patrick.net

An Antidote to Corporate Media

1,248,721 comments by 14,891 users - askmeaboutthesaltporkcure, FuckTheMainstreamMedia, mell, Tenpoundbass online now

"Their Wealth Has Vanished": Baby Boomers File For Bankruptcy In Droves

2018 Aug 6, 6:42pm 7,447 views 41 comments

Comments 1 - 40 of 41 Next » Last » Search these comments

1

NDrLoR

2018 Aug 6, 6:58pm

NDrLoR

2018 Aug 6, 6:58pm

And that's the generation that rejected their parents' values 50 years ago for "alternatives"! The joke is on them!

3

lostand confused

2018 Aug 6, 7:03pm

lostand confused

2018 Aug 6, 7:03pm

I think student loans should be limited to fields that have a shot at jobs-like engineering, medical, nursing or even blue collar jobs. is that racist.

5

Shaman

2018 Aug 6, 7:14pm

Shaman

2018 Aug 6, 7:14pm

Certainly there needs to be a restriction against student loans being used for worthless “studies” sorts of classes. We need to save the “women’s studies” majors from their own idiocy.

In the past, when a family had a dullard for a daughter, they’d quietly marry her off and let her husband guide her through life. Now that same poor girl winds up saddled with student loans, unemployable for any decent job, and aging out of marriage options while she marches with a pussy hat on for “women’s rights.” Then she adopts a few dozen cats in her later years, marries her “best friend” who’s a fat ugly divorcee bitch with a grown up kid, and rants about white male privilege on Facetwat.

In the past, when a family had a dullard for a daughter, they’d quietly marry her off and let her husband guide her through life. Now that same poor girl winds up saddled with student loans, unemployable for any decent job, and aging out of marriage options while she marches with a pussy hat on for “women’s rights.” Then she adopts a few dozen cats in her later years, marries her “best friend” who’s a fat ugly divorcee bitch with a grown up kid, and rants about white male privilege on Facetwat.

6

MrMagic

2018 Aug 6, 7:19pm

MrMagic

2018 Aug 6, 7:19pm

Booger says

Stupid parents that tap their home equity or retirement accounts to pay for their kids college, or for that matter, any parent that signs as a co-signer on a college loan for their kids should be euthanized.

Student loans should be outlawed.

Stupid parents that tap their home equity or retirement accounts to pay for their kids college, or for that matter, any parent that signs as a co-signer on a college loan for their kids should be euthanized.

7

MrMagic

2018 Aug 6, 7:23pm

MrMagic

2018 Aug 6, 7:23pm

lostand confused says

They need to be taught better math skills in high school, not the Liberal bullshit that gets pushed as math. Knowing if their investment in a school loan can bring a decent return on the investment show be task one for these math teachers. Unfortunately, they get their twisted math education from, well, you know who...

I think student loans should be limited to fields that have a shot at jobs-like engineering, medical, nursing or even blue collar jobs. is that racist.

They need to be taught better math skills in high school, not the Liberal bullshit that gets pushed as math. Knowing if their investment in a school loan can bring a decent return on the investment show be task one for these math teachers. Unfortunately, they get their twisted math education from, well, you know who...

8

FortWayne

2018 Aug 6, 7:36pm

FortWayne

2018 Aug 6, 7:36pm

We spend billions helping illegals paid by working class. Boomers and next gen been paying, subsidizing illegals and welfare lazy socialists.

9

Strategist

2018 Aug 6, 7:36pm

Strategist

2018 Aug 6, 7:36pm

MrMagic says

So what's the problem with BK? They end up not having to pay off big student loans, and they can charge up their credit cards and include them in the BK. Their problem now becomes the bank's problem.

What isn't helping is that many older parents report that helping their children contributed to their bankruptcies. Seattle bankruptcy attorney Marc Stern says he's seen parents co-sign loans for $10,000 or $20,000 for their kids, only to find themselves on the hook when their offspring couldn't service the debt.

Others parents had had co-signed their children’s student loans. “I never saw parents with student loans 20 or 30 years ago,” Mr. Stern said.

“It is not uncommon to see student loans of $100,000,” he added. “Then, you see parents who have guaranteed some of these loans. They are no longer working, and they have these student loans that are difficult if not impossible to pay or discharge in bankruptcy, and these are the kids’ loans.”

So what's the problem with BK? They end up not having to pay off big student loans, and they can charge up their credit cards and include them in the BK. Their problem now becomes the bank's problem.

10

Strategist

2018 Aug 6, 7:38pm

Strategist

2018 Aug 6, 7:38pm

Strategist says

I have no sympathy for banks that charge 29% interest.

