Thread for orphaned comments

2005 Apr 11, 5:00pm 199,478 views 117,730 comments

by Patrick ➕follow (61) 💰tip ignore

« First « Previous Comments 36,891 - 36,930 of 117,730 Next » Last » Search these comments

not the golden turkey report again! dude you should your icon to a turkey.

Yet prices rise for 4-5 months, and they care calling a recovery. It simply doesn't make any logical sense.

I somehow have to pay for this new BMW dammit! Let's get excited! I need some optimism because if I think about how much money I owe I'm going to cry!(or worse)

Goran_K says

Yet prices rise for 4-5 months, and they care calling a recovery.

That's because if they were all doom and gloom like you bloggers.. It would be a self-fulfilling prophecy of no home sales.

BUYERS MAKE VALUE ! Not Gubmint.

Intersting chart, but those debt bars must include QE, the effect of which is not so easy to understand. Bond sold by the government to the government and on the books of the fed.

Don't get me wrong. THere will be an effect but it's not clear at present what it will be.

OR maybe the pars represent just the government debt per person ? National Debt ?

Just keep in mind that past performance is no indicator of future performance. We're in uniquely chaotic financial times right now, and nothing of the sort has happened before, so we can't really predict where it's going short term.

What about rising interest rates? That will make mortgages less affordable.

It won't affect the ultra-high end market though. The rich keep getting even richer.

You will never learn anything.

lol-I'd say he's learned much better than you. His predictions have been correct. Yours have been incorrect.

He's right. You're wrong.

Own it.

History might, but reality doesn't..

You make me laugh. Seriously.

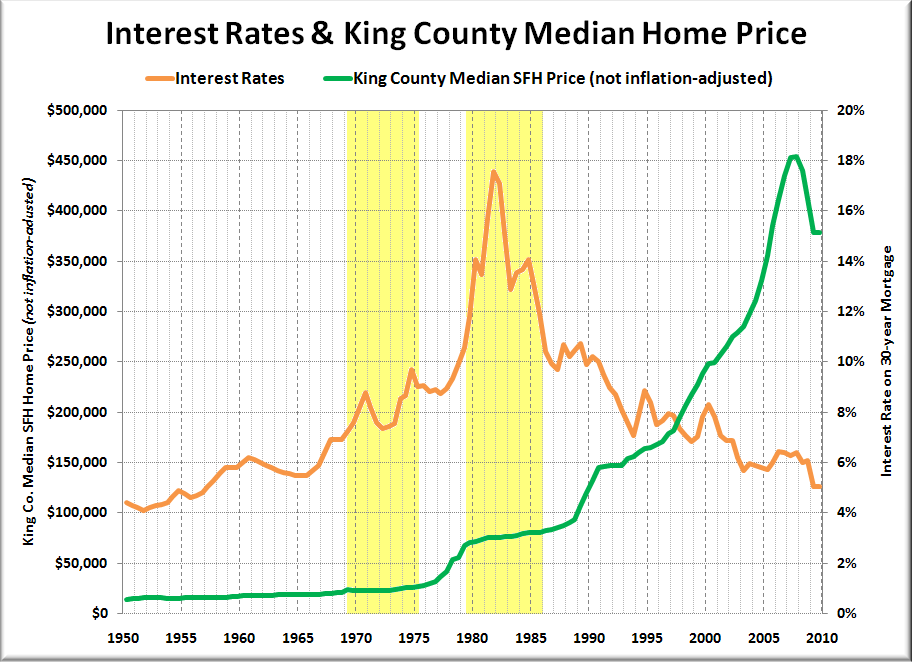

I've posted on here before the actual correlation (or lack thereof) between housing prices and interest rates. It's actually slightly postive indicating that prices move in tandem with interest rates.

You counter that with a survey that reports that people say higher rates make it more difficult for them to buy a house. Holy crap--stop the presses. A majority of people also probably think aliens landed at Roswell. Or that Obama is a Muslim.

It could be that interest rates tend to go up once the economy gets better. If the economy is better, people can spend more on houses. Maybe that helps counteract the higher mortgage payments from the higher interest rates.

It's just an educated guess on my part.

It could be that interest rates tend to go up once the economy gets better. If the economy is better, people can spend more on houses. Maybe that helps counteract the higher mortgage payments from the higher interest rates.

Unfortunately, mortgage rate is going up because Fed is tapering and not because of increased demand for money from improved economy.

Unfortunately, mortgage rate is going up because Fed is tapering and not because of increased demand for money from improved economy.

