Thread for orphaned comments

2005 Apr 11, 5:00pm 229,201 views 117,730 comments

by Patrick ➕follow (59) 💰tip ignore

« First « Previous Comments 5,147 - 5,186 of 117,730 Next » Last » Search these comments

Baltimore sold a bunch of pretty bad houses that they acquired for a section of I270 that was never built for $1.00 each in the 70's with stipulations that you had to live there and fix it up. Loans were available from the city for fix up. Baltimore at the time wasn't any better than Detroit is today. I used to run a concession at the Baltimore street fair every year in the early 70's (college job). We were armed and working behind very heavy chicken wire. These are really nice places now, so a program like this can work if set up properly.

Chicago high rise projects are getting torn down so the government created leeches are moving to their new free digs out in the south suburbs where the murder rate has skyrocketed! All my college roommates used to live in the upper middle class suburb of South Holland. It's now a freaking ghetto!!!

Chicago high rise projects are getting torn down so the government created leeches are moving to their new free digs out in the south suburbs where the murder rate has skyrocketed! All my college roommates used to live in the upper middle class suburb of South Holland. It’s now a freaking ghetto!!!

When was South Holland an upper middle class suburb? 1940?

"Are you being serious? I’m sure they could sell somewhere in the middle of what they were and the 1,000 they are asking now."

No they can't. Who wants a house in a city with high crime and absolutely no jobs? Countless hosues in Detroit are in horrible condition and make no economical sense to renovate. They have been stipped down to the studs or even have fire damage from arson. These houses are unsellable.

Baltimore sold a bunch of pretty bad houses that they acquired for a section of I270 that was never built for $1.00 each in the 70’s with stipulations that you had to live there and fix it up. Loans were available from the city for fix up. Baltimore at the time wasn’t any better than Detroit is today. I used to run a concession at the Baltimore street fair every year in the early 70’s (college job). We were armed and working behind very heavy chicken wire. These are really nice places now, so a program like this can work if set up properly.

Yes, but $1000 for a house the parts of Detrioit where these houses are might be above market.

On Walmart’s wages, a $1,000 house would be affordable. I know people who work at Walmart that qualify for food stamps.

Don't forget that the property taxes are probably several times more than the house. And then there's the daily cost of ammo for defense.

i would extend the offer to any military veteran, who is willing to live in the house for 2 years.

Good idea. Military training is probably essential for anyone who moves in. And Marines in particular tend to be a good influence in bad neighborhoods, IMHO. Everything would be in ship shape, at least at their house.

I disagree with you Patrick, if just a little. Chicago seems nicer, but the groups of angy black youths who routinely go “wilding†on the north side of Chicago is an ever growing problem. Even if the media doesn’t cover it.

Yes, Chicago has major problems, but compared to Detroit it's pretty safe and cushy. Which just shows you how bad Detroit is.

Corruption is something that Chicago excels at, as Mayor Daley has bankrupted the city

Old Mayor Daley is buried just two blocks from where I lived ages 0 to 9, in the same Irish cemetery as my paternal grandparents, aunts, uncles (Holy Sepulchre Cemetery). And my other grandfather worked for Daley's organization, in the Daley building downtown. One of my earliest memories is visiting him there. It was the first time I was in a tall building and kind of magical. Anyway, I know the Daleys are crooks but I can't hate them.

Detroit, Oakland, and Camden are all cities that should be paying people to live in vacant houses within their borders. Preferably military men with basic combat training.

Where is apocalypse when his insight in this would be so good.

To comment on the original post though, I'm just not sure whats with this political fetish for police and firefighters, what the hell makes them so special compared to everyone else.

Would you buy a $1,000 house in the middle of Kabul, Afghanistan or Mosul, Iraq? These cities are probably more safe than Detroit.

Despite most Americans believe, US is NOT a safe country.

This is why the houses in safe areas are selling for 700k+ easily.