So what's the problem with BK? They end up not having to pay off big student loans, and they can charge up their credit cards and include them in the BK. Their problem now becomes the bank's problem.

I have no sympathy for banks that charge 29% interest.

11

lostand confused

2018 Aug 6, 7:42pm

lostand confused

2018 Aug 6, 7:42pm

Strategist says

I think student loans cannot be discharged in bankruptcy.

They end up not having to pay off big student loans, and they can charge up their credit cards and include them in the BK. Their problem now becomes the bank's problem.

I think student loans cannot be discharged in bankruptcy.

12

Strategist

2018 Aug 6, 7:42pm

Strategist

2018 Aug 6, 7:42pm

FortWayne says

Now that is a major problem we face.

MrMagic says

If our math teacher here reads this, he will laugh like hell, and recommend a pay raise for teachers.

We spend billions helping illegals paid by working class. Boomers and next gen been paying, subsidizing illegals and welfare lazy socialists.

Now that is a major problem we face.

MrMagic says

They need to be taught better math skills in high school

If our math teacher here reads this, he will laugh like hell, and recommend a pay raise for teachers.

13

Strategist

2018 Aug 6, 7:43pm

Strategist

2018 Aug 6, 7:43pm

lostand confused says

They can't, but the article seems to imply cosigners can.

Strategist saysThey end up not having to pay off big student loans, and they can charge up their credit cards and include them in the BK. Their problem now becomes the bank's problem.

I think student loans cannot be discharged in bankruptcy.

They can't, but the article seems to imply cosigners can.

14

MrMagic

2018 Aug 6, 7:58pm

MrMagic

2018 Aug 6, 7:58pm

lostand confused says

True

Strategist says

I think the article implies they file BK because they can't pay ALL their bills. They still end up stuck with the school loan until they take a dirt nap.

I think student loans cannot be discharged in bankruptcy.

True

Strategist says

They can't, but the article seems to imply cosigners can.

I think the article implies they file BK because they can't pay ALL their bills. They still end up stuck with the school loan until they take a dirt nap.

15

MrMagic

2018 Aug 6, 7:59pm

MrMagic

2018 Aug 6, 7:59pm

Strategist says

Then blame it on Trump.

If our math teacher here reads this, he will laugh like hell, and recommend a pay raise for teachers.

Then blame it on Trump.

17

Strategist

2018 Aug 6, 8:12pm

Strategist

2018 Aug 6, 8:12pm

MrMagic says

OK, makes sense. I think parents cosigning for a lower interest rate for a child who is not responsible, or in the right major is a mistake.

Sadly, emotions can take precedence over rational thought.

lostand confused saysI think student loans cannot be discharged in bankruptcy.

True

Strategist saysThey can't, but the article seems to imply cosigners can.

I think the article implies they file BK because they can't pay ALL their bills. They still end up stuck with the school loan until they take a dirt nap.

OK, makes sense. I think parents cosigning for a lower interest rate for a child who is not responsible, or in the right major is a mistake.

Sadly, emotions can take precedence over rational thought.

18

RWSGFY

2018 Aug 6, 8:15pm

RWSGFY

2018 Aug 6, 8:15pm

lostand confused says

Hence the idea to replace student debt with some other kind of debt which is dischargeable.

Strategist saysThey end up not having to pay off big student loans, and they can charge up their credit cards and include them in the BK. Their problem now becomes the bank's problem.

I think student loans cannot be discharged in bankruptcy.

Hence the idea to replace student debt with some other kind of debt which is dischargeable.

19

Strategist

2018 Aug 6, 8:17pm

Strategist

2018 Aug 6, 8:17pm

MrMagic says

Damn Trump. It's obvious he is responsible for the lousy math and reading skills. A democrat would have solved the problem in one year.

Strategist saysIf our math teacher here reads this, he will laugh like hell, and recommend a pay raise for teachers.

Then blame it on Trump.

Damn Trump. It's obvious he is responsible for the lousy math and reading skills. A democrat would have solved the problem in one year.

21

Strategist

2018 Aug 6, 8:47pm

Strategist

2018 Aug 6, 8:47pm

Hassan_Rouhani says

I remember reading an article that indicates why student loans cannot be discharged in a BK. The example was of a medical student, who after graduating goes before a BK judge, and states the shirt on his back is all he has. He ends up with a free expensive education, even though he has the earning capacity to easily pay off the loan in the near future.

lostand confused saysStrategist saysThey end up not having to pay off big student loans, and they can charge up their credit cards and include them in the BK. Their problem now becomes the bank's problem.

I think student loans cannot be discharged in bankruptcy.

