patrick.net

An Antidote to Corporate Media

1,260,977 comments by 15,056 users - Ceffer, rocketjoe79, stereotomy online now

« First « Previous Comments 191 - 230 of 241 Next » Last » Search these comments

Since hitting an all-time high of $702.10 in September, Apple shares have slid some 35%. The drop is worse when you consider that the Nasdaq (INDEXNASDAQ:.IXIC) has risen 2.32% while the Dow (INDEXDJX:.DJI) has gained almost 7% in the same time period.

Apple shareholders got further bad news today as it was reported that the $92 billion Fidelity Contrafund, managed by Will Danoff, had reduced its stake in the iPhone maker by 10% in the first two months of 2013. According to its most recent monthly report, Fidelity, the largest active shareholder in Apple, held 10.43 million shares of Apple at the end of February. At the end of 2012, the fund had owned 11.56 million shares. News of Fidelity's actions probably explains why Apple has fallen over 1.5% in intraday trading so far today.

They might be worried about the history of Nokia repeating itself. Trees don't grow to the sky. OTOH, if I had to bet on AAPL (P/E=10) or FB (PE=289), I'd bet AAPL.

Android is an open source OS any manufacturer can license, in fact the Open Source Consortium (a partnership of many firms from around the world, from Samsung to HTC to Google, as well as multiple phone companies in the US and around the world) wants as many companies using it in their phones as possible. Android runs on a Linux kernel.

Apple does not license their proprietary black box OS at all, period, to other manufacturers and certainly never their direct competition in the mobile device field.

Google does not manufacture devices, it only writes software. Apple does both.

Android was mocked when first introduced. Yet despite Apple's incredible, massive lead over it, it is now far and away the dominant mobile OS.

http://news.yahoo.com/apple-stock-falls-one-low-supplier-news-154902181--finance.html

Apple stock falls to one-year low on supplier news

NEW YORK (AP) — Shares of Apple Inc. fell below $400 for the first time in a year and half on Wednesday, after a supplier hinted at a slowdown in iPhone and iPad production.

The stock was down $21.89, or 5.1 percent, at $404.35 in early afternoon trading. Earlier in the day, it hit $398.11, the lowest level since Dec. 2011.

The decline means Apple has —for now— lost its position as the world's most valuable publicly traded company to Exxon Mobil Corp., which has a market capitalization a few billion dollars above Apple's $380 billion price tag.

Late Tuesday, Cirrus Logic Inc., which supplies audio chips for the iPhone and iPad, said sales of a particular chip are slowing down as an unnamed customer moves to a newer component.

Analyst Peter Misek at Jefferies & Co. said Cirrus' news suggests a big decline in Apple sales in the April to June period. That supports his view that Apple is unlikely to launch a new iPad Mini in the quarter, and that the next version of the full-size iPad may launch late in the quarter rather than early. In the last three years, Apple has launched a new iPad in March or April.

Apple does not comment on its suppliers' announcements or its product plans. It's set to report results for the January to March quarter on Tuesday.

The latest decline in the stock comes after a bruising winter for Apple. The company's stock is down 42 percent from its all-time high of $705.07, hit on Sept. 21 when the iPhone 5 went on sale. Investors have concluded that with the demise of co-founder Steve Jobs, Apple may never again create another ground-breaking product of the magnitude of the iPhone or iPad.

This thread is still going?

Personally I mostly unloaded AAPL a while back although I did keep a small block.

If it hits $350 I will think hard about reloading.

Personally I mostly unloaded AAPL a while back although I did keep a small block.

If it hits $350 I will think hard about reloading.

Although I don't own any myself it happens to be 1 I follow.

This is how I see it going down... Watch price @ 385 for some "short term buying", which would be the only way I would be trading AAPL at this time. I would split my risk and perhaps take a shot @385 for 40pts +/-, not a all in situation however it very well could turn into it. Ultimately, my plan would be to "TEST buys" if it gets to 360-350 and leave a 1/3 or what ever your risk management allows for the possibility of the 325s. Make the M-Ms prove "price" to you with solid confirmation.