Ammo and silver for me. Those bomb shelters made in the 60's are looking mighty cozy! I used to laugh when I thought of my father looking at homes with the hidden bomb shelter. Maybe he aint so dumb after all.

At this point, it is very difficult to make generalizations about the entire housing market. Some cities are seeing significant price drops, others are not. A few places are even seeing slight increases in prices.

Inflation will be the big difference maker. If oil goes to $200 things will be very different than if it remains around $100.

Who knows ?

This time two years ago there were more incentives on the horizon. The question it seems to me is how highly motivated the sellers and buyers are. The winner will be the less motivated one, right ? Speaking as a potential buyer, I can tell you it's not just price that is important its the selection, the lack of choices that holds me back. If more of the people who are waiting to sell finally put what they have on the market, then I am more likely to buy. But I guess what i am really wanting is nicer homes to come to my price point, which is no different than waiting for further reductions.

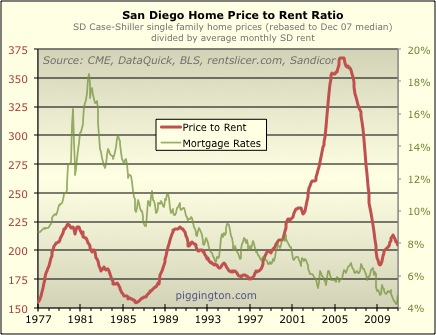

http://piggington.com/shambling_towards_affordability_yearend_2010_edition

I've argued a million times that price-based ratios are much more important than payment-based ratios in determining whether housing is fairly valued on a sustainable basis.

price-to-income and price-to-rent are still high.

if you go to a car dealership, the used car salesman always asks what payment you can afford and will never tell you the out-the-door price. that's because through creative financing, a ridiculously priced car can be made to have affordable payments using various strategies (for RE these would be: option arms, i/o loans, increase the term, low rates, etc). housing is the same, you can make over priced houses almost affordable through "payment magic".

only the financially ignorant fall for this at a used car dealership.

i also claim, it's these same people that are happy to overpay for their house because the payments are so affordable.

low rates promote over borrowing and over leveraging.

i can't wait for interest rates to go to 9% or higher (probably won't see it for 10 years or more), then this nonsense with creative financing would be greatly reduced.

at 10% interest most won't put 0% down, they'll put a decent down payment and actually try to pay the mortgage off.

i'm beginning to think buying in a low rate environment, regardless of price, is a mistake.

I'm not sure if this graph is right or just made up.

I have never seen an area in LA you can find housing near 4% of income. Here it's often close to 70%~80% for quite many.

Unless I know the data what exactly they are sticking into the graph, its just a pretty ugly picture with no real information. I can manipulate graphs all day long with data, it's pretty easy to do that.

San Diego is in the same pot as Miami and Vegas. They received lots of media attention.

I see no fault with Piggintons analysis. But do take some time to read his narrative and conclusion.

But why any particular number? The thing with metals is that every price seems about as reasonable as every other price.

The only connections to reality that I've heard are the cost of getting an ounce out of the ground, and the cost of replacing industrial silver with some other metal.

That's a dangerous game though. Bubbles tend to reverse just as suddenly as they rose, and it's really hard to know exactly when.

If you’re predicting a further crash in the real estate market, how do you reconcile that with the reality that real estate might be more affordable now than at any time during the last 34 years?

Well, for one, the annual per capita income of me, Bill Gates, and Warren Buffett is ~$5B, but that's not going to help me pay the rent.

2ndly, unemployment is 10% in SD:

http://research.stlouisfed.org/fred2/series/SAND706URN

SD has lost 100,000 jobs:

http://research.stlouisfed.org/fred2/series/SAND706NAN and it's unclear if they're ever going to get those jobs back.

Fraud was the major tractor of the economy 2003-2007, and the jobs that were supported by fraud are gone now.

