patrick.net

An Antidote to Corporate Media

1,263,443 comments by 15,096 users - anon5525, Misc, Patrick online now

CBO: Repealing Individual Mandate Would Save $30B/yr

2015 Sep 16, 12:29am 8,932 views 19 comments

Comments 1 - 19 of 19 Search these comments

The individual mandate's sole purpose is to exploit the younger generations so that the older generations don't have to pay their fair share of health care costs. It is morally and ethically wrong. It is also financially unsustainable to have younger generations support older ones, especially when the older generations are far richer.

If health care cannot be effectively done unless everyone has to pay into a system, whether that system is insurance or some other mechanism, then the system should have the following properties.

1. Each age bracket pays for its own care. There should be no transfer of funds from one age bracket to another.

2. Everyone should have the same coverage and it should be complete. This is simply the most efficient way to socialize the costs and get the greatest benefits from economy of scale.

3. Any subsidizing of the poor from the rich should be done purely on unadjusted total income and within an age bracket. That means married couples pay this tax separately even for joint tax returns.

If everyone is forced to buy a good or service, then by definition, you are abandoning free markets and capitalism. The ACA is a half-assed attempt to reconcile capitalism and socialized health care, and the two are mutually exclusive. In the very least, we need health insurance completely socialized and nationalized. We may also need to nationalize the hospital system.

The individual mandate's sole purpose is to...

maximize spending, which the authors of the legislation receive as revenue.

Regarding your generational argument, Robert Samuelson has made similar points for years, but Obamacare backfires on everyone. Usually he agrees with your comment that Obamacare requires the young to subsidize the old, but I tried (unsuccessfully) to find the one column I remember in which he acknowledged that effect is quite small compared to its intra-generational cost shifting. I wanted simply to quote him but I can't recall the exact phrases he used so I can't find the column and I'll have to use my own words to explain instead.

You seem perhaps to conflate at least two different types of medical spending.

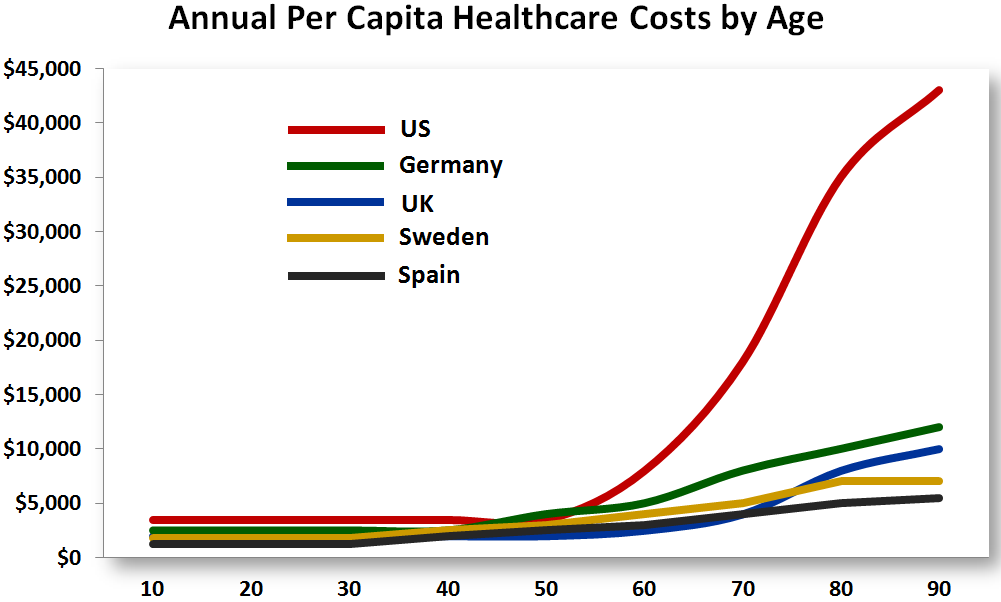

I'll call the first type inherent actuarial spending, which remains basically flat from ages 20-60. That includes car wrecks, falling off a ladder, and most diseases. A 20yo may be somewhat more likely to get injured expensively in a motorcycle crash, while a non-smoking 60yo of normal weight may be somewhat more likely to get cancer, but the differences are small enough that they balance out.

The second type results from cumulative injury: smoking, obesity, drinking too much alcohol, or toxo bob's endless injuries causing his use of opiates and opioids. Obese smokers become increasingly expensive to insure as they get older, because the cumulative injuries catch up with them. At 30, the difference might be small, but if they live to 60 it can become huge.

Your generational proposal would have the effect of subsidizing smoking, obesity, excessive drinking, and toxo bob's reckless driving, and within the context of American overpriced fee-for-service the primary beneficiaries would be the revenue recipients. That's very helpful to PhRMA, the AHA, the AMA, the tobacco industry, the fast food industry, the alcohol industry, and the oxymoronic "muscle car" industry (if you want muscles, ride a bicycle), but not really helpful to young people or old people for that matter. To borrow from Aesop's fable, you're saying ants should be required to subsidize grasshoppers every year throughout their lives, and removing a significant feedback mechanism (cost).

