patrick.net

An Antidote to Corporate Media

1,249,290 comments by 14,901 users - Booger, FuckTheMainstreamMedia, SharkyP online now

Call me crazy.. but I'm calling a bottom!

2012 Feb 24, 8:23pm 55,495 views 167 comments

« First « Previous Comments 10 - 49 of 167 Next » Last » Search these comments

Yup, your crazy, Housing still has a long way to go. Some markets may see some price stability but thats only because they have dropped so much.

Once we get a job recovery, the housing will be right behind.

-

-

prices can't bottom while prices are falling

speaking of understanding of data. When you smooth out the line you'll see that prices aren't really falling unless you're talking about a very narrow time frame.

Your purchases are IN-SANE!

Go ahead and buy...prices could still fall 70 percent.

Why not 100%.. free houses for everyone... (You realize how close you are to sounding insane... only about 30% away)

ECBB,

Clearly,you are running out of patience. Try adding another 10 to 15 years of crazy stuff that has been going on since 2008. I mean,think about it,who has interest in keeping the prices inflated? Govt,sellers,realtors,banks etc. - except the buyers. It is sort of a huge cartel working against the laws of economics. You can't simple pay one debt by another debt and keep going on and on. We are screwed for a long,long time,buddy. Live with it.

OH great Soothsayer , Will gubmint crony's pick up and profit from shadow inventory that will soon be afforded to them exclusively ? Or will the people eventually be allowed to decide value ?

This does NOT mean that people will start seeing any real price appreciation - only that I expect the downward momentum has finally ceased, and expect future reports to bear that out.

Depends on where you live. The big gorilla in the room is the 70 million baby boomers that will be dying in the next 30 years. Something like 8 in 10 boomers own a home and 1 in 4 have multiple properties. You can't take it with you. Who is going to buy all the real estate they own? Gen x/y is much smaller and has less money. Immigrants legal/illegal are mostly poor when they arrive and will take a long time to reach house buying status. Something has to give.

If you are somewhere that lots of boomers will be retiring to then things probably aren't looking bad long term. If you are somewhere that boomers are retiring from then things could and probably will slowly sink for a long, long time.

Crazy prediction, because just theorizing that we stay stagnant in prices would be a tricky balancing act. At todays home prices every day more and more people fall into default. Job losses, depleted savings/401ks, etc. are putting the strain on many mortgage payments. People don't want to foreclosure, they plan to succeed. Moving your family to a smaller rental or back in with the in-laws in not succeeding and they will try their best to avoid in most cases.

So, lets assume home prices are stagnant and this is the bottom. Then each day we get more foreclosures from here. More downward price pressure because of the foreclosures. Banks want to be in the money business, not a real estate holding firm, and they are finally trying to unwind. This year will be the most telling now.

The only two directions are really up (not likely) or down (most likely). Up will protect many people because they can then get the proper appraisal that shows they are eligible to refi. Down will continue the negative feedback and cause more down. These bandaids and free money gifts given out by the government are small efforts to a large problem. They are trying to turn a ship with a little tug boat. It will not work, like all the other gimmics. Obama will try his hardest and most likely will hold back the flood until he is re-elected, but then, good luck to all.

I will still be renting and very interested in how people here explain the collapse. Some will say they knew it was coming, when they really didn't. Others will say the data is not correct and they can still sell into the market for insane amounts. It takes all kinds today.

speaking of understanding of data. When you smooth out the line you'll see that prices aren't really falling unless you're talking about a very narrow time frame.

Not again? Ugh. Prices have been insanely falling since 2007. The brief reprieve was the product of 8K gifts, mortgage rate drops, many gov't helicopter cash drops to the banks, and many other gimmics. Our debt is growing because of these diving catch attempts. It is like someone slugged a home run out to the parking lot, and all the outfielders are still diving for the catch. The ball is gone! long gone! Next stop is down for 2012, again for 2013, same for 2014, then maybe we can reach some stability in this country. Enjoy the ride.

http://finance.yahoo.com/news/housing-bottom-120000751.html

Morningstar agrees with you.

