Thread for orphaned comments

2005 Apr 11, 5:00pm 199,077 views 117,730 comments

by Patrick ➕follow (61) 💰tip ignore

« First « Previous Comments 4,012 - 4,051 of 117,730 Next » Last » Search these comments

Troy Troy Troy … must you attack personally? As I said, the media has not held Barry and the leftisits to any firm public scrutiny. I just gave a few easy examples. The Arizona situation is a particularly disgusting act by Lord Barry and Co. If ‘ol GeeDub or Ahhnuld had done something like that when Gavin and the Deviant Army pulled their junk in Frisco, man oh man, the media would have went nutz-o (say “nutz-o†like Fonzie for the full effect). The liberal bias in media is too obvious to ignore. No need to attack me personally though, I aint in the media.

Bap, G-Dub and crew did pull stunts like that. One stunt that particularly sticks in my mind would/will likely be pulled by Obama n' co. as well. Ashcroft v Oregon on Assisted sucide and pot laws. It will be interesting if CA legalizes it to see Bammer's reaction. Gotta support the drug war, gives daddy gov. lots of cash and power.

Your gripes about the senate being unfair/unequal dhmartens amuse me. I'm sure Wyoming or Vermont or Delaware et. al would be so keen to be dragged around endlessly dancing to the tunes of New York, Texas and California.

"What ever shall I do?

Are you going to answer ANY of the questions put to you or are you just going to keep flinging out new ones?"

Yes and yes.

I answered your question: "“You might call it a generalization, but I call it a fact. Do you dispute it?â€"

I disputed it but if you want a yes or no answer, the answer is yes. Asians are considered a minority and are not considered white. Happy?

"Ann Coulter is a dime-store pundit interchangeable with any of a dozen others, which has nothing to do with sex or whatever else you are on about now."

Do you have a law degree and graduate cum laude from major universities?

During that 2008 time period, there were about 15 posters on this website calling it a double top and posting technical charts detailing a crash down to $300. You never hear from them anymore, yet they do still post on these forums. You won’t find them showing their face on this thread.

I called a double top around 1100 or so. Shoulda listened to my brain - because all the fundamentals support(ed) higher prices.

Can't completely knock me though - I went in really heavy on physical when it was well under 1000. Always a strong fan of the PM's - just got uneasy when it got to that level..... Now 1100 screams buy.

I still believe homes/cars/certain goods will deflate. It seems we are having it both ways, but I'm not in the hyperinflation camp yet.

Troy enters the twilight zone: "I’m reading up on 1920s Germany right now so this struck me as interesting. Substitute “jewish†for “white male†in the above and your clowncar ideology would be fully exposed for what it is, rabble-rousing bullshit.

You’re very big on arguments, and small on solutions."

Er, if such a substitution were made... it would illustrate that it's the LEFT bashing white males in a manner similar to the way the Jews were bashed as "privileged" and "rich" in the 1920's including quotas and discrimination against white males/Jews to level the playing field. Indeed, the same style of discrimination used against Jews IN THE STATES are now being used against white males. Congratulations, you totally shot yourself in the foot, pardon the pun.

And YOU brought it up. Not me!

“Ann Coulter is a dime-store pundit interchangeable with any of a dozen others, which has nothing to do with sex or whatever else you are on about now.â€

Do you have a law degree and graduate cum laude from major universities?

I can trot out a long list of people with law degrees and "cum laude" credentials that I don't think you'd respect one bit. "Cum laude" doesn't impress me particularly up or down. As my Daddy said however cum laude is better than O-Laude! I'm not much of an "honors" elitist, but I do wonder why wasn't she summa cum laude considering it was just a HISTORY B.A. at Cornell? What's YOUR bio look like? Should I worship you too? Will you be my facebook friend?

"I can trot out a long list of people with law degrees and “cum laude†credentials that I don’t think you’d respect one bit. “Cum laude†doesn’t impress me particularly up or down. As my Daddy said however cum laude is better than O-Laude! I’m not much of an “honors†elitist, but I do wonder why wasn’t she summa cum laude considering it was just a HISTORY B.A. at Cornell? What’s YOUR bio look like? Should I worship you too? Will you be my facebook friend?"

