Thread for orphaned comments

2005 Apr 11, 5:00pm 248,569 views 117,730 comments

by Patrick ➕follow (60) 💰tip ignore

« First « Previous Comments 2,263 - 2,302 of 117,730 Next » Last » Search these comments

Backing paper money with gold is the specifically the point. If more paper money is issued than an equal amount of gold reserves available to redeem them - then a crime has been committed. So how is gold a debt ???

Is it any different if a priest molests someones son than if the government steals from someones son ??

Backing paper money with gold is the specifically the point. If more paper money is issued than an equal amount of gold reserves available to redeem them - then a crime has been committed. So how is gold a debt ???

It's a good question. Paper money only accounts for a small fraction of the money supply. Are you proposing to eliminate fractional reserve along with re-adopting the gold standard?? How about bringing back the outhouse? Or horse drawn carraiges?

CNBC also had similar story and comments. The majority of the contruction is upscale Condos priced $100K well above normal salaries of Chinese consumers $3500-7500/year. Lots of money coming from the US to China as well.

Backing paper money with gold is the specifically the point. If more paper money is issued than an equal amount of gold reserves available to redeem them - then a crime has been committed. So how is gold a debt ???

It’s a good question. Paper money only accounts for a small fraction of the money supply. Are you proposing to eliminate fractional reserve along with re-adopting the gold standard?? How about bringing back the outhouse? Or horse drawn carraiges?

You seem to think paper money is a symbol of the progression of society. Paper money is an example of the degradation of society. It has already been tried before and has always failed.

It has monetary use. That’s why central banks have refused to sell it despite the fact that they haven’t used it to back the currencies for 40 years

First off--central banks have been selling gold. I posted a link to an article about Britain which talked about how their central bank had sold off almost all of its gold because they wanted the money "working" for them-ie earning interest.

Second--What do you mean by monetary use? You can't really use it to buy anything, so I don't follow.

It has monetary use. That’s why central banks have refused to sell it despite the fact that they haven’t used it to back the currencies for 40 years

First off–central banks have been selling gold. I posted a link to an article about Britain which talked about how their central bank had sold off almost all of its gold because they wanted the money “working†for them-ie earning interest.

Second–What do you mean by monetary use? You can’t really use it to buy anything, so I don’t follow.

store of value.

Like I said, stop trying to make this so complicated.

Obviously, the market has been buying gold steadily for 8 years now to use as a store of value.. So, if I were you, I'd stop trying to argue.

since britain sold their gold the nominal price of gold has more than quadrupled. How is that “money†working for them?

They made a poor decision--no doubt

You're joking right?? Is debasing and corrupting your own currency a symbol of the progression of society ? Debasing your own currency IS an example of the degradation of society. Debasing one's own currency has been tried before...and unfortunately it always works. The result is monetary and economic disaster.

"There is no subtler or surer means of overturning the existing basis of society than to debase its currency"...OOPS

"Paper money always returns to it's original value - zero"...OOPS

"If Americans ever allow private banks to control the issue of currency, first by inflation, then by deflation, the banks and corporations will deprive the people of their property"...OOPS

"Governments hate gold because it prohibits them from turning a free society into a tyrannical, economic dictatorship"...OOPS

"In a society with a fiat currency, all roads lead first to inflation, then to collapse"...OOPS

"Gold is the money of Kings

Silver is the money of Gentlemen

Barter is the money of peasants

Debt is the money of slaves"...OOPS

Aw shucks, just because things like this happened throughout history does NOT mean they will happen in America - right? History doesn't repeat itself - does it??? These things can't happen here, can they ???

Aw shucks, just because things like this happened throughout history does NOT mean they will happen in America - right? History doesn’t repeat itself - does it??? These things can’t happen here, can they ???

A bunch of quotes does not equal history. Just one man's opinion...

OK, I’ll ask you a question. How did the world operate when we WERE on the gold standard? Low inflation, fiscal responsibility, no currency debasing? I don’t know - thats sounds good to me.

When everyone is on a gold standard, it works.

If the US went back on the gold standard alone, we'd be royally screwed.

And, of course, since the US doesn't really have much gold anymore, it really doesn't seem like going back to a gold standard would make any sense. So we have all of this debt that we have to repay in gold now, but we don't have gold?

Why on earth would anyone intentionally persue such a strategy?

OK, I’ll ask you a question. How did the world operate when we WERE on the gold standard? Low inflation, fiscal responsibility, no currency debasing? I don’t know - thats sounds good to me.