Hence the idea to replace student debt with some other kind of debt which is dischargeable.

I remember reading an article that indicates why student loans cannot be discharged in a BK. The example was of a medical student, who after graduating goes before a BK judge, and states the shirt on his back is all he has. He ends up with a free expensive education, even though he has the earning capacity to easily pay off the loan in the near future.

22

MrMagic

2018 Aug 6, 8:52pm

MrMagic

2018 Aug 6, 8:52pm

Hassan_Rouhani says

Hence, don't take on the debt in the first place. There's ways to get a degree without taking on hardly any debt.

Hence the idea to replace student debt with some other kind of debt which is dischargeable.

Hence, don't take on the debt in the first place. There's ways to get a degree without taking on hardly any debt.

24

MrMagic

2018 Aug 6, 8:54pm

MrMagic

2018 Aug 6, 8:54pm

FortWayne says

Sort of, if planning on filing BK to get rid of school debt, it would have to be on a credit card, personal loan, or something similar, not guaranteed by the govt.

If student debt wasn’t backed by taxpayers, It can be discharged?

Sort of, if planning on filing BK to get rid of school debt, it would have to be on a credit card, personal loan, or something similar, not guaranteed by the govt.

25

MrMagic

2018 Aug 6, 8:55pm

MrMagic

2018 Aug 6, 8:55pm

clambo says

Sadly, I know a bunch, or maybe not broke now, but right on the edge, and don't have the financial savings to retire.

I don't know any broke boomers.

Sadly, I know a bunch, or maybe not broke now, but right on the edge, and don't have the financial savings to retire.

26

Tenpoundbass

2018 Aug 7, 4:28am

Tenpoundbass

2018 Aug 7, 4:28am

Impossible they are all billionaires and have been keeping all of the Patnet Millennials from the riches they so rightfully deserve.

27

CBOEtrader

2018 Aug 7, 6:30am

CBOEtrader

2018 Aug 7, 6:30am

It'd be interesting to know more about the bankruptcy numbers. Look at the improvement for young people over the same period of time?!

My best guess is its healthcare costs. I just took about 30 hours of certifications for medicare. Accoding to their numbers, over half of all long term care is paid for by medicaid. Considering that most seniors start LTC with their own funds, then move to Medicaid once they are broke, one can assume that well over half of seniors die as wardens of the state.

My best guess is its healthcare costs. I just took about 30 hours of certifications for medicare. Accoding to their numbers, over half of all long term care is paid for by medicaid. Considering that most seniors start LTC with their own funds, then move to Medicaid once they are broke, one can assume that well over half of seniors die as wardens of the state.

28

HeadSet

2018 Aug 7, 7:14am

HeadSet

2018 Aug 7, 7:14am

No they shouldn't. Not being able to discharge student loans in bankruptcy should be outlawed.

Strongly disagree. Encouraging even more irresponsible borrowing would just raise college prices for the responsible people who saved/worked to pay for school. I like the idea of no student loans at all, which would mean college prices would have to fall to be affordable by sponsorships, work study, and savings. Also would encourage cost saving measures such as courses that do not need labs to be taught through on-line A/V enhanced lectures followed by proctored tests. As it is now, colleges waste incredible sums on College Presidents building monuments to themselves adding infrastructure. Even with high endowments they keep raising tuition at a rate that exceeds general inflation. Easy finance is never the answer to affordability.

Strongly disagree. Encouraging even more irresponsible borrowing would just raise college prices for the responsible people who saved/worked to pay for school. I like the idea of no student loans at all, which would mean college prices would have to fall to be affordable by sponsorships, work study, and savings. Also would encourage cost saving measures such as courses that do not need labs to be taught through on-line A/V enhanced lectures followed by proctored tests. As it is now, colleges waste incredible sums on College Presidents building monuments to themselves adding infrastructure. Even with high endowments they keep raising tuition at a rate that exceeds general inflation. Easy finance is never the answer to affordability.

29

zzyzzx

2018 Aug 7, 7:18am

zzyzzx

2018 Aug 7, 7:18am

FPBT says

Which is pretty much the same as banning student loans, since nobody will be dumb enough to lend money for school if it can be discharged in bankruptcy.

No they shouldn't. Not being able to discharge student loans in bankruptcy should be outlawed.

Which is pretty much the same as banning student loans, since nobody will be dumb enough to lend money for school if it can be discharged in bankruptcy.

30

RWSGFY

2018 Aug 7, 8:23am

RWSGFY

2018 Aug 7, 8:23am

MrMagic says

This advice is kinda late for the people already in the hole.