Translation, your answer is "no."

In regards to your first assertion "I can trot out a long list of people with law degrees and “cum laude†credentials that I don’t think you’d respect one bit." Try me. I can disagree with people and even find their positions deplorable but I can acknowledge their successes. I could even hang out with them for a beer (especially Hillary! Scarfing down kielbalsa in PA? _I_ voted for her in the open primary!)

Gentlemen, It's been a pleasure discussing things with you (really) and I don't know if you feel the same for me (or will admit it) Fine. You're all invited for vodka and tea if you ever want to visit (I'm a tea partier who really has a high standard for tea. The good stuff from Russia and Turkey). Anyways, nothing personal.

I have to go for a day and may not get back to this for a few days or so. I haven't "run away". I will get back to it and after seeing a few dozen responses, indicate which ones I want to respond to so I don't get people mixed up or make too many errors (when it happens, my opposition doesn't seem too forgiving. :-) )

Take care and have a good weekend.

thunder .... no problem. GM will do exactly what it has done so far in its "pay back." They'll use TARP money. Honestly, Americans are probably the dumbest people on earth when it comes to politicians, big business and the banksters. I think the CEO was deserving of his $9 million salary, being that he's done such an amazing job. LOL

it’s the inevitable end of unregulated free markets.

No it is the inevitable end of the centralization of political/economic power (FED, corporations, Federal Government all have too much power).

Permit me to issue and control the money of the nation and I care not who makes its laws. — Mayer Amsched Rothchild

We look at rising gold and bond prices and see no conflict at all

This happening in a so called "flight to quality" crisis situation might not be a conflict, or unusual. But I find it to be quite strange, and very contradictory.

We look at rising gold and bond prices and see no conflict at all

This happening in a so called “flight to quality†crisis situation might not be a conflict, or unusual. But I find it to be quite strange, and very contradictory.

It is a move to quality, but it's just not a panic. Just preference for preserving wealth as opposed to risking it for further gain.

More importantly there is also the commodity aspect, which is fairly independent of USD deflationary forces. Almost all commodities have gotten dearer in the last 10 years as booming economies like China consume more of them with little new supplies. Gold? BFD. Copper and oil, which are generally not hoarded for speculative purposes, are around 4X what they were ten years ago, much like gold. Agricultural commodities up 2X.

Just a few more pennies now! This should make for a nice weekend!

just preference for preserving wealth as opposed to risking it for further gain.

Maybe you don't understand bonds. They are long term, and there is a huge risk of loss if and when interest rates go up (and or when much inflation occurs).

Maybe you don’t understand bonds. They are long term, and there is a huge risk of loss if and when interest rates go up (and or when much inflation occurs).

Yes and no. You only lose if you try to sell on the secondary market. You're guaranteed the stated return on the bond.

Yes and no. You only lose if you try to sell on the secondary market. You’re guaranteed the stated return on the bond.

Say it's five years down the road, inflation is kicking in and long term rates are up to 8%. You either sell at a massive loss, or yes, you hold on to the bonds in the current environment willing to continue receiving your 3.73% for the next 25 years. This is a loss either way.

You can quibble about semantics, and argue that it's only an opportunity loss. I say it's a real loss. Referring to my last comment, if you had been in cash instead of bonds, you would then be able to lock in an additional 4.25% for those 25 years. If you think of the difference in present value terms at that time, it is a huge loss.

Again, bonds and gold are saying two different things about the dollar. A good point was made about desirability of gold in Asia, maybe independent of the value of the dollar against other currencies. Seems like a lot of that value is factored in at this point.

Counting on a bubble ? Okay. I do think bonds are probably overvalued ( and may become more overvalued before a big downtrend ), and I understand the premise about gold. IT probably should be a part of everyones portfolio. Maybe that fact is enough to cause a bubble. I just don't know. I guess I can see that at some time it will happen. Maybe a decent chance it does in my life time.