When everyone is on a gold standard, it works.

If the US went back on the gold standard alone, we’d be royally screwed.

And, of course, since the US doesn’t really have much gold anymore, it really doesn’t seem like going back to a gold standard would make any sense. So we have all of this debt that we have to repay in gold now, but we don’t have gold?

Why on earth would anyone intentionally persue such a strategy?

Actually, the US has plenty of gold. And yes, paying our paper debt back in physical gold is a stupid idea. That's why you float it as an independent currency and let the dollar crash on its own.

Carey

Going DOWN! Buy buy buy!!!

http://www.redfin.com/CA/Concord/1130-Carey-Dr-94520/home/1580724

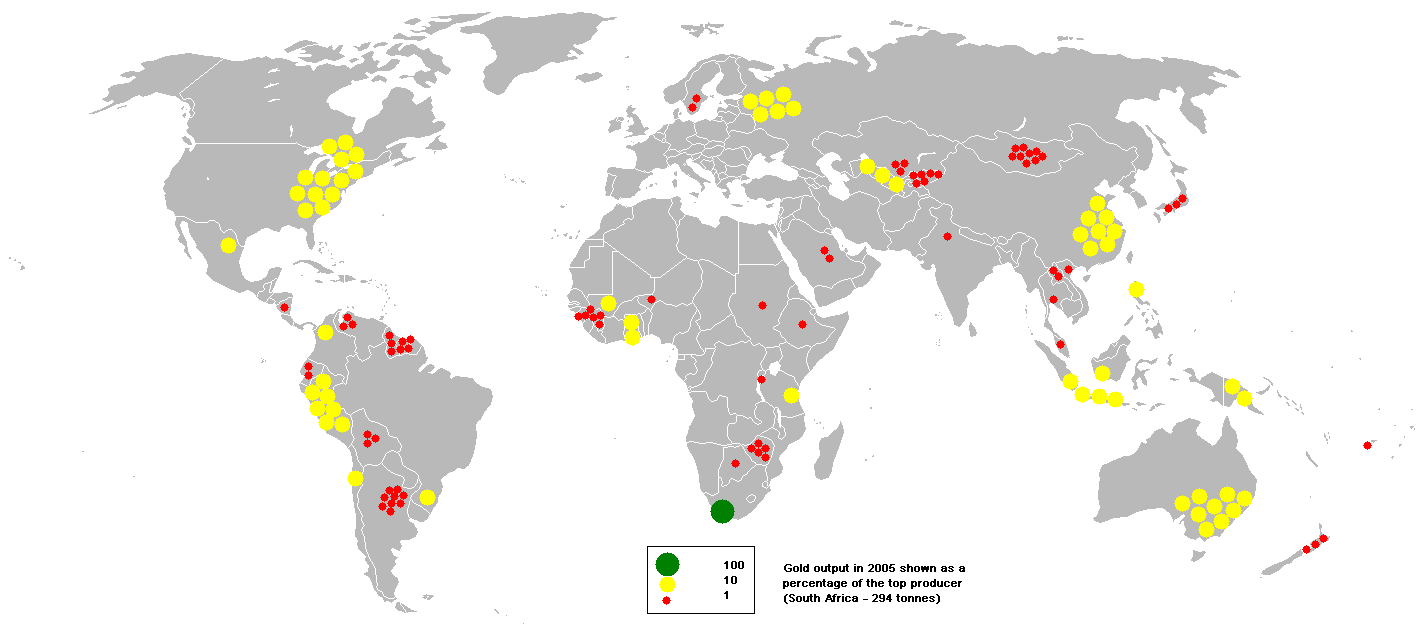

Exactly how much gold do we have Oakman? Last I recall we haven't even done a physical account of the storage in Fort Knox in decades. There's also quite a bit on ZeroHedge about the Gold ETF having pretty much no direct connection to actual physical gold. I have read that the entire world above-ground gold amounts to about 20 cubic meters. Looking at this chart:

We don't seem to have very many highly-productive mines.

1130 Carey is a tear down. I’m surprised they are asking that much.

Last refi was courtesy of World Savings Bank in 2006 (the 2002 refi was for $255k). Already a NOTS on this property so the clock is ticking...

He who has the gold sets the standards. I'm full of priceless gems today.

we looked at a lot of "Needs TLC. Fixer. Diamond in the rough. build sweat equity. " houses... most were tear-downs or in need of a complete gut/remodel

A tear down, really? Is it infested with termites or condemned due to mold? Seriously, unless it's condemned for some environmental reasons I doubt really a "tear down". Our house wasn't touched since 1949 except the roof, which was leaking...it was nowhere near a tear down, nothing that a roof, gutters, paint and flooring didn't fix.

