patrick.net

An Antidote to Corporate Media

1,259,176 comments by 15,027 users - Blue, DOGEWontAmountToShit, RayAmerica, RC2006 online now

Deflation Rearing its Ugly Head Around the Globe

2014 Nov 14, 12:55am 48,725 views 155 comments

« First « Previous Comments 30 - 69 of 155 Next » Last » Search these comments

According to the latest figures, deflation is now perched on China’s doorstep.

China is the next Japan. It has been so obvious now for years. But everyone keeps saying, "It's different this time." It's not.

Please provide the data showing that real wages perform better under deflation.

Feel free do do the same with inflation, especially the minimum wage.

Make sure to factor in the increase in prices especially rents, home prices and cost of education to show how much better off most workers are today than they were in say the 1950s

If the grossly overcompensated members of the FIRE industries feel the pinch in deflation so much the better.

Why are you fixated on what a dollar buys? If a dollar only buy 1/10 of what it did 100 years ago, but you made 100X what you did then, you'd agree that you're better off, right?

And if pigs could fly we wouldn't need airplanes.

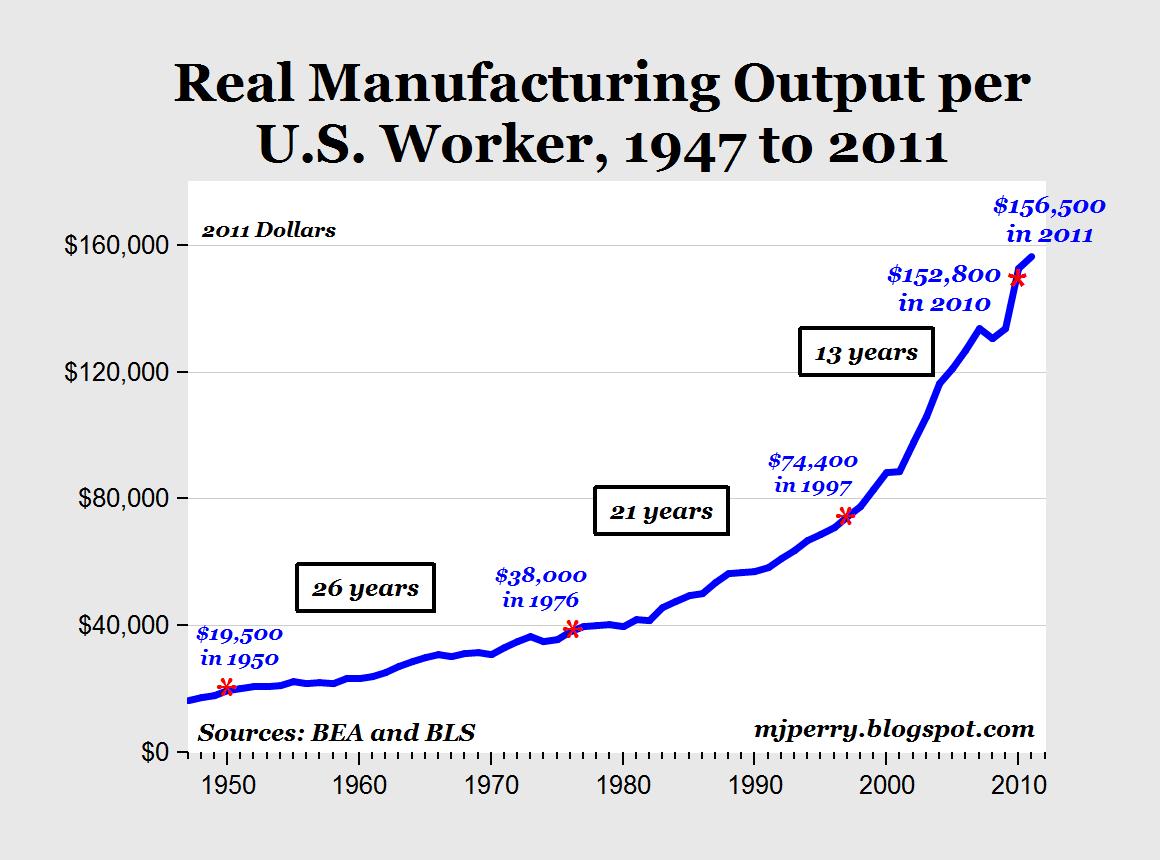

The dollar has lost 96% of its value over the past 100 year. That's a ratio of 1/25. Wages have not kept up despite workers being more productive due to technology. The average worker output today is four time as high as in 1950.