Affordability has been helped by very low interest rates, but it's unclear whether that trend will continue (a la Japan) or reverse (as it arguably has now).

Nominal prices:

http://research.stlouisfed.org/fred2/series/SDXRNSA

are still high compared to 2000, even though there are less well-paying jobs now than in 2000:

http://research.stlouisfed.org/fred2/series/SAND706PBSVN

http://research.stlouisfed.org/fred2/series/SAND706MFGN

http://research.stlouisfed.org/fred2/series/SAND706INFON

http://research.stlouisfed.org/fred2/series/SAND706FIREN

The two bright spots are government sectors: health, education, and defense.

http://research.stlouisfed.org/fred2/series/SAND706EDUHN

Health & education are immense bubbles given the $20B+ state deficit and the overall medicare situation. If medicare blows up this decade, retirement communities like SD are going to get slaughtered. SD is no doubt receiving an immense amount of the $500B/yr medicare outgo.

Plus SD is still dependent on military:

http://research.stlouisfed.org/fred2/series/SAND706GOVTN

With our current $900B/yr defense bill there is not any more growth left in that sector and SD will be lucky to retain what defense jobs it has this decade and next.

Maybe the snarky method of debate doesn't work afterall, because there are always others out there who are snarkier and smarmier than you.

That said, do snarky and smarmy comments -- based in emotion ultimately (anger, frustration, fear, etc.) -- constitute some sort of worthwhile "debate"?

Or is it more of a pissing match to see who has the biggest ego? If I want to see people exercise unlimited power over others, I'll watch execution videos for that, thank you. It's more to the point and wastes less time.

That said, it would be nice to watch some of you go at it with rusty butterknives, on live streaming video, to see who really does have the biggest ego and who is willing to kill other people to prove it. That process is covered in Robert's Rules of Order (parliamentary procedure), is it not?

BTW, it's "jibe" and not "jive," you jive turkey.

Nope–I’m asking you. Because you posted this: “OK! so you actually did read his narratives/conclusion and have ignored it because it doesnt jive with your own opinion.â€

And he said "yes" he has his own opinion what ever that may be...

so ask him that same question...

If you are not in silver then you are in an investment (including cash) other than silver.

Name the other investment and demonstrate that it is as undervalued and in greater demand than silver. I'd also like to see your prediction/profit rates and your ability to analyze a chart (use silver).

Markets do follow rules/patterns. The most predictable are known as Fibonnacci sequences. Chart patterns are also very predictable.

You are correct -- fundamentals do not matter. I had lunch with chief trading strategists from Oppenheimer and also Wachovia a few years ago. Even they agreed with me on this point. Most hedge funds use technical analysis (price, volume and put/call ratio sentiment) instead of fundamentals to make buy/sell decisions. It has been this way for many years.

I am a quant analyst and I build profitable automated trading systems. I have been doing this for 12 years now.

Are people actually buying physical silver now (instead of gold)? I mean literally, buying up the metal itself?

Or are people actually investing into something related like mining, exploration, companies that use it?

That’s a dangerous game though. Bubbles tend to reverse just as suddenly as they rose, and it’s really hard to know exactly when.

Long-term bull cycles tend to collapse when they enter a "bump and run" chart pattern. I recommend educating yourself about this so you know what it is. The term "bubble" is completely meaningless if you are truly interested in making money.

Are people actually buying physical silver now (instead of gold)? I mean literally, buying up the metal itself?

Or are people actually investing into something related like mining, exploration, companies that use it?

Who knows? A better question to ask is, "Will silver bullion be more profitable than silver mining stocks"?

Historically, mining stocks perform better than the metals. However, I recommend owning both long-term due to the current nature of the market.

Like I said, I agree with the Pennington's chart and narratives.

Would you like to add now some comments to his narratives ?

Like I said, I agree with the Pennington’s chart and narratives.

Would you like to add now some comments to his narratives ?

So you agree that prices are about right historically. That interest rates don't typically have a large effect on nominal home prices. And that nominal home prices should be flat to slightly higher in the near future?