I agree with Mark--bonds are saying something about global uncertainty. People want a safe place to put their money. And I agree with you that most aren't going to keep them for 30 years. Probably they will sell them at a slight discount as things improve everywhere.

The "bailout" was never intended to do anything more than payback union members for their support for Democrats. To think otherwise is just plain silly.

The taxpayer pumped some 30B to save GM and in exchange essentially got 60% ownership. Then there is a fair amount already repaid and a fair amount as preferred shares which carries an interest that the government is collecting. The union in exchange for pension relief got a bunch and the bondholder got converted to ownership as well. Existing shareholder got wiped out since they got diluted from the union, the fed and bondholders.

Structurally, GM does not have the cripping long term debt from bondholders anymore and the pension obligations are much more managable since they too are converted to shares. Instead of Pontiac, Saturn, Geo and many repeatable brand stretching their resource, the new GM will have a luxury class, a mid class and an entry class, like every other car manufacturer. So besides long term debt obligations, their business is focused on their profitable brands as well and dump the excessive brands like they should have years ago. It's not dead going forward, the demand for vechicle will be significantly above 2009 base.

Techincally, $ per share is a horrible measure of value. If there is 1,000 share outstanding, the 134 = 13,400. A more appropriate measure is total market cap and % ownership, here 50Billion market cap is 30 billion equity to the government and considered the breaking point to the extent they can sell the position at that price and above.

Ford motor company has a 43B market cap, I don't see why GM can't make more money than Ford and deserve a higher market cap given their long term debt obligations and renewed focus can put them in a position ahead of Ford.

The CEO did an excellent job to put this company back in the profitability path. I have no issues saving GM as they just need to restructure their debt (which they did converting preferred/bond holder in the commons), other long term such as pension obligations (which they did), focus on profitable brands (which they did) and rewrite some bad contracts (which they did). Now they need find a top seller. (which will be easier to accomplish now that they can invest their resource in 3 brands instead of 20)

In 20 years, you'll be glad we still have GM, Ford and Crystler.

What happened to restructuring your debt the old fashioned way, via bankruptcy court? The stockholders got the dividends all the years GM made money, not the taxpayers. Should we have saved all 548 of the car manufacturers that have gone out of business in America over the years? Would we be glad to have them?

Gm is just another example of privatized profits and socialized losses. Government should provide physical, societal, and legal infrastructure to business. That's all.

@bob

They wanted to avoid bankruptcy. Stockholders got virtually nothing in the new GM. Pensioners and the Government were about the only ones to walk away with anything.

Now the government could have just let the whole thing blow up, but the fallout would have been enormous. This wasn't just "one large company falling" it would have taken down one of the largest sectors in the US with it. We simply don't have many car manufactures now. Maybe someone would argue it would be better to have lots of small ones anyways, the problem with that is, it would be lots of small companies + ford + toyota + every major car manufacturer in the world. Those companies would kill off the small ones, leaving essentially one US based manufacturer in one of the largest sectors in the US, with everyone else being a global competitor.

Having too big to fail companies is bad, but when the other too big to fail companies aren't yours, it's a dangerous game to play. If all the major manufactures where in the US it would be one thing. New business would be created from the ashes of GM, unfortunately, the most likely outcome would be a complete loss of the automotive sector in the US.

So when do the nominations for "idiot of the year" open up? I know a Knight from Poland that I want to propose...

PolishKnight says

I could even hang out with them for a beer (especially Hillary! Scarfing down kielbalsa in PA? _I_ voted for her in the open primary!)

So you voted for the loser in a primary - just proves you were wrong about yet another thing.

PolishKnight says

I disputed it but if you want a yes or no answer, the answer is yes. Asians are considered a minority and are not considered white. Happy?

Are you asian and have an axe to grind? Heck I'm part Cherokee and my axe isn't nearly as big as yours. You need to go back to anger management class - apparently you didn't graduate "cum laude". I hope all of the tea party members aren't as mad as you.

"Two things are infinite: the universe and human stupidity; and I'm not sure about the the universe."