And that's a conservative estimate. Looking at manufacturing it's more like 8 times.

The average yearly income has gone from $800 to $26,364 from 1913 to 2013. If we take into conservative increase in productivity (doubling every 25 years) and take into account the debasement of the currency, then the $800/yr income of 1913 should have changed to $297,248.01 in 2013.

Currency debasement and the resulting rise in the cost of living have done nothing to increase the wealth of the typical American. On the contrary, as Elizabeth Warren has proven discretionary income has decreased during all the years of inflation.

The modern single-earner family trying to keep up an average lifestyle faces a 72 percent drop in discretionary income compared with its one-income counterpart of a generation ago.

The bottom line is that currency debasement is nothing more than stealing from savers, the very people needed to allow other people to get loans for college, houses, and new businesses. Meanwhile, everyone in charge of Social Security is shitting their pants because Americans aren't saving enough to retire.

Well, if savers are getting screwed, then no one will save.

Of course, saving is evil. So don't bother funding your 401Ks and IRAs. Social Security will take care of everything, just as long as the U.S. population keeps doubling every 100 years. Let's just hope that all that talk about peak baby is just bullshit. As long as there are 620 million Americans 100 years from now, this generation will be OK. Of course with such exponential growth in population, it won't be long before humans are covering every each of surface area on the Earth including the oceans, but hey, if Noah can save two of every species on an ark, why should that be a problem.

The really sick thing about currency debasement is that it forces hard-working, honest people who pay their taxes and actually produce wealth for a living to then play zero-sum games with the money they store their wealth in just to avoid losing it. People should be able to put the money they earned someplace where it won't lose purchasing power after taxes and currency debasement.

And people should not have to go into debt in order to buy anything that cost more than a week's wages. They should be allowed to save for big purchases without getting screwed over by the Federal Reserve.

People should be able to put the money they earned someplace where it won't lose purchasing power after taxes and currency debasement.

And people should not have to go into debt in order to buy anything that cost more than a week's wages. They should be allowed to save for big purchases without getting screwed over by the Federal Reserve.

Full ack. If "target inflation" is 2% but even the "highest-yield" savings rate is less than half than that (keep in mind that as a taxpayer you need much more than the inflation rate to break even with savings from net income), then you know savers are getting fucked by the Fed. They are actively discouraging saving with the ongoing debasement theft and the middle-class to wage-slaves (upper-middle class to upper class) bear the brunt of this crime, not the 47% or the wealthy.

And if pigs could fly we wouldn't need airplanes.

The dollar has lost 96% of its value over the past 100 year. That's a ratio of 1/25. Wages have not kept up despite workers being more productive due to technology. The average worker output today is four time as high as in 1950.

First of all, wages HAVE kept up.

.

As you can see, flat median real wages is a somewhat recent phenomena (since Reagan) and it's a distribution problem, not a wealth creation problem. As such, it has very little to do with inflation.

The average yearly income has gone from $800 to $26,364 from 1913 to 2013. If we take into conservative increase in productivity (doubling every 25 years) and take into account the debasement of the currency, then the $800/yr income of 1913 should have changed to $297,248.01 in 2013.

Yep, but that problem has very little do with inflation.

Currency debasement and the resulting rise in the cost of living have done nothing to increase the wealth of the typical American. On the contrary, as Elizabeth Warren has proven discretionary income has decreased during all the years of inflation

Don't confuse correlation with causation.

Well, if savers are getting screwed, then no one will save.

If no one was saving, savings rates wouldn't be next to zero. Rates are driven by supply and demand, despite what the Fed cult will tell you. The fact that rates are zero means plenty of people are saving.

