Thread for orphaned comments

2005 Apr 11, 5:00pm 172,486 views 117,730 comments

by Patrick ➕follow (60) 💰tip ignore

« First « Previous Comments 36,906 - 36,945 of 117,730 Next » Last » Search these comments

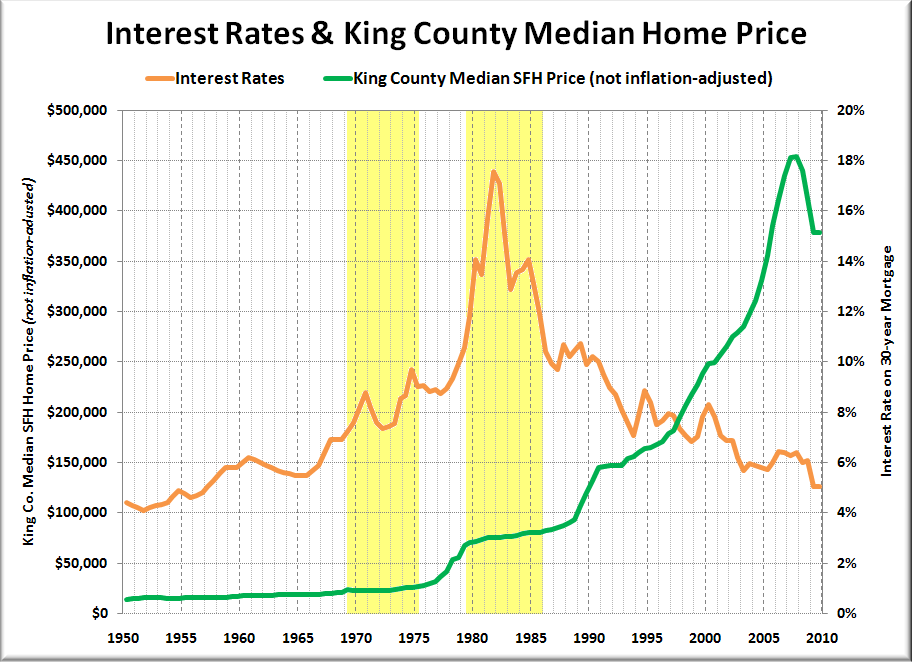

There is no correlation in this chart before 2000. If at all, there is one for higher prices for lower rates and lower prices for higher rates for the current millenium.

There is no correlation in this chart before 2000. If at all, there is one for higher prices for lower rates and lower prices for higher rates for the current millenium

There is no correlation after 2000 either. Interest rates have slowly fallen while home prices went up sharply, then down sharply. I defy anyone to find a correlation there.

I know I really shouldn't encourage the bears, but here's an interesting flipper special that swung for the fences this summer -- and missed (so far).

The home at 1231 Neilson Street was originally purchased for $410k in 2002. Looking at the recorder's site, it appears that there were a couple of WaMu refies (usually the kiss of death) which resulted in a NOD and eventual foreclosure. According to Redfin, it was purchased at a foreclosure auction for $555.5k in February of 2013. It went up for sale in April for $750k. It still has not sold and is now asking $639,900. Stay tuned at http://www.redfin.com/CA/Berkeley/1231-Neilson-St-94706/home/1578849

It should be noted, inventory is still tight and the market was hot this summer.

There is no correlation in this chart before 2000. If at all, there is one for higher prices for lower rates and lower prices for higher rates for the current millenium

There is no correlation after 2000 either. Interest rates have slowly fallen while home prices went up sharply, then down sharply. I defy anyone to find a correlation there.

It is a direct correlation if you take 2000 (first bubble burst) to the crisis of 2008 (then the Fed "liquidity bazooka") and since it ends in 2010 it does not show the increases in the last 2 years. But they can't push em any lower so the effect is wearing off now. You could argue there is no strong correlation even since 2000, but it's good enough for me to predict stagnating/falling house prices for stagnating/rising long-term yields.

What matters is the *real* interest rate. Sure, nominal rates were high in 1980, but so was inflation. R=N-I

We need a "talk your own book" thread, where everyone can badmouth or plug real estate, gold, whatever according to whether they're long/short/owning/renting/etc.

It is a direct correlation if you take 2000 (first bubble burst) to the crisis of 2008 (then the Fed "liquidity bazooka") and since it ends in 2010 it does not show the increases in the last 2 years.

So there's a direct correlation if you cherry pick the data. Got it.

But they can't push em any lower so the effect is wearing off now

Huh? If there's a correlation, it will show. Correlations don't "wear off".