Take care and have a good weekend.

And don't go home and kick your dog. I'm OK with kicking cats though.

Now they need find a top seller. (which will be easier to accomplish now that they can invest their resource in 3 brands instead of 20)

In 20 years, you’ll be glad we still have GM, Ford and Crystler.

If only they actually built good cars - I bought a Chevy POS model in February and it has spent a total of one full month in the shop since I bought it. They keep saying it's fixed, then discover something else they should have done. When I mention "and another thing I noticed..." it turns out that there was a service bulletin on it - but they only fix it if you ask. I realize that it would have been bad for the economy if they'd gone under and that we have an opportunity to recoup our investment - but it would be alot better if they actually built good cars.

I wonder what the execs at Chevy really drive. Unless it's mandatory that they drive their own crappy cars, I'll bet they drive better ones. Are Hugos still around?

I don't know if they can succeed regaining market share. I really believe the sympton of their problems were too many brands. Branding is everything in the car world. It is the only reason why people buy a Mercedes over a Cadallac without regards to price.

Resource are limited and It's hard to spread investment/marketing/research dollars on too many brands, you end up with half ass efforts everywhere. BMW spends all their resource to create the best 3,5,7 series possible and put as much investment and marketing resouce it takes. I like their chances a little more now as they can just focus on one or two brands instead of 8.

Company:

Toyota, Totoya, Lexus,

DMG, Mecedes Benz

BMW BMW, MINI

Honda Honda, Acura

Nissan Nissan, Infiniti

Note how other car manufacturer's do it. Brand their products into a entry level brand and a luxory brand, that's it and it works.

Prior to the reorg, GM had a ridicoulous amount of brand, not surprisingly, they end up with no branding and Saturn, Pontiac, Geo or whatever was just the same car with different names. Now, GM focus only on Chevy, Cadillac, GMC and Buick Brand which in my opinion is still 2 brands too many. If I was the CEO, I would focus on the Chevy and Cadillac brand and discontinue the GMC and buick Brand as well. A company shouldn't be spreading their resoucre on both the Cadallac and Buick Brand, it makes no sense. At least they got rid of Pontiac, Saturn, Hummer and Geo brands

Actually Honda only has the Acura brand within North America if I remember correctly. Elsewhere it's just Honda.

I feel it's not horrendous having that many brands, however every brand they had seemed to have a bad name! I think they started to get into trouble as employees aged. The motto of "I can't be fired for what worked last year..." started to take hold. Partial fear of failure, and probably loss of creativity as people get older probably helped doom them to their current quality of cars.

Cars are not only part of our culture, but also help identify each individual. Therefore, having a whole slew of cars gives people a better chance of finding something unique among their coworkers, friends and family. I think BMW/Mercedes get away with essentially 3 models because they don't have a lot of vehicles out there. Therefore your choice is unique in a way.

"however every brand they had seemed to have a bad name!"

It's not an accident they have a bad name, A company like BMW spends all their resource on the BMW, a company like GM splits their resource into Cadillac and Buick which makes no sense to me. It's the same market segment with same target customer.

The bad name came from quality, and lack of innovation. If they had one brand, I'm betting the same team who designed it would be doing it year after year, creating the same boring cars. The same quality would come into play as well! They make enough cars that they should be able to clean up quality control. Considering how much is shared between each model, it should be pretty easy in fact! They're aiming for cheap bulk, which is going to generate a bad name regardless.

If I was blindfolded and put in a mercedes I would know I was in a mercedes, I could just tell from the quality. Close the door, quality. Get on the highway, nothing rattles, quality. These companies spend money to improve their brand and to ensure top dollar for their vehicles, but these other cars are just horrible from the bottom up!

I think there is a lot more to it than too many brands. I'm betting if honda created 15 brands, they would all sell well. Even if they were printed under another name and no one EVER knew who made them. THe quality is just there. They would all get good reputations very quickly.

Maybe you don’t understand bonds. They are long term, and there is a huge risk of loss if and when interest rates go up (and or when much inflation occurs).