The really sick thing about currency debasement is that it forces hard-working, honest people who pay their taxes and actually produce wealth for a living to then play zero-sum games with the money they store their wealth in just to avoid losing it. People should be able to put the money they earned someplace where it won't lose purchasing power after taxes and currency debasement.

And people should not have to go into debt in order to buy anything that cost more than a week's wages. They should be allowed to save for big purchases without getting screwed over by the Federal Reserve.

If there was no inflation, banks would charge you fees to hold your money. There is no free lunch. If you think a world where people keep their money in their mattress is better than what we have now, then we just disagree.

Feel free do do the same with inflation, especially the minimum wage.

Make sure to factor in the increase in prices especially rents, home prices and cost of education to show how much better off most workers are today than they were in say the 1950s

If the grossly overcompensated members of the FIRE industries feel the pinch in deflation so much the better.

I posted a chart of real median wages since 1939. And I'm not saying inflation helps grow real wages--I'm saying it's a distraction.

Deflation doesn't solely affect the FIRE sector--everyone would be affected. Something about cutting of one's nose to spite one's face would seem to be appropriate when discussing deflation.

If "target inflation" is 2% but even the "highest-yield" savings rate is less than half than that (keep in mind that as a taxpayer you need much more than the inflation rate to break even with savings from net income), then you know savers are getting fucked by the Fed.

The Fed doesn't set savings rates. Further, savings rates NEVER keep up with inflation--it's the cost of safety and liquidity.

They are actively discouraging saving with the ongoing debasement theft and the middle-class to wage-slaves (upper-middle class to upper class) bear the brunt of this crime, not the 47% or the wealthy.

Savings rates of near zero seem to indicate that there is plenty of money in savings.

Not that this is the best source, but Wiki describes numerous theories about deflation and its causes from several economists. At least using this source, there seems to be no consensus, and I would have to say that no one really knows.

Some intriguing bits:

"It is agreed that hoarding money, whether in cash or in idle balances, is deflationary in its effects." - Without trust in the financial system, folks will hoard cash. The failure to apply the law to financial crimes and reform Wall Street reinforces this belief, and is deflationary.

"Historically not all episodes of deflation correspond with periods of poor economic growth." E.g., technological progress.

"To slow or halt the deflationary spiral, banks will often withhold collecting on non-performing loans (as in Japan, and most recently America and Spain)." - Perhaps an explantation of folks living for free in defaulted homes.

" (Deflation) causes a transfer of wealth from borrowers and holders of illiquid assets, to the benefit of savers and of holders of liquid assets and currency..."

The average yearly income has gone from $800 to $26,364 from 1913 to 2013. If we take into conservative increase in productivity (doubling every 25 years) and take into account the debasement of the currency, then the $800/yr income of 1913 should have changed to $297,248.01 in 2013.

Yep, but that problem has very little do with inflation.

Isn't it a combination of both creating inflation and then not appropriately distributing it correctly? So you're both right. Then if all this liquidity exists and the banks are flush with cash, savings rates will naturally be low because the demand for money is low. The fed is pumping liquidity into the banks, which is keeping that money in the hands of the rich thereby creating your distribution problem. So the fed is a large part of the cause if the gov't isn't forcing a proportionate amount of wealth redistribution to compensate.

Deflation is caused by a decrease in the money supply.

Inflation is caused by an increase in the money supply.

There is no other definition.

The fed is pumping liquidity into the banks, which is keeping that money in the hands of the rich

I don't follow that---the Fed is buying assets from banks, and injecting money into circulation through bond purchases. How do either of these keep money in the hands of the rich?

The distribution problem is caused by the lack of leverage of labor vs. capital and current tax structure.

It is agreed that hoarding money, whether in cash or in idle balances, is deflationary in its effects." - Without trust in the financial system, folks will hoard cash. The failure to apply the law to financial crimes and reform Wall Street reinforces this belief, and is deflationary

Wealth inequality is deflationary and that's what the Fed is fighting.. Unfortunately, at some the Fed will lose and Austrians will get their beloved deflation. I'm afraid they won't enjoy it once it comes, however.

Why are you fixated on what a dollar buys?