Except that's not really the case. More likely, it is because traders expect that the Fed wouldn't begin tapering until the economy was improving. So they take the Fed's warnings about tapering as an indication that the economy is improving.

yeah, those investors sure made prices go high because we know it wasn't actual owner occupiers who were buying those homes

now they are holding the bag, guess what happens next!!!

Say hey! This was in the Wall Street Journal on March 30, 1999:

Holy cow/interesting/compelling ...!

And where is it up to date??? Right here ... see the first chart shown in this thread.

Recent Dow day is Thursday, September 5, 2013 __ Level is 95.4

WOW! It is hideous that this is hidden! Is there any such "Homes, Inflation Adjusted"? Yes indeed, go here:

http://patrick.net/?p=1219038&c=999083#comment-999083

they sell them back little by little to homebuyers and/or make money from rent as the years go by. And a nitwit like you prattles on online?

yeah because that's what happened in 2006 and 2007 right Roberto a Ribas, you moron!

There is no correlation in this chart before 2000. If at all, there is one for higher prices for lower rates and lower prices for higher rates for the current millenium.

There is no correlation in this chart before 2000. If at all, there is one for higher prices for lower rates and lower prices for higher rates for the current millenium

There is no correlation after 2000 either. Interest rates have slowly fallen while home prices went up sharply, then down sharply. I defy anyone to find a correlation there.

I know I really shouldn't encourage the bears, but here's an interesting flipper special that swung for the fences this summer -- and missed (so far).

The home at 1231 Neilson Street was originally purchased for $410k in 2002. Looking at the recorder's site, it appears that there were a couple of WaMu refies (usually the kiss of death) which resulted in a NOD and eventual foreclosure. According to Redfin, it was purchased at a foreclosure auction for $555.5k in February of 2013. It went up for sale in April for $750k. It still has not sold and is now asking $639,900. Stay tuned at http://www.redfin.com/CA/Berkeley/1231-Neilson-St-94706/home/1578849

It should be noted, inventory is still tight and the market was hot this summer.

There is no correlation in this chart before 2000. If at all, there is one for higher prices for lower rates and lower prices for higher rates for the current millenium

There is no correlation after 2000 either. Interest rates have slowly fallen while home prices went up sharply, then down sharply. I defy anyone to find a correlation there.

It is a direct correlation if you take 2000 (first bubble burst) to the crisis of 2008 (then the Fed "liquidity bazooka") and since it ends in 2010 it does not show the increases in the last 2 years. But they can't push em any lower so the effect is wearing off now. You could argue there is no strong correlation even since 2000, but it's good enough for me to predict stagnating/falling house prices for stagnating/rising long-term yields.

What matters is the *real* interest rate. Sure, nominal rates were high in 1980, but so was inflation. R=N-I

We need a "talk your own book" thread, where everyone can badmouth or plug real estate, gold, whatever according to whether they're long/short/owning/renting/etc.

It is a direct correlation if you take 2000 (first bubble burst) to the crisis of 2008 (then the Fed "liquidity bazooka") and since it ends in 2010 it does not show the increases in the last 2 years.

So there's a direct correlation if you cherry pick the data. Got it.

But they can't push em any lower so the effect is wearing off now

Huh? If there's a correlation, it will show. Correlations don't "wear off".

You could argue there is no strong correlation even since 2000, but it's good enough for me to predict stagnating/falling house prices for stagnating/rising long-term yields.

I'm not arguing it, that's a fact. You can predict whatever you'd like, just realize that the data doesn't support such a prediction.

You pointed to a blog while I pointed to an article.

He posted the graph illustrating the lack of correlation. Looking at that, you still claim a correlation??

Further, that is real house prices--we should be looking at nominal which actually show a slight positive correlation with interest rates.

I'm not arguing it, that's a fact. You can predict whatever you'd like, just realize that the data doesn't support such a prediction.

Not true. Since 2000 there is definitely much more of a case for a correlation as before. The data is the fact, the conclusions are subject to interpretation. Correlation does not imply causation, and other factors need to be considered as well. Once the cash buyers/investors (= other factors) are out and debt-financing is the main route to go these days (savings is so last millenium in the Krugmanite parallel universe), prices will fall with rising rates and stagnating wages and they are already turning.

You pointed to a blog while I pointed to an article.

He posted the graph illustrating the lack of correlation. Looking at that, you still claim a correlation??

Further, that is real house prices--we should be looking at nominal which actually show a slight positive correlation with interest rates.

It is a fact that higher rates are a factor, because they diminish purchasing power, so TA is right in that case. Of course if higher rates are accompanied by some period of great economic wealth, then that factor may become irrelevant. Since we are lacking any positive catalysts so far, look out below! ;)

Since 2000 there is definitely much more of a case for a correlation as before.