Wish you well, just don't get in a hurry or ahead of the market and trade it based on price performance.

Regardless of all that you hear AAPL 250-200 isn't off the table, it's just to soon to calc. the odds.

My reasoning has very little to do with fundamentals being that I am a conceptual/technical trader. I know markets do what the hell they want regardless of all the fundamental talk.

However, I am aware of some of the fundamental attributes, I just leave those for the longer term investors, because I am 1 who shoots for tops and bottoms which fundamentals are useless for that purpose.

My system calculates logical price points that contain the odds and edge based on several factors and anchors that weigh price, and it is simply pointing @350+/-, and as a trader I can test other price points along the way, however treating them more like counter trend measures instead of home run plays so at a min. I will have something in the game if price is knocked out of the field. Your welcome to look at some of my other comments and judge my tactics yourself.

I apologize if my answer is void of much help to you which is probably due to me actually being a trader. The odds are I make more trade in a month then most do in their life time giving me some edge over others just due to the pure experience in volume.

Depending on the circumstance 500/1 leverage is on the table for certain trades I participate, which all I can say about that is you better know your odds and have solid risk management practices.

I am far from a sophisticated investor, I'm just a trader that will take the trades as they come regardless of what the gurus and experts have to say.

I am far from a sophisticated investor, I'm just a trader that will take the trades as they come regardless of what the gurus and experts have to say.

Aren't the gurus and experts just there to get on the mainstream news and herd the retail sheep? I don't really ascribe much value to the highly publicized experts' opinions because I don't believe that anything they do is in anyone's interest but their own. There have been some (apparent) exceptions, but I trust nobody.

Why do you think $350 is the bottom ?

I could go on about P/E. I could prognosticate with lots of charts. In this case I'm going on nothing other than that's about what I bought my first AAPL shares for back around the time the iPad1 came out.

Vicente says

Do the numbers support the Doomers?

They are not my #s so I don't have an opinion. I said about all I can say about my best "guess" as to what "I" see the possibilities.

I bought my first AAPL shares for back around the time the iPad1 came out.

My question for you is; did you take any profits since you bought, and if not "why"?

Seems like Samsung and Android in general will be dominating the mobile phone market by commoditization - unstoppable juggernauts.

My question for you is; did you take any profits since you bought

Yes several times over.

Seems like Samsung and Android in general will be dominating the mobile phone market by commoditization - unstoppable juggernauts.

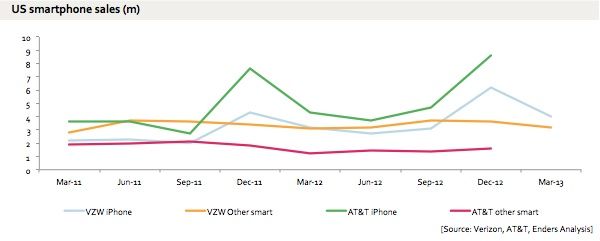

Based on what? I'm not saying you're wrong, but I haven't seen yet where Android sales have taken off, looks flat as a pancake.

Seems like Samsung and Android in general will be dominating the mobile phone market by commoditization - unstoppable juggernauts.

Based on what? I'm not saying you're wrong, but I haven't seen yet where Android sales have taken off, looks flat as a pancake.

http://techland.time.com/2013/04/16/ios-vs-android/

This is a decent overview and comes up as first hit when you search. While AAPL is still making more profits from their sales the trend by numbers (not profit) seems clear. I have no positions in either, I just think it is risky to buy back here as I think the general market is looking somewhat toppy (commodities not acting that great) here and there's some sideways/downside risk.

Too much competition from Android operating system (Samsung smart phones, Google tablets, Google chromebooks) and low-cost Windows 8 laptops are the main reasons to take Apple down a notch.

Apple just does not have a breakthrough product line like it did from 2000 to 2010 with the IMac, Apple Book, Ipod, Iphone, and Ipad.

Hence, even though Seekingalpha.com shows a forward P/E ratio of around 10, I see Apple having to readjust growth projections downward for the next year or two.

My question for you is; did you take any profits since you bought

Yes several times over.