Hassan_Rouhani saysHence the idea to replace student debt with some other kind of debt which is dischargeable.

Hence, don't take on the debt in the first place. There's ways to get a degree without taking on hardly any debt.

This advice is kinda late for the people already in the hole.

31

MrMagic

2018 Aug 7, 9:40am

MrMagic

2018 Aug 7, 9:40am

CBOEtrader says

The young people are in better shape because mommy and daddy are paying all their bills (which is why BK is up for them). The parents are paying for school, paying for their cars, paying their cell phones, giving them allowance. It's tough to declare BK while living in mommy's basement with everything provided for you.

It'd be interesting to know more about the bankruptcy numbers. Look at the improvement for young people over the same period of time?!

The young people are in better shape because mommy and daddy are paying all their bills (which is why BK is up for them). The parents are paying for school, paying for their cars, paying their cell phones, giving them allowance. It's tough to declare BK while living in mommy's basement with everything provided for you.

32

MrMagic

2018 Aug 7, 9:41am

MrMagic

2018 Aug 7, 9:41am

Hassan_Rouhani says

Maybe the knuckleheads here who have kids in high school might wake up and do some research before signing their life away.

MrMagic saysHassan_Rouhani saysHence the idea to replace student debt with some other kind of debt which is dischargeable.

Hence, don't take on the debt in the first place. There's ways to get a degree without taking on hardly any debt.

This advice is kinda late for the people already in the hole.

Maybe the knuckleheads here who have kids in high school might wake up and do some research before signing their life away.

33

MrMagic

2018 Aug 7, 9:48am

MrMagic

2018 Aug 7, 9:48am

CBOEtrader says

You win!

...."The questionnaire asked filers what led them to seek bankruptcy protection. Much like the broader population, people 65 and older usually cited multiple factors. About three in five said unmanageable medical expenses played a role. A little more than two-thirds cited a drop in income. Nearly three-quarters put some blame on hounding by debt collectors.

The study does not delve into those underlying factors, but separate data provides some insight. The median household led by someone 65 or older had liquid savings of $60,600 in 2016, according to the Employee Benefit Research Institute, whereas the bottom 25 percent of households had saved at most $3,260. -NYT"

Medical situations is a BIG part of this, and it's going to get worse, as more people are fat and overweight, which just leads to more medical issues down the road.

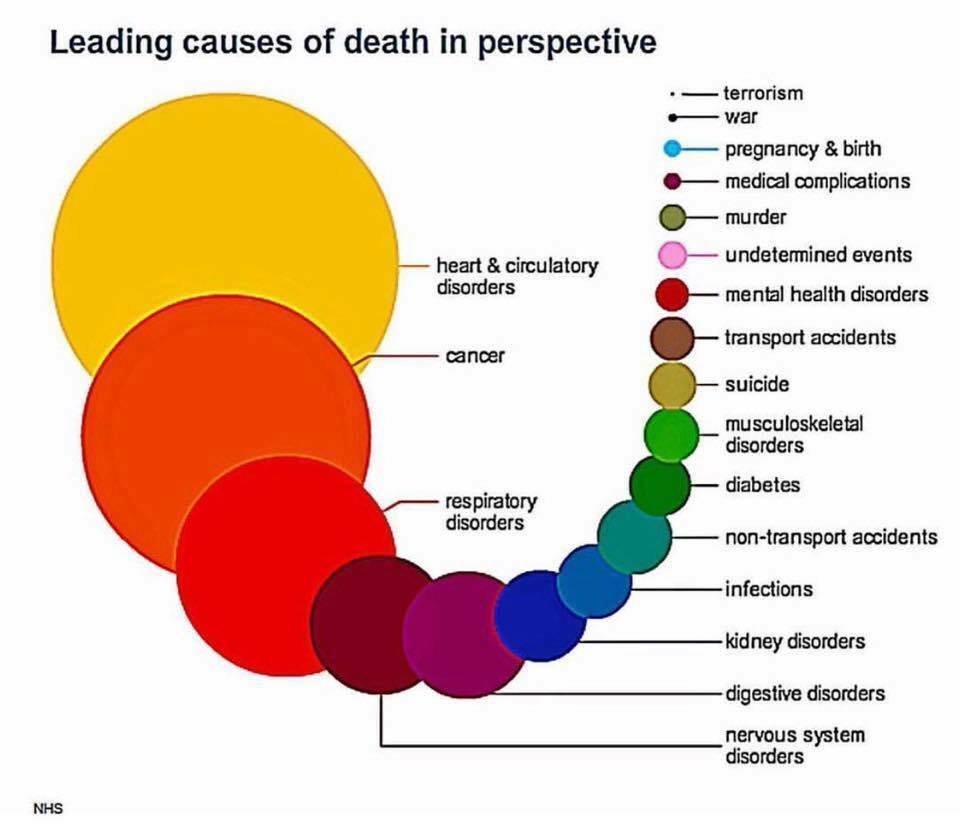

How many of these leading causes of death are attributed to poor diets, lack of exercise and generally not taking care of your self?