If you want public policy to produce better results, then it would make more sense to tax the things that cause the costs. In a socialized system, e.g. the UK, cigarette taxes may pay the cost of smoking-related illness. In the American lemon socialist system, everything gets muddled, for example cigarettes can be sold tax free on Indian reservations and then re-sold as "loosies" on Staten Island, but that's another story. I wrote this as a relapse into SIWOTI, simply to say that (a) you should take care of your health and not smoke, and (b) if you read your comment again 20 years from now, you may find your opinion has changed: you won't like the idea of subsidizing the tobacco and fast food industries simply because a bunch of fat smokers happen to have been born around the same time as you.

I'll call the first type inherent actuarial spending, which remains basically flat from ages 20-60. That includes car wrecks, falling off a ladder, and most diseases. A 20yo may be somewhat more likely to get injured expensively in a motorcycle crash, while a non-smoking 60yo of normal weight may be somewhat more likely to get cancer, but the differences are small enough that they balance out.

Did not know that, but confirmed, mostly.

It diverges greatly after 50, and the bracket from 50-65 before medicare kicks in definitely is being highly subsidized by the younger adults. That was, after all, the point of the individual mandate.

Experts say that young, healthy people must enroll in ObamaCare’s health exchanges to cover the cost of insuring sicker, older people. It’s a simple math equation: Charge everyone roughly the same rate for access to basically the same product. The people who use it less will subsidize the people who use it more.

The problem with this plan is that it hoses young, relatively poor people like me right when we least need high bills for services they’re not using. And it helps older, relatively rich people who should be able to afford the care they need. If America’s downtrodden and struggling young people are smart, they’ll opt out. Then it’ll be up to the federal government to fine them enough to make up for the shortfall.

And if it weren't for this effect, why not bracket revenue to age brackets?

Your generational proposal would have the effect of subsidizing smoking, obesity, excessive drinking, and toxo bob's reckless driving, and within the context of American overpriced fee-for-service the primary beneficiaries would be the revenue recipients.

That is true of any socialization of cost. Some individuals are more expensive to keep healthy for various reasons both under and not under their control. I don't mind that nearly as much as the inter-generational discrimination. It's not fleecing people like the later, and it's unavoidable.

There are things we can do to mitigate those effects like charging obese people or smokers a premium or taxing junk foods, but it's only mitigation. Socializing the cost of medical care does mean the less healthy people will be subsidized by the more healthy people, at least within age brackets. But there is no perversed incentive to become obese or cancer-stricken to come out ahead in health care benefits. Everyone still has a very strong motivation to be as healthy as possible.

I don't mind paying more so that the physically worse off get treatment. I do mind one generation taking advantage of another. Before I found the graph above, I thought that people in my age group were benefiting from this injustice, yet I still was against it.

If you want public policy to produce better results, then it would make more sense to tax the things that cause the costs. In a socialized system, e.g. the UK, cigarette taxes may pay the cost of smoking-related illness. In the American lemon socialist system, everything gets muddled,

Yep, but such sin taxes have little effect on behavior. People who aren't willing to stop smoking when they could die, aren't going to stop because it costs more. Same for people who eat fast food and junk food.

No matter what steps you take, socializing costs entails some redistribution of wealth because everyone does not use the services equally. This is true of the highway system, the educational system, the police, the fire department, and everything else. However, the waste and profit taking of the current and pre-ACA systems cause far more expense than socializing all health care costs.

The individual mandate's sole purpose is to exploit the younger generations so that the older generations don't have to pay their fair share of health care costs.

While they spent their youth in the 70s avoiding paying for health care at their first jobs...

In the great scheme of things, it's all one big bell curve and large groups diffuse the costs so much it doesn't matter.

The place is attack unhealthy habits is at the doctor-patient level. Encouraging doctors to prescribe weight loss before surgery or pills (only possible with a Socialist Health Care system; a capitalist one would never allow doctors to push for healthy eating and moderate exercise over expensive pills).

Taxes are also a way. Cig Taxes more than pay the difference, but it's used for other purposes. Remember that smokers who die at 60 never collect Social Security, never spend 10 years in a nursing home at $100k a year. The costs of their heart attack hospitalization and attempt at a bypass is dwarfed by the huge savings of their early deaths.

Once you open the door to cutting off people for their lifestyle, it's hard to close it...

"Bungee Jumper? Mountain Climber? Light Aircraft Pilot? Work nights in a convenience store?"

Car,home insurance,etc. are simply redistribution schemes.Why should I be forced to pay for any insurance to cover those that can't pay cash for any loss?

Any Rep/Con/Tea that is on ACA is nothing but a failure as an American.

Those that can't pay cash for medical care are American failures.

If everyone is so damn smart,why aren't "you" rich?

Come on guys,you have to admit this is pretty good trolling even it hits home.

It's true that the Baby Boomers, and to a lesser extent Gen X, didn't pay into the system. So arguing that the Millennials and beyond are just required to pay into the system is disingenuous.