Yah, there is no biasing there. Why don't we check out what Wells Fargo things about the real estate market? They wouldn't try to talk things up. Why would they do that. Can't they make the same amount of money if things continue to go down. No? Damn, that puts them in a hard spot. Talk it up folks, your jobs are on the line!

Yah, there is no biasing there. Why don't we check out what Wells Fargo things about the real estate market? They wouldn't try to talk things up. Why would they do that. Can't they make the same amount of money if things continue to go down. No? Damn, that puts them in a hard spot. Talk it up folks, your jobs are on the line!

I see a lot of people doing this. I agree that one needs to consider the source of the article, but if you think the source is biased, you should be able to dispute the data or the conclusion. Disregarding an article solely based on the author is lazy.

baby boomers will reverse-mortgage their houses and stay in them. That means those houses won't hit the market before 2045.

baby boomers will reverse-mortgage their houses and stay in them. That means those houses won't hit the market before 2045.

The reverse mortgage market it long gone. Banks want nothing to do with it. They are trying their hardest to get people to have more equity in their houses, not less! The problem is already in the trillions, lets not move to the quadrillion for crying out loud. Baby boomers, when they start selling in mass, will suck whatever life is left to the housing market. We better make a few worker efficiency breakthroughs n technology before it happens, or today will feel like a vacation. Ugh

I'm not saying that the fact that we've bottomed is a good thing. I'm just saying that my feel for the data is that things have bottomed out (measured by average home price on a national basis), more or less. Now the "upper tier" homes still have further to fall, but the lower tier isn't going down all that much more - all the stuff in between will find its own equilibrium - but if you look at the national prices relative to the typical HH income most, not all, but most areas have fallen back in line with historical norms. I'll try and come back and site data later... since I know there will be plenty that doubt me. If I'm wrong so be it. I’ve been wrong before - but as someone who has been bearish on housing for a long time... I think the light at the end of the tunnel has finally arrived.

Yah, there is no biasing there. Why don't we check out what Wells Fargo things about the real estate market? They wouldn't try to talk things up. Why would they do that. Can't they make the same amount of money if things continue to go down. No? Damn, that puts them in a hard spot. Talk it up folks, your jobs are on the line!

I see a lot of people doing this. I agree that one needs to consider the source of the article, but if you think the source is biased, you should be able to dispute the data or the conclusion. Disregarding an article solely based on the author is lazy.

So, my approach is to never trust sources that are tied to a particular direction of the subject they are covering. That way all my sources start from the same unbiased place. 99% of what we read about real estate is from the biased sources. I don't need to go through them all and investigate their true intents, that is not lazy, that is just efficient. If I read something from the 1% of potentially unbiased that I think is good facts then I will investigate the source and intent. The other 99% can eat my shorts for all I care. They are in the money business and will always behave badly. Some people in this world just suck. I used to think that everyone had good intentions, but then I grew up.

Here is a dispute to the argument of a recovery. Last quarter saw another drop in prices. Article attached.

Last month, saw another drop in price action (in article) 162K to 154K! Crap

Screw sales increase, it means nothing but sellers starting to adjust down to meet buyers. Sellers are desperate and will continue to adjust down. End of dispute.

Clearly,you are running out of patience. Try adding another 10 to 15 years of crazy stuff that has been going on since 2008.

Not sure to whom this comment was meant, but it does describe us.

If I was in my 20's or 30's (and without kids and pets) I could sit on the sidelines and wait a little longer but in the meanwhile we've spent more than a quarter million dollars renting and we are not getting any younger.

Rents are high and our landlord is an a-hole. Bouncing around from rental to rental with a family is not an option.

2002 prices are fine with me, at this point. It's about then that I first felt ready (life, career, family, etc.) to buy, and then the market went crazy and I said no way.