Nice, good for you Vicente I see so many who let great profits disappear into just as great of losses. I never figured out the purpose they might have for doing so.. Just makes absolutely no since to me.

I just heard on the news, that Apple, instead of paying dividends out of cash .. they borrow the money to pay out dividends. Supposedly more corporations are getting back into borrowing again, money is so cheap that way, it's just hard to resist.

FFS, can't you folks badmouth AAPL harder?

I need it down to 350! And you guys are waffling on your job so it's stuck around 400. Hop to it!

An Apple Smartwatch? I haven't worn a watch in years. If I want to check on the time, I look at my Android based Smartphone.

i was looking for a smartwatch (before i knew apple was making one).

i want something that will let me keep track of various things and i'm too lazy to carry a phone or tablet all the time.

it'd mainly be for entering work items i've done, diet information (what did i eat), and exercise information.

the watch is the best form factor since it's always with me.

if it has an accelerometer i might be able to get rid of my nike fuelband.

if it has a camera i might be able to just take pictures of what i eat instead of typing data (then i can estimate if i pigged out just by looking at pictures).

if it's made by apple, there's a very good chance it'll look good. apple understands aesthetics are important.

some watches can be priced excessively high if they are considered jewellery which means high margins. i don't know if apple can pull it off, but if they can i can see them opening a new billion dollar market.

Friends of mine that are hardware engineers at Apple have been telling me that there is an exodus of employees right now. Engineers, leads, mid-level managers and some directors. They are going to Google, Lab 126 and Microsoft. The stock price dip has effectively halved the compensation incentive for working "Apple hours" and dealing with the pressure cooker environment there, and people are starting to walk. People there know what the competitors pay, and AAPL shares were a big leg-up for employee retention. Now that overall compensation is falling closer to what the competitors offer, Apple folks are thinking, "I can go work at X Inc. and make about as much money for fewer hours and less stress." Google is a little bit of an exception in that friends that have gone there say that the hours are long and the pressure high, but they compensate at least as well as Apple used to.

With that in mind, how would you bet on Apple stock? Already has a large captured audience of iPhone users who will suddenly be wanting to upgrade as the wonders of 5G on a kick ass iPhone are revealed....

If I was a person who liked to short stocks, I would short Apple now. Samsung is coming out with a new phone that apparently is much better than the iPhone: Bigger screen, faster, removable battery, better screen clarity, etc. Apple is

442 right now.

Removable battery?

iPhone 12 will be 5G right? Sources say that this is a game changer, will enable all sorts of applications that wouldn’t have worked without 5G. Could be as significant as the switch from flip phones to smart phones in 2007 with the first iPhone.

With that in mind, how would you bet on Apple stock? Already has a large captured audience of iPhone users who will suddenly be wanting to upgrade as the wonders of 5G on a kick ass iPhone are revealed....

The limiting factor for enticing people to upgrade to 5g is there is almost no infrastructure for 5g. The number of locations that you might have access to 5g signal is currently extremely limited. It will likely be 5 years before 5g signal is close to 4g in terms of availability. The 5g signal requires more towers/infrastructure because 5g waves cannot penetrate buildings as well as 4g signals can.

I’m no where near being interested in upgrading for 5g device because there simply is no 5g signal in my area.

Phone 12 will be 5G right? Sources say that this is a game changer, will enable all sorts of applications that wouldn’t have worked without 5G.

I can't think of anything that would work with 5G and not 4G - well, 3G for that matter.

The real advantage of 5G is that it uses (paradoxically) less bandwidth, because it does faster transfers of data. It's not that it's good for you, it's good for your carrier.

I have no opinion betting on Apple stock. Their users are a cult, and that will evaporate overnight at some point. 25 years ago, people waited outside stores all night to get the new Windows 95. This seamed crazy to me, because I was already running a Linux workstation. Well, there are no real fanboys for MS like that around anymore.

I can't think of anything that would work with 5G and not 4G - well, 3G for that matter.