People are fixated on what a dollar buys because they look to it as a way to store value. Misguided, perhaps, but it's easy-think and comforting to think of the world as unchanging.

Wealth inequality is deflationary and that's what the Fed is fighting.

Corrected: "Wealth inequality is deflationary and that's what the Fed is causing."

here was massive bailout for FIRE.

Who owns the Fed?

If you're trying to tweak your anxiety to the fevered pitch a of tinfoil hat level, I suggest you ask bgamall4.

it's a simple question. If you don't know the answer, that's OK.

The Fed doesn't set savings rates. Further, savings rates NEVER keep up with inflation--it's the cost of safety and liquidity.

That's simply false. Since 2009 the one year treasury bill is far, far below inflation, whereas in the years before (bailouts+QE) it was mostly well above inflation.

Savings rates of near zero seem to indicate that there is plenty of money in savings.

No it means banks can borrow from the Fed's discount window at zero. Why pay anybody else more?

there is plenty of money in savings.

"savings" is money leaving the paycheck economy, sigh

it can all return if it funds loans that increase demand for labor, but not if it's buried in a coffee can or used to build a lights-out factory for that matter.

The fed is pumping liquidity into the banks, which is keeping that money in the hands of the rich

I don't follow that---the Fed is buying assets from banks, and injecting money into circulation through bond purchases. How do either of these keep money in the hands of the rich?

The distribution problem is caused by the lack of leverage of labor vs. capital and current tax structure.

Who is getting the money that the Fed is injecting into circulation?

China is the next Japan.

. . .

Japan...China...India...Nigeria...there will always be an emerging market and a fading market...

Who is getting the money that the Fed is injecting into circulation?

In both cases, nobody is getting "free" money--owners of US bonds are selling those bonds for cash, or owners of MBS are selling them for cash. The Fed puts more cash into circulation by taking on assets.

Since 2009 the one year treasury bill is far, far below inflation, whereas in the years before (bailouts+QE) it was mostly well above inflation.

OK--I was referring to bank savings--1 year treasury isn't as liquid. In any event, 1 year treasury rates are determined by supply and demand--I feel like a broken record, but the reason its rate is low is because there is too much savings, not too little. More demand = lower rate.

No it means banks can borrow from the Fed's discount window at zero. Why pay anybody else more?

Incorrect. They borrow from other banks first and, when annualized, the rate is higher than savings rates.

It and its member banks are independent of congress

The member banks, of which the NY Fed is the most important, are owned "by big private banks." Source: http://www.factcheck.org/2008/03/federal-reserve-bank-ownership/

It seems difficult to determine who these banks are. It is not inconceivable that if the NY Fed is owned by Wall Street banks, and they are committing securities fraud, that the NY Fed will look the other way.

Deflation is caused by a decrease in the money supply.

Inflation is caused by an increase in the money supply.

There is no other definition.

And just because there is inflation does not meant there are price increases. Several factors may explain that such as lack of demand and increase in supply.

And just because there is inflation does not meant there are price increases. Several factors may explain that such as lack of demand and increase in supply.

lol--what is the point of defining inflation in that manner? The point of that measure is to characterize price increases and their effect on consumers. Who cares about increases in money supply if they have no effect?

hanks for that. There are attributes of the FED system better left to the fog of memory.

Very true and well said.

Recall that NY fed president said he did not view his role to be that of a regulator when questioned during his confirmation hearing why he did not regulate the Wall Street banks in the run up to the financial crisis.

From the Fed website:

"What is the purpose of the Federal Reserve System?

Supervising and regulating banks and other important financial institutions to ensure the safety and soundness of the nation's banking and financial system and to protect the credit rights of consumers."

One shouldn't expect Patnet posters to be experts on the Fed, especially with regards to ownership of its member banks,information regarding which is purposely opaque, IMHO. But even the NY Fed president is unsure of the role of the Fed, it seems.

But the Fed didn't do its job in the run up to the financial crisis.

First of all, wages HAVE kept up.

No they haven't.

Here is an analysis from your very same source:

Five Decades of Middle Class Wages: Update

November 12, 2014

by Doug Short

Here's a perspective on personal income for production and nonsupervisory private employees going back five decades.