But waiting another 5-10 years for baby boomers to start dying? Sheesh, I'll be almost ready to retire by the time that happens.

Some of us just need a place to live. Housing as an investment is just as effed up as health care for profit.

we've spent more than a quarter million dollars renting

Some people lost that and more in 3 years by owning. ;) Think on the bright side of things.

If I read something from the 1% of potentially unbiased that I think is good facts then I will investigate the source and intent.

Just curious--what are the 1%?

Hey, if you find something you like and the numbers work, and it makes you happy, go for it.

Do I think it's a bottom? Depends on where you are. I think Las Vegas and South Florida are close.

Just remember, at these interest rates you sign on for 200K (as an example what ever) and the price drops for whatever reason, you still owe 200K

APOCALYPSEFUCK is Tony Manero says

It's never been a better time to buy!

Ha!

Hahaha!

Hahahahahahahahahahahaha!

Why so skeptical Tony ?

Baby boomers won't all sell, many will reverse-mortgage. I know some who are planning on this exact thing when they hit the magic age of 62: collect social security, medicare, and reverse mortgage their property. Tough shit for their kids, let them eat MTV.

Baby boomers won't all sell, many will reverse-mortgage. I know some who are planning on this exact thing when they hit the magic age of 62: collect social security, medicare, and reverse mortgage their property. Tough shit for their kids, let them eat MTV.

You not listening. Reverse mortgage are gone like the dinosaurs. Your friends will have to sell if they want to use their houses for cash.

Oh I agree real housing prices are definitely falling

http://www.calculatedriskblog.com/2012/01/real-house-prices-and-house-price-to.html

(snip from the above link about real house prices);

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q1 1999 levels, the Composite 20 index is back to April 2000, and the CoreLogic index back to February 2000.

In real terms, all appreciation in the '00s is gone.

Back to Q1 1999! Not long now before we get back to 1997 and we have then completed the retracement back to where we started. Then guess what? No bubble correct in history has ever just gone back to the beginning, they always over-correct. Not just my words.

SHILLER: Those things have come down a lot. I don't know exactly where the middle is but it's not like we're overpriced anymore. Now the question is whether we'll overshoot, which is a common thing that happens after bubble burst.

From this link.

http://finance.yahoo.com/blogs/daily-ticker/robert-shiller-housing-bottom-thinking-134116144.html

You want someone in the 1% of unbiased group. I'd add Shiller to that group. I'm sure there are a few realtard that would take a shot at him if they could.

If I read something from the 1% of potentially unbiased that I think is good facts then I will investigate the source and intent.

Just curious--what are the 1%?

This site. A lot of blog sites that use web snoopers to collect data that NAR would like to keep under wraps. Things like DOM (real ones) and price adjustments. I'd put all the flipper in trouble sites in that category.

http://flippersintrouble.blogspot.com/

http://phoenixflippers.blogspot.com/

http://seattleflippers.blogspot.com/

This site.

http://www.calculatedriskblog.com/

There are lots of people collecting data that shows what is happening. Over the years it is absolutely amazing the disconnect in main stream media and what is actually really happening. Your see some guys chasing the market down in Sacramento losing a life savings in the process on the flipper site, and then the next day you'll heal some realtard saying sales are fierce in Sacramento and everyone needs to buy! Just idiotic and the worse things got the crazier the realtards screamed buy. Really what I hear is, "Help, my SL500 payment is up this month and I need your money to pay for it!". Scum

But waiting another 5-10 years for baby boomers to start dying? Sheesh, I'll be almost ready to retire by the time that happens.

Who recommends to rent for life? DO IT if it makes financial sense to you. You lost 250K in rent? Try buying a $2 mil property and if it looses 500K in value how much have you made? Just a example. Math has been clearly explained in Patrick's calculator. Run the numbers and if you think it makes financial sense(rent v/s buy) then go for it. GL to you.

We have been actively looking to buy in San Francisco for the past 2 months.

Buying any place in SF or BA in general today, resignation is your friend and guiding light. Just accept that there are worse fates than paying too much for a house and get on with your life.