That’s more a failure of imagination than anything else. Perhaps I can help:

https://www.fool.com/investing/2019/03/20/3-exciting-innovations-made-possible-by-5g.aspx

That’s more a failure of imagination than anything else. Perhaps I can help:

https://www.fool.com/investing/2019/03/20/3-exciting-innovations-made-possible-by-5g.aspx

That's just marketing BS. VR I don't see being any or worse with 4G versus 5G - unless it's all rendered off site - self driving cars we could do right now, wireless home is an awful thing. Basically is just allows more intrusion with less control of what data is sent and received. All of you are getting telescreens into your home.

That's just marketing BS. VR I don't see being any or worse with 4G versus 5G - unless it's all rendered off site - self driving cars we could do right now, wireless home is an awful thing. Basically is just allows more intrusion with less control of what data is sent and received. All of you are getting telescreens into your home.

I agree with the substance but not the details.

1)VR has to be updated fast to keep up with the moving person. Imagine virtual advertising on walls only available to people with special VR glasses connected to 5G phones. The speed here is the key, which is ten times faster than 4G.

2)Self driving cars have stalled because of one problem: the endless driving situations make it impossible to code for every possible situation. What about a snow covered road with random homeless people wandering across it? What about faded or missing lines on the road or road construction? And which do you choose? Safety of pedestrians or safety of car occupants? There’s just too many issues that require the judgement of a thinking person to do correctly or perhaps morally. So what you REALLY need is an AI to drive the car for you. An advanced AI with quantum technology should be able to parse all of these situations and so a great job driving the car. But the problem is this: such an AI is expensive and also much larger in physical equipment than could be placed in a spare glove compartment. Also it would be wasted only driving one car occasionally. You’d want to connect the AI to thousands of cars at once, maybe even millions! And here is where the data transfer speed comes in. It’s GOT to be snappy. No latency or lag can be acceptable when fractions of a second are involved in REAL TIME. This is why they included self driving cars in the benefits of 5G.

Oh and I agree with you about the virtual homes or whatever. No privacy!

He left by his own accord, and didn't turn into violent hater, and was banned before he experience any TDS meltdown.

My old 5 is for international use.

Apple stock shares should bounce by the New Year or maybe before.

Apple products are not expensive; they just cost more than some people can afford.

Also it would be wasted only driving one car occasionally. You’d want to connect the AI to thousands of cars at once, maybe even millions! And here is where the data transfer speed comes in. It’s GOT to be snappy.

You really don't need any complicated AI if the cars are all wired up, and know the location of every other car. I'm not an expert, but i doubt we need high speed coms for it.

I also, VERY STRONGLY DISAGREE with centralization. A mouse can navigate a path at high speed. A squirrel can. I would bet the computer next to me has enough transistors, and enough storage to have something that appears to be sentience. It's probably got more storage than I do, and the neurons work at about 10,000 times the speed my own neurons do. I'm just massively parallel, but your neurons are digital as well. It's just recreating the connections of the brain and running a small portion of it at a time.

The human brain has less than 100 billion neurons. My hard disk has 10,000 billion bytes. If you can represent a neuron, with storage, with 100 bytes, yeah, my computer can simulate my thinking process.

The 14-nanometer A10 Fusion iPhone 7 chip was the first Apple-designed SOC; it delivered 40% better processor performance and 50% better graphics than the one it replaced.

The 7nm A11 processor that followed unleashed a 25% performance boost in contrast to the A10.

Last year's A12 again unleashed significant performance gains over the A11.

The current A13 chips deliver 20% more performance and 40% better power efficiency than 2018’s A12.

Macs are moving to Apple silicon. Try to imagine how unfathomable that statement would have been when this thread was created in 2012. Macs transitioned to Intel processors in 2006 and in 2007 the first iPhone came out. In 2008 Apple purchased P.A.Semi and in 2010 Intrinsity. The rest is history.

It will require some sort of platform disruption to dethrone them as king of the hill. What comes after smartphones? What comes after silicon processors?

« First « Previous Comments 191 - 230 of 241 Next » Last » Search these comments

Starting my New Year with a nice bump on the AAPL I picked up last year.

Consensus on AAPL to $500? It's testing 52-week high.