The Bureau of Labor Statistics has been collecting data on this workforce cohort since 1964. The government numbers provide some excellent insights on the income history of what we might think of as the private middle class wage earner.

The first snapshot shows the growth of average hourly earnings. The nominal data exhibits a relatively smooth upward trend.

There are, however, two critical pieces of information that dramatically alter the nominal series: The average hours per week and 2) inflation.

The average hours per week has trended in quite a different direction, from around 39 hours per week in the mid-1960s to a low of 33 hours at the end of the last recession. The post-recession recovery has seen a disappointingly trivial 0.8 bounce (that's 48 minutes).

What about inflation? The next chart adjusts hourly earnings to the purchasing power of today's dollar. I've use the familiar Consumer Price Index for Urban Consumers (usually abbreviated as the CPI) for the adjustment with a linear extrapolation for the latest month. Theoretically, the CPI is designed to reflect the cost-of-living for metropolitan-area households.

Now let's multiply the real average hourly earnings by the average hours per week. We thus get a hypothetical number for average weekly wages of this middle-class cohort, currently at $700 -- well below its $828 peak back in the early 1970s.

Note that this is a gross income number that doesn't include any tax withholding or other deductions. Disposable income would be noticeably lower.

Latest Hypothetical Annual Earnings: $34,983, Down 15.5% from 42 Years Ago

If we multiply the hypothetical weekly earnings by 50, we get an annual figure of $34,983. That's a 15.5% decline from the similarly calculated real peak in October 1972. In the charts above, I've highlighted the presidencies during this timeframe. My purpose is not necessarily to suggest political responsibility, but rather to offer some food for thought. I will point out that the so-called supply-side economics popularized during the Reagan administration (aka "trickle-down" economics), wasn't very friendly to production and nonsupervisory employees.

The FED and the Treasury and the Full Faith and Credit of the U.S. Gov. aren't going to prevent free market excess. They're going to clean up after it.

They are creating/aiding free market excess by forcing interest rates at lows. Greenspan, Bernanke, Yellen doesn't matter.

The FED and the Treasury and the Full Faith and Credit of the U.S. Gov. aren't going to prevent free market excess. They're going to clean up after it.

They are creatiing/aiding free market excess by forcing interest rates at lows. Greenspan, Bernanke, Yellen doesn't matter.

There is nothing even resembling a "free market" today. At best, the U.S. economy should be described as a fascist form of crony capitalism.

As Milton Friedman so accurately stated,

"Indeed, a major source of objection to a free economy is precisely

that... it gives people what they want instead of what a particular

group thinks they ought to want. Underlying most arguments against

the free market is a lack of belief in freedom itself."

No they haven't.

Here is an analysis from your very same source:

Are you arguing that since Reagan they haven't kept up? I agree with that. My point was that from 1939 to 1978 or so, they did.

Well, if companies were not up to their eyeballs in debt, they would not have to lay so many people off.

That is fiction. Companies only employ the minimum number of people needed to meet demand. Whether they have a mountain of cash, or are up to their eyeballs in debt, they will lay off employees that are not needed.

Otherwise, they wouldn't be serving their stockholders....

They are creating/aiding free market excess by forcing interest rates at lows. Greenspan, Bernanke, Yellen doesn't matter.

There is nothing even resembling a "free market" today.

OK, guys, is what we have too free (as in too much government meddling) or not free enough (as in too much government meddling)? The government is your boogeyman, so show me how it's responsible for both the presence and the absence of something. Or you could just cut to the chase and blame it for existing in the first place.

Too much government meddling:

Telling two consenting human adults can and cannot do in the privacy of their own bedroom.

Marijuana laws

To little government meddling

Goldman Sachs and the rest of the gang.

This also does not relate to yoru overall point that inflation is good for normal americans as it keeps money from being hoarded

That wasn't my point. My point was that inflation is a distraction. Real wages is what matters--whether inflation is 1% or 10%

So there is PLENTY of money in circulation and PLENTY stashed in real negative interest bank accounts. Yet the labor participation rate continues to drop. What's clear is inflation is NOT helping spur demand for labor.