Here is a dated looking little bunny hutch I grew up near as teenager that is on the market and pending for over a million dollars.

1167 Pimento Ave

Sunnyvale, CA 94087

Looky what this bad boy sold for in 1999 - a damn good year for industry in America!

This site. A lot of blog sites that use web snoopers to collect data that NAR would like to keep under wraps. Things like DOM (real ones) and price adjustments. I'd put all the flipper in trouble sites in that category.

http://flippersintrouble.blogspot.com/

http://phoenixflippers.blogspot.com/

http://seattleflippers.blogspot.com/

This site.

http://www.calculatedriskblog.com/

No offense, but it looks to me like you're falling into the trap where sites that agree with what you think are unbiased and those that disagree are biased.

Gentle Readers,

Bottoms, anyone? Link:http://img.metro.co.uk/i/pix/2008/11/sloggibumcompEPA_450x464.jpg

Regards,

Roidy

This site. A lot of blog sites that use web snoopers to collect data that NAR would like to keep under wraps. Things like DOM (real ones) and price adjustments. I'd put all the flipper in trouble sites in that category.

http://flippersintrouble.blogspot.com/

http://phoenixflippers.blogspot.com/

http://seattleflippers.blogspot.com/

This site.

No offense, but it looks to me like you're falling into the trap where sites that agree with what you think are unbiased and those that disagree are biased.

The flippers and calculatedriskblog are all about numbers. Very little actual opinions, so I disagree with you. Numbers don't lie, unless someone is manipulating them. Could the sites I listed be manipulating the numbers? Absolutely they can. However, for what reason, benefit? There is no money trail to justify the corruption in this case. Just the way I like it. You show me someone making money from something and I will show you some form of manipulation of the data. I work in data and make very good money analyzing it each and every day. Have been doing it for 30 years now and I don't think I am far from the best at it. Each day I see the corruption, even in my work group. I can smell it, like other people can smell a spoil infant in a restaurant. :)

No offense, but it looks to me like you're falling into the trap where sites that agree with what you think are unbiased and those that disagree are biased.

classic confirmation bias

No offense, but it looks to me like you're falling into the trap where sites that agree with what you think are unbiased and those that disagree are biased.

i agree with whoever is right.

flippers in trouble? those examples prove that buying an extremely expensive home in 2006 was a bad idea... thank you for the news flash!

However, in any market today where someone can buy a home 20% down 30 year fixed, and lock in a mortgage way the heck under rent, in some cases at half of rent... what is your point again?

No real point, more of a progress to stupidity. It started with the OP claiming a bottom. I posted data suggesting that it is a tough call (highly improbable) and then there was a backlash saying I only look at data one sided. However, no alternative data was presented. My biasing was questioned and then ridiculed. Still no data. Guess that bottom must be happening with all the proof that was posted. Interesting thought process we have here. ;)

So, can we get all the realtors in this forum to agree that purchasing a house in 2006 was a big mistake? I bet we can't. I bet they have some hair-brained reasoning that makes buying that house still correct in their minds. Remember "It is never a better time to buy... repeat". Have they all called up the clients they sold to during that time and apologized?

Call me crazy.. but I'm calling a bottom!

CNN ..

Too bad none of these news portals like CNN, MSNBC, San Jose Mercury News have come out and apolgoized for dismissing the Housing Bubble in the first place, and frankly getting it wrong.

Bottom.. for a home your buying ... 1997 price PLUS inflation which can be 35-40%. Thats the bottom...

If we overshoot to the downside in housing... I predict we bounce hard off the new bottom, just like the stock market did in March 2009. I dont think we see 2007 prices again though until 2025 or later.. And most of it will be due to inflation... Wages will be a lot higher... Hell, physical money will probably be phased out... Our debt will be so high as a country... The US will only survive by devaluing the dollar... If anyone thinks we will pay off our national debt with more deflation of assets they are insane!