You could argue there is no strong correlation even since 2000, but it's good enough for me to predict stagnating/falling house prices for stagnating/rising long-term yields.

I'm not arguing it, that's a fact. You can predict whatever you'd like, just realize that the data doesn't support such a prediction.

You pointed to a blog while I pointed to an article.

He posted the graph illustrating the lack of correlation. Looking at that, you still claim a correlation??

Further, that is real house prices--we should be looking at nominal which actually show a slight positive correlation with interest rates.

I'm not arguing it, that's a fact. You can predict whatever you'd like, just realize that the data doesn't support such a prediction.

Not true. Since 2000 there is definitely much more of a case for a correlation as before. The data is the fact, the conclusions are subject to interpretation. Correlation does not imply causation, and other factors need to be considered as well. Once the cash buyers/investors (= other factors) are out and debt-financing is the main route to go these days (savings is so last millenium in the Krugmanite parallel universe), prices will fall with rising rates and stagnating wages and they are already turning.

You pointed to a blog while I pointed to an article.

He posted the graph illustrating the lack of correlation. Looking at that, you still claim a correlation??

Further, that is real house prices--we should be looking at nominal which actually show a slight positive correlation with interest rates.

It is a fact that higher rates are a factor, because they diminish purchasing power, so TA is right in that case. Of course if higher rates are accompanied by some period of great economic wealth, then that factor may become irrelevant. Since we are lacking any positive catalysts so far, look out below! ;)

Since 2000 there is definitely much more of a case for a correlation as before.

You must be looking at different data than I am. Because mine shows prices rising with falling interest rates, followed by prices falling with falling interest rates.

How can there be any correlation there?

It is a fact that higher rates are a factor, because they diminish purchasing

power, so TA is right in that case.

No, he's not right. You can mathematically measure correlation, and the data shows none.

Regardless of what you THINK should happen, the data doesn't lie.

Since 2000 there is definitely much more of a case for a correlation as before.

You must be looking at different data than I am. Because mine shows prices rising with falling interest rates, followed by prices falling with falling interest rates.

How can there be any correlation there?

2000-2006 rates falling and prices rising, then rates rising and prices falling. Isn't really that hard to see. The only disconnect is towards the end of the graph were rates were pushed down again and prices didn't pick up, but there is only so much fiat you can pump into a system, the "returns" keep diminishing.

Further, that is real house prices--we should be looking at nominal which

actually show a slight positive correlation with interest rates.

Correct

The guy in 1979 believing in the correlation was likely saying "im not paying 75K! Just wait til interest rates rise and prices will CRASH, and I will scoop it up for 50K!!!!". Imagine his disappointment as rates went from 9% to 18% and nominal prices continued to slooowly rise...

The only disconnect is towards the end of the graph were rates were pushed down

again and prices didn't pick up, but there is only so much fiat you can pump

into a system, the "returns" keep diminishing.

lol. Like I said, if you cherry pick the data set, then you can make it say what you want. That's intellectually dishonest, but you can do it.

The guy in 1979 believing in the correlation was likely saying "im not paying 75K! Just wait til interest rates rise and prices will CRASH, and I will scoop it up for 50K!!!!". Imagine his disappointment as rates went from 9% to 18% and nominal prices continued to slooowly rise...

I agree with you. Inflation was very high at the time as well, so homes were seen as an inflation hedge. Wages were rising along with inflation as well.

I think the real question going forward is whether rates will rise a few points while inflation remains relatively low.

If so, maybe real estate would slow down a bit, or drop a little bit. If inflation picks up, I could see real estate continuing upward even as rates rise.

Pennsylvania Zillow Home Value IndexPennsylvania real estate info

Anybody that waited to buy, missed this run up over the past couple years.

LOL

Pennsylvania Zillow Home Value Index

Pennsylvania real estate info

Anybody that waited to buy, missed this run up over the past couple years.

LOL

Where can I buy a home based on the Zillow Home Value?

Here's the chart you mean to show (up 10% YOY):

call it and renting for half and company are just a bunch of miserable flops that are bitter about life and hate anyone that prospers and does well...no real point listening to them...they have been wrong for years and years now. Why bother with their opinion?? They are nothing but a broken record. I personally don't care about the comments from those who have been completely wrong. I don't care about the excuses. Wrong is wrong. If had followed any of their rants/advice/opinions I'd be paying an insane amount now in rent for the same house now and buying would be once again a thing that may never happen in my life unless I double my income again.

So...just ignore those fools. They are just as wrong as the extreme bulls were in 2005/06.