My best guess is its healthcare costs.

You win!

...."The questionnaire asked filers what led them to seek bankruptcy protection. Much like the broader population, people 65 and older usually cited multiple factors. About three in five said unmanageable medical expenses played a role. A little more than two-thirds cited a drop in income. Nearly three-quarters put some blame on hounding by debt collectors.

The study does not delve into those underlying factors, but separate data provides some insight. The median household led by someone 65 or older had liquid savings of $60,600 in 2016, according to the Employee Benefit Research Institute, whereas the bottom 25 percent of households had saved at most $3,260. -NYT"

Medical situations is a BIG part of this, and it's going to get worse, as more people are fat and overweight, which just leads to more medical issues down the road.

How many of these leading causes of death are attributed to poor diets, lack of exercise and generally not taking care of your self?

34

Tenpoundbass

2018 Aug 7, 11:11am

Tenpoundbass

2018 Aug 7, 11:11am

Terrorism can create and exacerbate many of those other conditions at the top.

35

fdhfoiehfeoi

2018 Aug 7, 11:19am

fdhfoiehfeoi

2018 Aug 7, 11:19am

What's wrong with them, the economy is better than ever! Everything valued in fiat currency will only continue to go higher, FOR ever!!

36

MrMagic

2018 Aug 7, 11:39am

MrMagic

2018 Aug 7, 11:39am

Tenpoundbass says

Like what, fear of cheeseburgers... so you have to eat them to make them go away?

Terrorism can create and exacerbate many of those other conditions at the top.

Like what, fear of cheeseburgers... so you have to eat them to make them go away?

37

Tenpoundbass

2018 Aug 7, 12:08pm

Tenpoundbass

2018 Aug 7, 12:08pm

MrMagic says

You have EU Gloablists importing rapeugees and if you speak out or report it, you go to Tommy Robinson Prison.

That can be a strain the heart.

Like what, fear of cheeseburgers... so you have to eat them to make them go away?

You have EU Gloablists importing rapeugees and if you speak out or report it, you go to Tommy Robinson Prison.

That can be a strain the heart.

38

Ceffer

2018 Aug 7, 12:31pm

Ceffer

2018 Aug 7, 12:31pm

These BoomFucks will have to kick out the MillXY's, live in the basement, and rent the upstairs out while they scrape by on SS.

39

Y

2018 Aug 7, 1:00pm

Y

2018 Aug 7, 1:00pm

Dirt naps should not let them off the hook.

All babies should be carbon dated and genetically traced to their last known form of existence.

And then back-billed for any/all student loan debt...

MrMagic says

All babies should be carbon dated and genetically traced to their last known form of existence.

And then back-billed for any/all student loan debt...

MrMagic says

I think the article implies they file BK because they can't pay ALL their bills. They still end up stuck with the school loan until they take a dirt nap.

Comments 1 - 40 of 41 Next » Last » Search these comments

An alarming number of older Americans are being forced into bankruptcy, as the rate of people 65 and older who have filed has never been higher - at three times what it was in 1991, while the rate of bankruptcies among Americans age 65 and older has more than doubled, according to a new study by the The Bankruptcy Project.

“When the costs of aging are off-loaded onto a population that simply does not have access to adequate resources, something has to give,” the study says, “and older Americans turn to what little is left of the social safety net — bankruptcy court.”

“The people who show up in bankruptcy are always the tip of the iceberg,” said Robert M. Lawless, an author of the study and a law professor at the University of Illinois.

*

What isn't helping is that many older parents report that helping their children contributed to their bankruptcies. Seattle bankruptcy attorney Marc Stern says he's seen parents co-sign loans for $10,000 or $20,000 for their kids, only to find themselves on the hook when their offspring couldn't service the debt.

Others parents had had co-signed their children’s student loans. “I never saw parents with student loans 20 or 30 years ago,” Mr. Stern said.

“It is not uncommon to see student loans of $100,000,” he added. “Then, you see parents who have guaranteed some of these loans. They are no longer working, and they have these student loans that are difficult if not impossible to pay or discharge in bankruptcy, and these are the kids’ loans.”

https://www.zerohedge.com/news/2018-08-06/their-wealth-has-vanished-baby-boomers-filing-bankruptcy-droves