I predict we bounce hard off the new bottom, just like the stock market did in March 2009.

The things fuelling equities are not the same that would be fuelling residential real estate.

Here's why I think that we're at bottom.

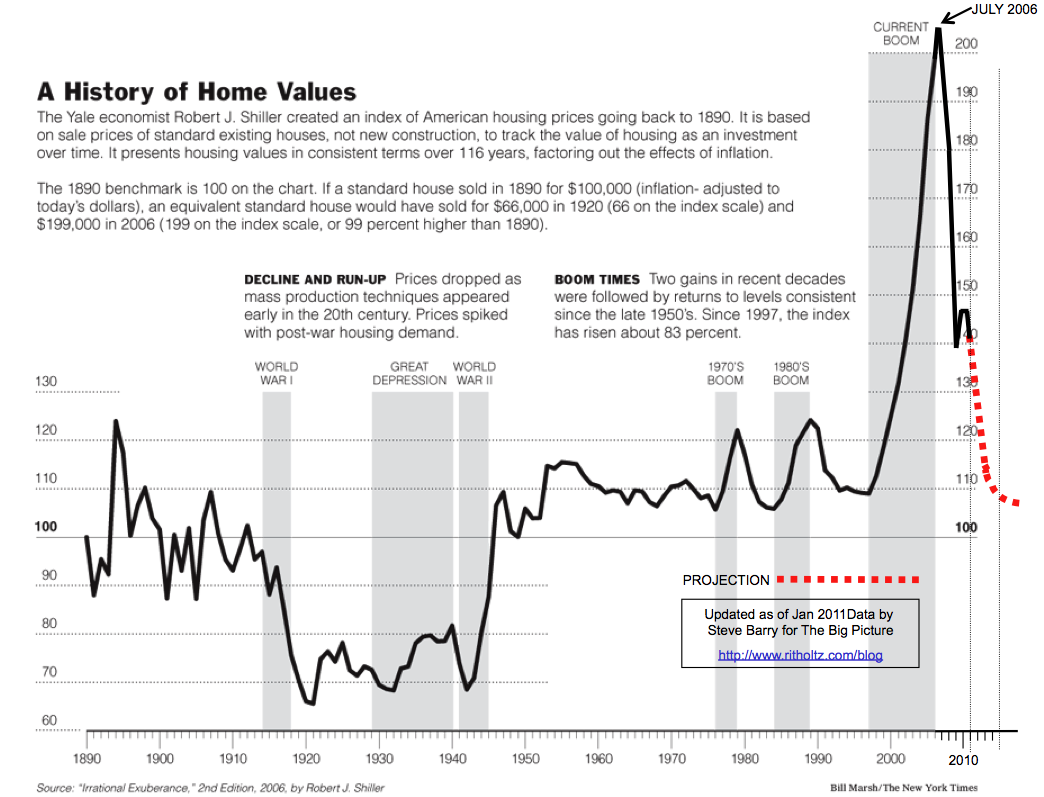

In the last two bubbles (1970's and 1980's) prices didn't overshoot on the down side. At the end of the 80's bubble (and even in the smaller mid 90's bubble) prices did not revert to the benchmark index value of100. They reverted to an index value of about 110. My hypothesis is that this is due more multi-income homes being commonplace, but I haven't dug up the data to support or refute that.

At the end of the day an index value of just over 110 (say 112 to 113) is about the right place for a bottom. So if the article is correct that prices have returned to 2001 prices in most areas... That's why I'm saying that this is the bottom - certainly time will tell if I am right or wrong.

« First « Previous Comments 10 - 49 of 167 Next » Last » Search these comments

http://money.cnn.com/2012/02/22/real_estate/home_sales/index.htm

Now in some areas prices might still have 5% to 10% to go, but on the average, we're probably more or less at the bottom. Prices may move slightly (+/- 1.5%) up or down month to month from here on out, but from my take on the available data, the days of large year over year price drops are over.

Just my two cents.