So you agree that prices are about right historically

Like I said many times over.. its a good time to buy in Miami.. be sure not to trip over the dead homeowner lying in the streets. Pretty sure you will find the same in Vegas and parts of San Diego..

That interest rates don’t typically have a large effect on nominal home prices.

As I have said many many times over and used San Diego as an example how prices fell along with interest rates in tandem post 1990. Pannington wrote about this back a few years back.

And that nominal home prices should be flat to slightly higher in the near future?

We have a long way to go in SF Bay Area. So no! expect plenty of correction in the BA to occur.

That’s a dangerous game though. Bubbles tend to reverse just as suddenly as they rose, and it’s really hard to know exactly when.

People were on this site saying it was dangerous play to go all in when it dropped from $22 to $10. They thought it was going to $3. It's 1000% above the predictions that were prevalent on this board. Silver is going to $50.

Paraphrasing here a bit but the main take aways of the Piggington's analysis are:

1 - To general affordability if you are willing to stay in possession of the house up to 10 years, put very little down of your own money, and buy something that is not overvalued, it is probably favorable to buy in those conditions.

I don't think many will argue with this here on the forum. A good buy is a good buy. The trick is finding it and for an owner being willing to stay put in order to gain the benefit. Overall to me the market activity seems pretty stagnant. Everyone seems to be waiting to see which way the wind blows and not many seem willing to hold a house for a long period of time.

2 - Home prices are in the middle of their historical range and could move up or down. Typically after booms there is an undervaluation that occurs. Based on headwinds to the housing the author believes home prices will drift downward overall but not a radical cliff dive in value.

The alternative or counter to that? They go up slightly? Again, basically the market seems boring and kind of stalled.

--

Are we strongly arguing over a "flat with a slight up" or "flat with a slight down" trend in home prices? Or are we arguing really a huge crash in prices versus a huge boom in prices? To me, major movements in price in either direction seem unlikely in the short term but I base that off of gut and a sense that "we" are trying to figure out how to breathe life back into the market.

I feel often that the debates here on the forums rage back and forth between a viewpoint of those seeing homes/rentals as investment and business opportunities versus those simply looking for a decent place to live. There are commonalities in interest, homes/rentals, but the overall motives and conclusions are very different.

How's this for a crazy view point: it's a good time for investors to buy but not a great time for a would be owner to buy. Wait a minute? Wouldn't a good buy for one be a good buy for the other? I don't necessarily think so. A buyer would rather put more money down, own more of the home outright, and have less debt over them. An investor on the other-hand cares less about these things than simply can they make money on it.

One is purely seeing benefit from any monetary gain that can be made off the house while the other is seeing benefit from investment as well as the roof over their head, location, and features of the property. This leads to the tactics of sellers emphasizing all the things outside the investment/price angle and toward the features and "quality of life" angle.

That's actually pretty minor, though very emotional, compared to the real difference between an investor and a buyer/owner: length of exposure to risk and risk aversion. If you can throw your money in and get out quickly conditions actually look favorable for that right now. I think people will work much harder right now to move a single home than they have in the past though. There just isn't much action. If you are going to buy and hold that seems to have a fair amount of risk involved in it unless you can hold for a long time. So being a shorter term owner doesn't seem to be very favorable right now. Being a flipper or a long term investor still looks good.

We know the gov. and the market will remain irrational longer than we can "stay solvent" as the saying goes. Go Wall Street! There are some big open questions about the future of how home buying will occur, the nature of mortgages, and financial law. Couple this with a flat economy, and most people knowing at-least second hand of numbers of people being laid off recently, and you don't have a lot of risk takers in the buyer/owner category. People are taking cash out of the game in favor of mobility and flexibility with where they invest. The result is a pretty sluggish housing market.