Obviously. The problem is inequality, not inflation.

I think you are making the rather dramatic assumption that deflation will make people hoard cash looking for a bottom. I'm not seeing it.

You don't see it because that's not at all the point I'm making. The point is that deflation occurs because of reduced demand. It doesn't happen in a vacuum.

Here are a real world example of "deflation" spurring demand for a high ticket item:

http://www.cnet.com/news/microsoft-cuts-windows-8-oem-prices-to-spur-demand-wsj/

Maybe you didn't see my earlier post, but I'll summarize it again. Both loss of demand and productivity gains can both cause prices to fall, but they are not the same thing.

@New Renter, I have a problem reconciling your graphs with the concept that people are paid according to their productivity.

1) the productivity gains may not have raised prices of the goods. Fast food restaurants are incredibly productive but the dollar menu is still there.

2) I don't think your graphs show total wages paid to employees. i.e. employee wages + paid holidays + paid sick leave + paid personal days + paid vacation time + employer subsidized dental/medical/vision/prescription insurance + retirement plan employer contributions + employer paid life insurance + Medicare tax + Social Security tax + unemployment tax + workers compensation tax + etc., etc., etc.

3) they do not measure the specific contribution of labor to growth in output. Rather, they reflect the joint effects of many influences,

including changes in technology; capital investment; utilization of capacity, energy, and materials; the use of purchased services inputs, including contract employment services; the organization of production; managerial skill; in addition to the characteristics and effort of the workforce.â€

That wasn't my point. My point was that inflation is a distraction. Real wages is what matters--whether inflation is 1% or 10%

So show some evidence that workers are directly worse off with deflation than inflation.

@New Renter, I have a problem reconciling your graphs with the concept that people are paid according to their productivity.

1) the productivity gains may not have raised prices of the goods. Fast food restaurants are incredibly productive but the dollar menu is still there.

Why would productivity gains raise the price of goods?

I don't think your graphs show total wages paid to employees. i.e. employee wages + paid holidays + paid sick leave + paid personal days + paid vacation time + employer subsidized dental/medical/vision/prescription insurance + retirement plan employer contributions + employer paid life insurance + Medicare tax + Social Security tax + unemployment tax + workers compensation tax + etc., etc., etc.

Most of these benefits have been declining as well.

they do not measure the specific contribution of labor to growth in output. Rather, they reflect the joint effects of many influences,

including changes in technology; capital investment; utilization of capacity, energy, and materials; the use of purchased services inputs, including contract employment services; the organization of production; managerial skill; in addition to the characteristics and effort of the workforce.â€

If labor isn't productive it's eliminated rather quickly.

1) the productivity gains may not have raised prices of the goods. Fast food restaurants are incredibly productive but the dollar menu is still there.

Why would productivity gains raise the price of goods?

Misspoke, meant to say price of labor.

Most of these benefits have been declining as well.

How does that effect the graphs?

If labor isn't productive it's eliminated rather quickly.

Not the point.

Too much government meddling:

Telling two consenting human adults can and cannot do in the privacy of their own bedroom.

Marijuana lawsTo little government meddling

Goldman Sachs and the rest of the gang.

Exactly. Keep in mind that no laws were needed, just enforcement of existing laws. GS committed clear cut fraud for which joe 6 pack would go straight to prison. But the rule of law was abolished by the administration.

« First « Previous Comments 30 - 69 of 155 Next » Last » Search these comments

According to the latest figures, deflation is now perched on China’s doorstep.

In September, China’s consumer price index was up 1.6%, but its producer price index fell 1.8%. The CPI increase was its lowest since 2010.

Economic growth is also receding. It’s hard to pinpoint the exact figures, because Chinese economic data is notoriously sketchy. But in September, demand for electric power, a “bellwether for China economic activity,†fell 8.4% from the prior month, the second straight monthly decline.

“Deflation is the real risk in China,†stated the chief economist at a Hong Kong bank.

http://www.globaldeflationnews.com/deflation-rearing-its-ugly-head-in-subtle-and-not-so-subtle-ways-around-the-globe/