It's funny how when it's a house you buy in the area for too much money it's a light fixer. When it's a house that shows prices are still falling, it's a tear down.

Exactly how much gold do we have Oakman? Last I recall we haven’t even done a physical account of the storage in Fort Knox in decades. There’s also quite a bit on ZeroHedge about the Gold ETF having pretty much no direct connection to actual physical gold. I have read that the entire world above-ground gold amounts to about 20 cubic meters. Looking at this chart:

We don’t seem to have very many highly-productive mines.

I'm assuming it's still in Fort Knox and the Fed isn't lying about it's balance sheet. As far as GLD, GLD does has tons of physical in vault. They just don't have enough to pay out the holders of GLD.

Forgive me for jumping in with all that preceded this. I've only scanned through the comments. My question is "how much of this is mental?" I had that discussion with a sub-vendor of mine earlier today. Everyone wants to believe that things will go up to, but few are willing to put their $$$ where their mouth is. Many RFQ's, few orders. The bottom line is we are all "cautiously optimistic" but no one is willing to make that fist move into the unknown. If suddenly we collectively say "the worst is over, it's save to spend again" then things will stake off, and we will have two - three years of growth, and "recovery" independent of the fundamentals behind said growth. In short believing things will get better is almost as good as things actually getting better.

If suddenly we collectively say “the worst is over, it’s save to spend again†then things will stake off, and we will have two - three years of growth, and “recovery†independent of the fundamentals behind said growth. In short believing things will get better is almost as good as things actually getting better.

This assumes the collective in question is entirely comprised of savers with stable employment/stable and/or growing salaries, all waiting to spring from the sidelines. I don't see that, for the most part. You cannot spend what you don't have, and what the banks aren't lending, and I think the money-for-nothing paradigm is a thing of the past.

I guess the question is - why would anyone fork over 1850 a month in rent when they could buy the same property with zero down for what you paid and have less overhead every month? It doesn't make good sense - unless, of course, your renters are on a temporary contract or something.

pkennedy and thomas,

Well here is how I look at it.

50/50 change, either I meet the dinosaur on the street or not (c. joke)

But if what's the worst case scenario: for me, is that it is a double dip. Hence I'd rather wait it out for example.

It is all a matter of perception, is the cup half full or half empty.

You both looking it at it from two opposite directions.

I think I am with thomas, because if dips the 2nd time I can be screwed. If it does not, well, for now I will save, and will have ability to put an even bigger down payment (dollar and % wise to cover), but risk will be less.

Just my 2 cents

I’m assuming it’s still in Fort Knox and the Fed isn’t lying about it’s balance sheet.

Fort Knox has not has an audit for over 50 years. As far as the Fed is concerned, to the best of my knowledge, they've never had an audit. As far as "lying" by the Fed? I'm sure that they are absolutely trustworthy and would never, ever deceive anyone.

Interesting, "no cars on the street" policy. So If it is a 4/2 house where there are two adults and 1 kid over 18, i.e. 3 cars in the household, where should they store their 3rd car (provided there is space carport or garage for two cars)

As far as rent for 1800, well, area is not so great in that part of Concord. I can see how renters credit may not be so good either, hence they are somewhat forced to pick this community over living in an apartment for example.

You can't get 100% financing on investment properties, more like 75%, and only then if your ratios and credit score are pristine. Claiming that, puts the BS meter on high for one poster on this thread, its been a good while since any bank would offer anything close to that.

OK, I’ll ask you a question. How did the world operate when we WERE on the gold standard? Low inflation, fiscal responsibility, no currency debasing? I don’t know - thats sounds good to me.

You are perhaps somehow not aware that there was a major financial crises in America roughly every 20 years from the signing of the Declaration of Independence up to and including the great depression. Here are some hints:1797, 1819, 1837, 1857, 1873, 1893, 1901, 1907. These were just the biggies, there were smaller economic hiccups also. Widespread business collapses, stock market collapses, massive bank failures, high poverty, 20% unemployment, credit collapse, real estate collapses, high foreclosures. All of which happened on the gold standard. Sounds familiar to me. Explain again how this is utopia.

Rose colored glasses are always a good thing. Nothing changes.

So why is it that the DOLLAR has gone into a death spiral since the US has went off the gold standard in 1973?