Investors I am sure are busy positioning themselves, licking their lips, and thinking that the time is looking near. They will see the positive before a buyer will otherwise they won't be an investor for long, or be a sub-par investor.

--

Isn't this the real debate we have in many different flavors across the forum? Or maybe I just have no clue what I'm talking about. (shrug) One thing is pretty certain to me here in the bay area, overall prices have moved a little, but in general the game hasn't changed from "put almost nothing down and buy something very expensive". When something exciting happens or that changes to "put a lot of money down and buy something reasonable" wake me.

Until then rent is far more attractive to me and cheaper than I have seen it in 9 years. If home prices shoot up again in California/the BA I'll expect we might consider moving out of the area for better quality of life elsewhere when we are ready to buy. Investors need not be scared. I'm sure there will always be those much less risk adverse than I. When you are talking about moving at-least 450K around, in the US of A, there is always money to be made off fees/interest/handling/transactions/etc., right?

Interesting summary.

There just isn’t much action. If you are going to buy and hold that seems to have a fair amount of risk involved in it unless you can hold for a long time. So being a shorter term owner doesn’t seem to be very favorable right now. Being a flipper or a long term investor still looks good.

But who then will buy from the flippers?

Homeowner demand is still relatively low in the BA - currently sales are dropping and mortgage apps are diving (well, at least nationwide)- even as cash buyers are making offers and sellers are jacking up asking prices. Sure, homeowner demand may pick up as the spring and summer selling season gets underway. It still doesn't seem likely though that it will be stronger than last year give that under/unemployment is about the same and rents haven't gone up that much. I suspect a weaker response given the lack of government incentives.

But who then will by from the flippers?

Well, likely at this stage other investors or the very occasional would be owner/buyer. Seems ridiculous from my would be buyer/owner viewpoint but commodities and stocks are traded from investor to investor everyday, so why not houses? You also have troubled asset managers, like banks, trying to offload, their 'investments'. We have seen reports in HK where empty apartments are being traded back and forth. People love to buy and sell things, to do it, and for the potential to make money, so why not houses?

I think short term trading of houses at this point has to be a small segment of the market, but given the overall inactivity, it is probably a larger percentage of the total transactions (random speculation on my part).

I don't disagree with you at all about your outlook. You will be right. I bet also prices will be reported as going up some at some point this year in certain areas. It's going to wiggle. I guess my point simply stated is it seems there are two major forces that are sandwiched into operating in one market. You have investors and buyer/would-be-owners both with overlapping interest and goals. The market is a combination of these forces acting on one another and right now, like most everything, investing is a good deal because cash is king.

A little irksome as a potential buyer/owner type though that doesn't want to "invest" in housing. To do that I would have to know how to trade it and profit from it. I want use of the asset value instead but I can't see myself stuck for 10 years in one place just to recover the amount of money bled out for the transaction. It's ok though as I'm pretty darn happy with my rental right now.

It's almost as if we should have different purchase methods and valuations for an actual person who will live in the house versus someone who will "trade" the home. Total pipe dream but taking some of that out of the system would probably be healthy for the majority of the population since the majority make their money in other vocations outside of real estate.

I can sell my used car to you without a bunch of third parties involved and people making predictions on the value of my and comparable cars. Why can't my 'used' house be the same? Oh, that's because prices of cars tend to always trend down until they are classic and then remain a little buoyant at whatever level they fell to. Should houses be any different? I suppose if locations radically change that could have an effect, but honestly, I don't think there should be as much difference as there has been. We have done some really goofy artificial things to the market and land use which is fogging up the real picture.

With a little more clarity the market will thaw and life will come back. I hope I like the picture in the Bay Area better after the fog is gone this time around. I'm guessing probably not as we are still very densely populated around urban centers and heavily land regulated. After CA suffers some more business attrition and migration away from the state it may change. Give it what ... 20-30 years? By then it likely won't matter and it might not be such a desired place to be.