Also, any system that is sustainable is so because of negative feedbacks. A large and wealth generation will have to pay more for health care, but an also afford to. The small and poor generation won't be able to pay much for health care, but because there is less money to drive up costs, they won't have to. There is an automatic adjustment of expenses that compensates for differences in the size and wealth of generations when each generation pays its own way. When younger generations pay for older ones, the system collapses when a smaller and/or poorer generation has to support the larger one. And the age distribution in America is still quite fucked up from the post-WWII baby boom.

Try this, there are actually TWO bulges...

First intelligent thing you've ever said, thus proving that a broken clock is occasionally right. However, in our society any law that prevents men from subsidizing women will be opposed and any law that requires women to subsidize men will be considered tyranny.

And now you're back to stupid. Didn't take long, which is something you probably hear a lot from your wife.

[Lame Georgie's reference from CIC in 3, 2, 1, ...]

And if it weren't for this effect, why not bracket revenue to age brackets?

Obamneycare does bracket premiums based on age. In California, the only variables are age and region.

[Per capita annual medical cost by age] diverges greatly after 50...

Your statement is accurate but imprecise, and your graph shows the effect is limited primarily to the USA (and to some extent Germany, the land of chocolate and marzipan and beer), despite the genetic similarities among all five countries measured. Remember, if Bill Gates walks into an African classroom with 60 kids who have nothing but their clothes, the net worth of people in that room jumps to $1 billion per capita. It doesn't mean the typical child in that classroom has become a billionaire. The average American is overweight, and a growing number are obese, and as I said earlier the cumulative injuries of smoking and obesity take a while to show up in medical spending. To borrow from Aesop's fable, ants are subsidizing the costs of grasshoppers; younger ants may be subsidizing older grasshoppers' costs even more, but by far the biggest differences occur within age groups and between countries.

On your graph, the biggest disparity by far is between the USA and the other countries. Moreover, that difference becomes largest after age 65, when Americans become eligible for Medicare (single payer, socialized medical insurance). It might not fit comfortably for those who advocate "Medicare for all", but your graph shows a huge disparity in the American Medicare population compared to their contemporaries around the world. If you are going to have socialism in the medical sector, then the model to consider is the British NHS, which maintains the lowest costs age 20-70 with hardly any increase in the 20-60 range. That's biology. The difference between American spending and British spending is policy (including subsidized corn, cheap cigarettes, Medicare, etc.) not biology. As your graph shows the British example with basically flat costs age 20-60, the difference in insurance costs in America results from other factors having nothing to do with age.

Obamneycare does bracket premiums based on age.

It is my understanding that the private insurers have control over that and they use the healthy young people to subsidize the old, expensive people.

Yes, the premiums are bracketed, but the revenue from the premiums is not.

On your graph, the biggest disparity by far is between the USA and the other countries.

True, and that is a much bigger problem. Ultimately, I think we need to get rid of profit taking from insurance, streamline medical administration, have a single payer system for transparent and honest pricing, and possibly nationalize hospitals if market forces can't keep them from exploiting their patients.

, we need health insurance completely socialized and nationalized. We may also need to nationalize the hospital system.

NO YOU KNUCKLE HEAD!!!!

We just need an independent Federally ran Hospital system from education to the hospital room.

The Private market then should be free to see if they can compete with a Federal healthcare system while they continue to blind bill their patients.

If the so-called free market is so god-damn good at health care, then why has it fucked up for the past century?

And why is there NO market, free or otherwise, in health care today? When was the last time you even COULD get competing prices on treatment especially during an emergency?

Because in most cases, you can't shop across state lines. Open healthcare insurance like Auto, Life, Boat or home owners, where you can shop across the country for coverage, and see what happens.

Interesting. So, you are in favor of the Federal Government imposing the rules on all 50 states?? That seems out of character for you.

It's amazing how your brain processes information. We already HAVE the rules, they should be taken OFF!

So the Federal Government should tell the States that they don't have the right to impose any rules on health care in their state?

Everyone still has a very strong motivation to be as healthy as possible.

Whatever that motivation is, it doesn't seem to be working.

And why is there NO market, free or otherwise, in health care today?

Because in most cases, you can't shop across state lines.

Yeah, because people typically travel across states to shop around for health care.

If capitalism was working at all in health care, you'd be able to shop around in your own state for health care like you can for groceries, cars, electronics, and just about anything else. You can't because you never know the price of any health care before hand except for cosmetic surgery. Capitalism does not create free markets. In health care, it didn't even create a market of any kind. In markets you know the prices of goods and services and use that information to choose where to get those goods and services from. That's the very definition of market.

When have you ever been able to get competing prices during ANY emergency: hurricane, flood, auto accident/towing, fire damage, death, sewer backup, etc?

Every time I use the yellow pages or the Internet.

"[E]liminating the requirement that individuals purchase health insurance and associated penalties established by the Affordable Care Act...would reduce the deficit by about $305 billion over the 2015-2025 period. That total consists of a $311 billion decrease in direct spending partially offset by a $6 billion decrease in revenues."

Careful readers of PatNet might remember similar estimates posted here in 2012.

#politics