How is it again that inflation, fiscal irresponsibility, deficit spendig, and the debasing of our currency is a good thing? Nothing changes, the result is always the same, economic chaos. Well -DAH.

OK, I’ll ask you a question. How did the world operate when we WERE on the gold standard? Low inflation, fiscal responsibility, no currency debasing? I don’t know - thats sounds good to me.

You are perhaps somehow not aware that there was a major financial crises in America roughly every 20 years from the signing of the Declaration of Independence up to and including the great depression. Here are some hints:1797, 1819, 1837, 1857, 1873, 1893, 1901, 1907. These were just the biggies, there were smaller economic hiccups also. Widespread business collapses, stock market collapses, massive bank failures, high poverty, 20% unemployment, credit collapse, real estate collapses, high foreclosures. All of which happened on the gold standard. Sounds familiar to me. Explain again how this is utopia.

Rose colored glasses are always a good thing. Nothing changes.

Well, fractional reserve banking is an abandonment of the gold standard. It should be illegal. All these banking crises that you speak of are a symptom of paper money being substituted for gold.

I’m assuming it’s still in Fort Knox and the Fed isn’t lying about it’s balance sheet.

Fort Knox has not has an audit for over 50 years. As far as the Fed is concerned, to the best of my knowledge, they’ve never had an audit. As far as “lying†by the Fed? I’m sure that they are absolutely trustworthy and would never, ever deceive anyone.

I don't trust them one bit. That's why I own gold. But to act like all that gold just left our country and is somewhere else is pretty far fetched.

How is it again that inflation, fiscal irresponsibility, deficit spendig, and the debasing of our currency is a good thing? Nothing changes, the result is always the same, economic chaos. Well -DAH.

Not sure anyone is arguing that those things you listed are good. Also not sure going on a gold standard is feasible or will fix any of our ills...

taputu: IF interest rates rise several years from now, after we have regained the 8 million job losses, plus some, after California's budget is back to surplus, then both can move up together.

Right now, with millions of foreclosures still coming and a moribund job market, if rates move up it will be immediately negative for housing: every loan approval will be adjusted down in terms of maximum price by that little bit more.

"December 29, 2009, 2:05PM EST"

A lot has happened since December, most of the houses I was looking at in Dec, has shaved 30 to 40K off the price.

tapatu: So the government decided to LOWER rates... because that has no effect on home prices! So, why did the FED buy 1.5 trillion dollars in mortgage backed securities again? Because mortgage rates don't matter?

"Its not about cause and effect, but if rates go up nothing will happen to housing prices" Actually, you have managed to contradict yourself in one single sentence! Hilarious!

Rob--

When you use quotation marks, you are supposed to write verbatim what the phrase is. Not a poor paraphrase. I would think you'd have learned that at some point during your mulitple PhDs.

It's not that difficult of a concept. I'll try to explain it again for you. There is an indirect relationship between interest rates and home prices. Yes, lower interest rates are better for home prices--ALL ELSE BEING EQUAL. Unfortunately, all else is never equal. So, other factors have a larger effect on home prices than interest rates. That's all I'm saying.

other factors, such as increasing foreclosures? piss poor job market? ending credits that have encouraged buying? good points tapupu...! Housing is in real trouble!

other factors, such as increasing foreclosures? piss poor job market? ending credits that have encouraged buying? good points tapupu…! Housing is in real trouble!

Wow--you don't really want to have an objective conversation, do you? You just want to do anything you can to say housing prices will fall. OK--whatever you say Dr. Doom.

taputu: those are called factors! I would say the 100% increase in people not paying their mortgages in the past 18 months is significant, but you would prefer to dismiss it and cast insults? did you just buy a home or something that you are so desperate to cast aspersions rather than actually think?

I own some physical gold but have been thinking about selling. I have a hard time understanding why gold is so expensive. I love the US Buffalo coins however. 24 karat pure gold.

taputu: those are called factors! I would say the 100% increase in people not paying their mortgages in the past 18 months is significant, but you would prefer to dismiss it and cast insults? did you just buy a home or something that you are so desperate to cast aspersions rather than actually think?

Do you really not get it? Of course those are factors. Those are factors explaining why interest rates won't be rising (much) in the near future.

« First « Previous Comments 2,263 - 2,302 of 117,730 Next » Last » Search these comments

patrick.net

An Antidote to Corporate Media

1,271,751 comments by 15,200 users - Ceffer, clambo, RC2006, Tenpoundbass online now