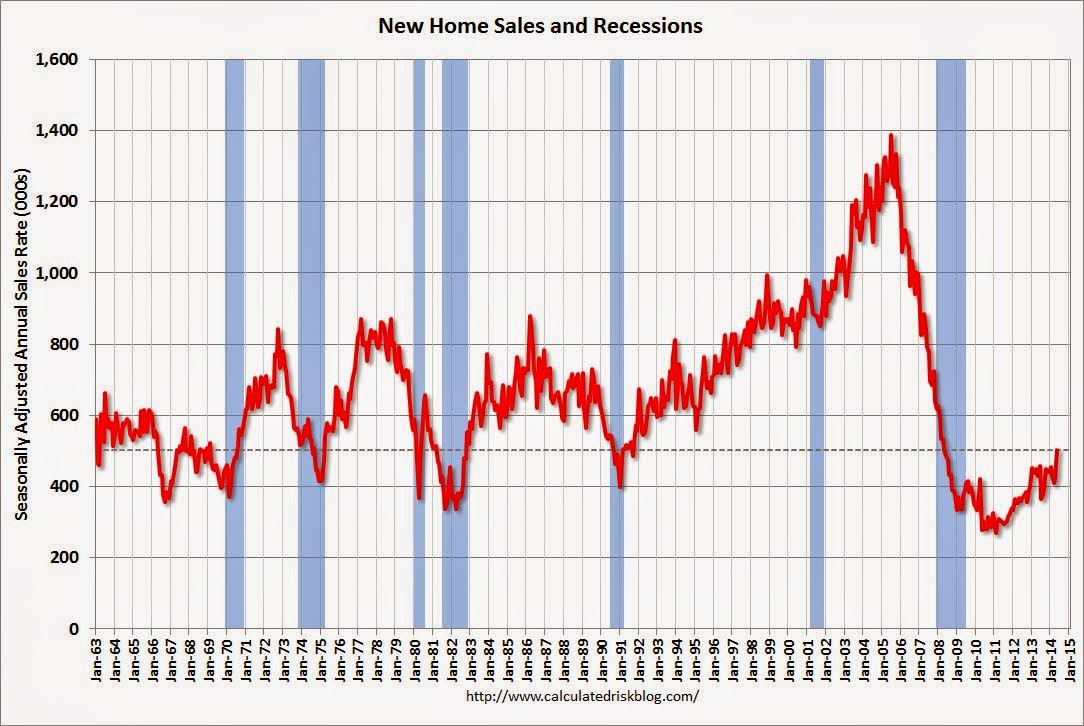

Is it me or does the image (#4) highlights exaclty why you should be buying land in San Francisco, penninsula. It is literally, Ocean, seaside, mountain range, a teeny valley that is 3-7 miles wide and then the bay.

based on the image, I would buy in the south side of SFO, say San Bruno.

Compared that to say Fresno, Sacramento, Denver or even Dallas.

25% price drop from last; 45 percent drop from peak:

http://www.zillow.com/homedetails/26804-120th-Ave-SE-Kent-WA-98030/48829249_zpid/

« First « Previous Comments 8 - 47 of 61 Next » Last » Search these comments

More "pile-in before it's too late" mentality. Any thoughts?

Of course, most of us MIGHT buy if we had that price point available around here (SFBA). Oh well.

http://www.businessinsider.com/rupkey-home-prices-will-go-up-from-here-2014-6?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+clusterstock+%28ClusterStock%29