You should try to find out why you are so bothered by other's success...

success? do you call a 2.8 rating from your students success Roberto Ribas? do you call living in a home where you have to rent every room to pay the bills success? is that the low bar you have set for yourself Roberto Ribas?

Say hey! This was in the Wall Street Journal on March 30, 1999:

Holy cow/interesting/compelling ...!

And where is it up to date??? Right here ... see the first chart shown in this thread.

Recent Dow day is Friday, September 6, 2013 __ Level is 95.3

WOW! It is hideous that this is hidden! Is there any such "Homes, Inflation Adjusted"? Yes indeed, go here:

http://patrick.net/?p=1219038&c=999083#comment-999083

Slow to react?

I dunno man.

Reacted pretty darn quick when credit tightened up by Volker.

He followed the Oracle's advice to near perfection. You should try to find out why you are so bothered by other's success...

That's a good question, why isn't Roberto listed as an alias for this commenter?

Roberto A Ribas of Scottsdale Community College found out that acting like a pure dickface has consequences

fuck that guy, i'm glad he got in trouble, and whoever did get him in trouble, i'm buying an extra beer in honor of you tonight

i don't hate you Roberto, but im glad you got in trouble, and someone fucked you over

you are a total dick, and its about time someone messed up your shit haha

i don't hate you Roberto, but im glad you got in trouble, and someone fucked you over

you are a total dick, and its about time someone messed up your shit haha

You need to grow up.

i don't hate you Roberto, but im glad you got in trouble, and someone fucked you over

you are a total dick, and its about time someone messed up your shit haha

If someone did get him in trouble in his professional life, that is pretty effed up. I disagree with a lot of people online. Pat.net is some of the worse because some of the posters are actually being terribly disingenous with the position they are promoting, Roberto not being one of those. I think he truly believes what he posts and also gets way too wrapped up and emotional over it.

But screwing around with someones personal life because of what they post online is way over the line.

If someone did get him in trouble in his professional life, that is pretty effed up. I disagree with a lot of people online. Pat.net is some of the worse because some of the posters are actually being terribly disingenous with the position they are promoting, Roberto not being one of those. I think he truly believes what he posts and also gets way too wrapped up and emotional over it.

But screwing around with someones personal life because of what they post online is way over the line.

i think that messing around with someones life is messed up

but Roberto has acted like an ass for a long time. you dont poke a tiger with a stick and dont expect it to make you a sandwich. roberto played with fire and got destroyed. cheers to being a dumb ass

Bigs, I only saw what he wrote, cause you quoted it. I put him on ignore bec of the personal attacks.

Alas poor Roberto has left the patnet realm.

The style of writing is the same.

It's the same person.

hey sell them back little by little to homebuyers and/or make money from rent as the years go by.

Where are all those home buyers going to come from? Will they be the boomers who will be trying to unload themselves, or the young kids out of school ridden with college debt? Oh yes, I forgot about the foreigners who are now pulling out of the US market too.

UN Says Rebels Used Chemical Weapons in Syrian Attack.

http://www.bbc.co.uk/news/world-middle-east-22424188

If the world doesn't retaliate, then what?

progressive/leftist/liberal demoncrats are not interested in facts, they want to move the media target and keep moving it .. its all for trevon, and ignore bengazi, and ofcourse it is all Bush's fault. Disagree and you are a racists homophobe

UN Says Rebels Used Chemical Weapons in Syrian Attack.

Dated May 6th, it has been discussed.

Well, any way, Obama has acted brilliantly by taking this to the G-20, Congress, talking with Boehner, and waiting for the UN report.

Then he had a little talk with Putin where they agreed to disagree.

I'm sorry, but this is looking kind of positive for such a horrible situation.

UN Says Rebels Used Chemical Weapons in Syrian Attack.

Dated May 6th, it has been discussed.

No, it has not. It does not appear in any public dialogue. No corporate media. No questions to Obama. It is being ignored as if it did not happen at all. And they paid good money for this false flag gone bad.

Well, any way, Obama has acted brilliantly by taking this to the G-20, Congress, talking with Boehner, and waiting for the UN report.

Then he had a little talk with Putin where they agreed to disagree.

I'm sorry, but this is looking kind of positive for such a horrible situation.

Actually, he is looking more like a tin horn George W. Bush.

Arm the rebels just enough to even the playing field and prolong the war as long as possible. Let them off each other.

« First « Previous Comments 36,906 - 36,945 of 117,730 Next » Last » Search these comments

patrick.net

An Antidote to Corporate Media

1,237,254 comments by 14,795 users - FortwayeAsFuckJoeBiden, tjArg, WookieMan online now