You must be looking at different data than I am. Because mine shows prices rising with falling interest rates, followed by prices falling with falling interest rates.

How can there be any correlation there?

It is a fact that higher rates are a factor, because they diminish purchasing

power, so TA is right in that case.

No, he's not right. You can mathematically measure correlation, and the data shows none.

Regardless of what you THINK should happen, the data doesn't lie.

Since 2000 there is definitely much more of a case for a correlation as before.

You must be looking at different data than I am. Because mine shows prices rising with falling interest rates, followed by prices falling with falling interest rates.

How can there be any correlation there?

2000-2006 rates falling and prices rising, then rates rising and prices falling. Isn't really that hard to see. The only disconnect is towards the end of the graph were rates were pushed down again and prices didn't pick up, but there is only so much fiat you can pump into a system, the "returns" keep diminishing.

Further, that is real house prices--we should be looking at nominal which

actually show a slight positive correlation with interest rates.

Correct

The guy in 1979 believing in the correlation was likely saying "im not paying 75K! Just wait til interest rates rise and prices will CRASH, and I will scoop it up for 50K!!!!". Imagine his disappointment as rates went from 9% to 18% and nominal prices continued to slooowly rise...

The only disconnect is towards the end of the graph were rates were pushed down

again and prices didn't pick up, but there is only so much fiat you can pump

into a system, the "returns" keep diminishing.

lol. Like I said, if you cherry pick the data set, then you can make it say what you want. That's intellectually dishonest, but you can do it.

The guy in 1979 believing in the correlation was likely saying "im not paying 75K! Just wait til interest rates rise and prices will CRASH, and I will scoop it up for 50K!!!!". Imagine his disappointment as rates went from 9% to 18% and nominal prices continued to slooowly rise...

I agree with you. Inflation was very high at the time as well, so homes were seen as an inflation hedge. Wages were rising along with inflation as well.

I think the real question going forward is whether rates will rise a few points while inflation remains relatively low.

If so, maybe real estate would slow down a bit, or drop a little bit. If inflation picks up, I could see real estate continuing upward even as rates rise.

Pennsylvania Zillow Home Value IndexPennsylvania real estate info

Anybody that waited to buy, missed this run up over the past couple years.

LOL

Pennsylvania Zillow Home Value Index

Pennsylvania real estate info

Anybody that waited to buy, missed this run up over the past couple years.

LOL

Where can I buy a home based on the Zillow Home Value?

Here's the chart you mean to show (up 10% YOY):

call it and renting for half and company are just a bunch of miserable flops that are bitter about life and hate anyone that prospers and does well...no real point listening to them...they have been wrong for years and years now. Why bother with their opinion?? They are nothing but a broken record. I personally don't care about the comments from those who have been completely wrong. I don't care about the excuses. Wrong is wrong. If had followed any of their rants/advice/opinions I'd be paying an insane amount now in rent for the same house now and buying would be once again a thing that may never happen in my life unless I double my income again.

So...just ignore those fools. They are just as wrong as the extreme bulls were in 2005/06.

You should try to find out why you are so bothered by other's success...

success? do you call a 2.8 rating from your students success Roberto Ribas? do you call living in a home where you have to rent every room to pay the bills success? is that the low bar you have set for yourself Roberto Ribas?

Say hey! This was in the Wall Street Journal on March 30, 1999:

Holy cow/interesting/compelling ...!

And where is it up to date??? Right here ... see the first chart shown in this thread.

Recent Dow day is Friday, September 6, 2013 __ Level is 95.3

WOW! It is hideous that this is hidden! Is there any such "Homes, Inflation Adjusted"? Yes indeed, go here:

http://patrick.net/?p=1219038&c=999083#comment-999083

Slow to react?

I dunno man.

Reacted pretty darn quick when credit tightened up by Volker.

He followed the Oracle's advice to near perfection. You should try to find out why you are so bothered by other's success...

That's a good question, why isn't Roberto listed as an alias for this commenter?

Roberto A Ribas of Scottsdale Community College found out that acting like a pure dickface has consequences

fuck that guy, i'm glad he got in trouble, and whoever did get him in trouble, i'm buying an extra beer in honor of you tonight

i don't hate you Roberto, but im glad you got in trouble, and someone fucked you over

you are a total dick, and its about time someone messed up your shit haha

« First « Previous Comments 36,891 - 36,930 of 117,730 Next » Last » Search these comments

patrick.net

An Antidote to Corporate Media

1,251,462 comments by 14,925 users - Misc, SouthMtn, stereotomy, WookieMan online now