Yes and no. You only lose if you try to sell on the secondary market. You’re guaranteed the stated return on the bond.

Also, not if you invest in bonds through an intermediary (like a bank or MM fund) that buys the bonds and assumes the interest rate risk, giving you a "cash balance". There is still a lot of demand for cash.

not if you invest in bonds through an intermediary (like a bank or MM fund) that buys the bonds and assumes the interest rate risk

Money market funds do not invest in bonds (AT ALL), they only invest in the shortest term securities such as 90 day treasury bills, or possibly commercial paper and other short term securities, but not bonds.

There are bond funds, but they have a very significant risk of loss of principal, just like bonds.

Maybe some people don't get this because the trend in interest rates has been down (in rates) and up in bond prices for so long.

Things keep going the way they are, and there is going to be a genuine mini wealth effect from rising PM prices in the alternative/fringe/gloom and doom investment crowd. The one thing all of these anti-orthodoxy/mainstream economic gurus have in common is a love for the yellow and silver precious. I can just imagine a mini economic boom in places like New Hampshire as a result, lol. The "nutjobs" have done far better with their investments than indoctrinated mainstreamers for several years now - I'm glad I listened to what they had to say.

How many of you bugs on this thread follow Max Keiser, Gerald Celente, VisionVictory (Daniel on his Youtube channel), Marc Faber, Peter Schiff, Jim Willie, etc.?

Anybody have any additional "nutjobs" that would be good recommendations for me? Thanks in advance.

Things keep going the way they are, and there is going to be a genuine mini wealth effect from rising PM prices in the alternative/fringe/gloom and doom investment crowd. The one thing all of these anti-orthodoxy/mainstream economic gurus have in common is a love for the yellow and silver precious. I can just imagine a mini economic boom in places like New Hampshire as a result, lol. The “nutjobs†have done far better with their investments than indoctrinated mainstreamers for several years now - I’m glad I listened to what they had to say.

How many of you bugs on this thread follow Max Keiser, Gerald Celente, VisionVictory (Daniel on his Youtube channel), Marc Faber, Peter Schiff, Jim Willie, etc.?

Anybody have any additional “nutjobs†that would be good recommendations for me? Thanks in advance.

Keiser and Celente are entertainers. Marc Faber is no nut job. Marc Faber is probably the greatest economist living today. Schiff is pretty smart but a lot of his arguments are rhetoric rather than describing the actual process. That being said, I owe Peter a big one since he recommended to me to pick up Skyworth Digital 2 years back.

Maybe you don’t understand bonds. They are long term, and there is a huge risk of loss if and when interest rates go up (and or when much inflation occurs).

Yes and no. You only lose if you try to sell on the secondary market. You’re guaranteed the stated return on the bond.

With the interest rates being doled out by the bond market now, you are pretty much guaranteed a return damn close to 0.1% annually. When inflation comes alive, those returns become -1% or -5% annually in real terms. Buying a long term bond earning under 6% with the plan of holding it to maturity is suicide today. People piling into the bond market are nothing but your modern day condo flippers looking to unload their garbage on the foolish masses. In 4 years time, we'll have all kinds of experts on TV trying to explain why no one understood that a 10 year bond that earns 1% with no risk of default is not a good or safe investment.

Money market funds do not invest in bonds (AT ALL), they only invest in the shortest term securities such as 90 day treasury bills, or possibly commercial paper and other short term securities, but not bonds.

Money markets in fact do invest in long term debt, just not directly. You have to follow the chain to the ultimate debtor.

Just take a look at VMMXX. #2, #3, #4 holdings are short term mortgage securities. OK, short term.....but what are those securities backed by? Long term mortgage debt. The GSE is just another intermediary. Your "money market" cash is backed by a short term GSE security, which is backed by a 30 year mortgage.

Much of the rest is finance companies like GE, Toyota, and banks. What are their holdings in? Multi-year debt.

Money market funds provide a huge demand to the the bond market.