Well, likely at this stage other investors or the very occasional would be owner/buyer. Seems ridiculous from my would be buyer/owner viewpoint but commodities and stocks are traded from investor to investor everyday, so why not houses? You also have troubled asset managers, like banks, trying to offload, their ‘investments’. We have seen reports in HK where empty apartments are being traded back and forth. People love to buy and sell things, to do it, and for the potential to make money, so why not houses?

Sure, but the speculative buying/selling has to eventually end with a homeowner signing a bloated mortgage for the ponzi to work, right? I guess it is all a matter of timing...

It’s almost as if we should have different purchase methods and valuations for an actual person who will live in the house versus someone who will “trade†the home. Total pipe dream but taking some of that out of the system would probably be healthy for the majority of the population since the majority make their money in other vocations outside of real estate.

How about a flexible county-specific, statewide progressive tax for sellers, prorated from THEIR date of purchase. Goes to zero as X months pass. Rates and X's could be easily adjusted to cool down speculators in targeted markets... Send all proceeds to fund education.

A pipe dream as well... the CAR would never let something like this get written into law, or would quickly find a way to pervert it in their favor.

Sure, but the speculative buying/selling has to eventually end with a homeowner signing a bloated mortgage for the ponzi to work, right? I guess it is all a matter of timing…

They can keep trading paper back and forth until someone actually goes to try and sell it. "The house down the street went for ..." "Last year this was traded for ..." "yeah, but we have held this for too long and blah blah needs to be repaired ..." ... on and on.

Pretty neat and flexible tool to force "real" buying of homes to take place. Would definitely take some of the game out of the system.

These charts do not tell the entire story.

In 1981 mortgages were not affordable because rates were ridiculously high. Rates topped 20 percent. See:

http://mortgage-x.com/general/indexes/prime.asp

However, in 1981 existing home sale activity fell. Home sales went from 2,973,000 in 1980 to 2,419,000 in 1981.

In 2006 existing home sales reached 6,478,000 -- the third highest total on record. How? Lenders made option ARMs and other "nontraditional" loans available so that a given level of income could buy more house. People could bid up prices because they had more borrowing power.

In 2009, corrected for inflation, household had less income than in 1999.

http://www.census.gov/hhes/www/income/data/historical/household/H05_2009.xls

What these charts really show is how the financial system was tilted to enable more borrowing with less buying power.

It’s very difficult to get a loan without meeting these requirements

amen .... it is proctology-ish

If Joe six pack decides to move out there will be little left for the ‘elite’ landlords as rental revenues decline.

Not if Jose Seis pack decides to move in.

You know, people doubling, tripling, or quad'ing up to share on the rent in what a different poster derisively referred to as a "starter" home, working 2 or 3 low wage jobs, it is still a very high standard of living conditions compared to much of the world. As long as there's money and elites in The Fortress for service employees, there's gonna be tennants.

How’s this for a crazy view point: it’s a good time for investors to buy but not a great time for a would be owner to buy.

This makes sense to me. The article made the point that it is a good time to buy some houses in SD now if you are going borrow money and hold for a long time. If you need to sell in 5 yrs, it might not be a good time to buy. This is pretty clear from the high price but low payments (relative to historic levels) due to low interest rates.

The only bad thing for the long hold leveraged buyers would be deflation in rent coupled with price declines.

The first plot has monthly mortgage payments as a fraction of annual per capita income. The typical value is around 0.06. Multiply this by 12 months, and the mortgage payments to income ratio per year is 72%. The high in 1981 was 0.11, which is 132% of per capita income. If there are two wage-earners per house @ 25%tax rate, that means that the mortgage was 88% of the total take home pay. I can't imagine there was much buying and selling going on at that time. The current low value of 0.035 is 42% of per capita income. That's still pretty high.

« First « Previous Comments 5,147 - 5,186 of 117,730 Next » Last » Search these comments

patrick.net

An Antidote to Corporate Media

1,266,261 comments by 15,139 users - WookieMan online now