Money markets in fact do invest in long term debt, just not directly

When there is only six months left on a 20 or 30 year bond, then it is a short term security, that could be part of a money market fund. That is the one and only sense in which you are correct.

http://en.wikipedia.org/wiki/Money_market

http://en.wikipedia.org/wiki/Money_market_fund

Money market funds provide a huge demand to the the bond market

You're a smart guy, so sometimes when you make something up, it's going to be correct. But not in this case.

Your VMMX:

Characteristics as of 08/31/2010

Number of holdings 303

Average maturity 58.0 days

Weighted average life 116.0 days

Fund total net assets $107.8 billion

Portfolio composition

Distribution by issuer (% of fund) as of 08/31/2010

Prime Money Mkt Fund

Bankers Acceptances 0.0%

Certificates of Deposit 17.2%

Commercial Paper 17.7%

Other 0.0%

Repurchase Agreements 5.3%

U.S. Govt. Obligations 23.4%

U.S. Treasury Bills 16.8%

Yankee/Foreign 19.7%

Total 100.0%

I don't see the mortgages here, but a short term mortgages, say a mortgage with 9 months left on it is not really related (in price) to mortgages with over 20 years till maturity. And buyers of such short term mortgage securities are not putting a dent in the supply of long term mortgage securities that need to be sold. The backing has to do with how secure they are, not the price (the interest rate). Assuming low risk, the price is determined by comparison to other securities of similar risk and duration.

I don’t see the mortgages here

I think you're missing my point. No, I'm not saying money market funds own mortgages, but they do buy short term securities, which ultimately go to fund mortgages. I'm not making anything up.

https://personal.vanguard.com/pdf/hold0030.pdf?cbdForceDomain=false

#2 "Federal Home Loan Mortgage Corporation" $11 Billion

Freddie Mac, borrows funds short term, and lends them long term, much like any other other financial entity. Holders of VMMXX, a money market fund, are providing funds ultimately to long term mortgages. The money market fund is not buying mortgages that have 9 months left, it's buying short term notes issued by Freddie Mac (about 1/3 of Freddie Mac's debt is short term), and Freddie Mac is turning around and lending long term to homeowners.

More importantly there is also the commodity aspect, which is fairly independent of USD deflationary forces.

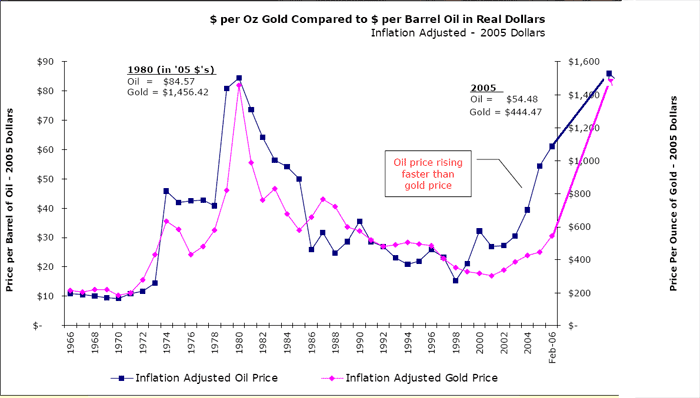

Just to elaborate this point, here is a comparison of gold and oil prices (I took the liberty of modifiying the chart to reflect present prices. Chart was from 2006, and noted that oil was rising faster than gold. Since them they are right about the same again)

Note that the chart is inflation adjusted so the spikes have nothing to do with inflation.

Gold price is mostly just a function of increased demand from BRIC countries for commodities. China now buys more oil from Saudi Arabia than the US.

It has not much to do with anticipating inflation, sovereign default, etc.

Mark,

Cool graph.

Inflation is a monetary thingee, not exactly the same thing as "rising prices" though it can (and often does) lead to higher prices. But not necessarily so.

We can have deflation and rising prices and I think it is happening.

« First « Previous Comments 4,012 - 4,051 of 117,730 Next » Last » Search these comments

patrick.net

An Antidote to Corporate Media

1,251,165 comments by 14,921 users - Booger online now