Thread for orphaned comments

2005 Apr 11, 5:00pm 213,373 views 117,730 comments

by Patrick ➕follow (60) 💰tip ignore

« First « Previous Comments 4,042 - 4,081 of 117,730 Next » Last » Search these comments

not if you invest in bonds through an intermediary (like a bank or MM fund) that buys the bonds and assumes the interest rate risk

Money market funds do not invest in bonds (AT ALL), they only invest in the shortest term securities such as 90 day treasury bills, or possibly commercial paper and other short term securities, but not bonds.

There are bond funds, but they have a very significant risk of loss of principal, just like bonds.

Maybe some people don't get this because the trend in interest rates has been down (in rates) and up in bond prices for so long.

Things keep going the way they are, and there is going to be a genuine mini wealth effect from rising PM prices in the alternative/fringe/gloom and doom investment crowd. The one thing all of these anti-orthodoxy/mainstream economic gurus have in common is a love for the yellow and silver precious. I can just imagine a mini economic boom in places like New Hampshire as a result, lol. The "nutjobs" have done far better with their investments than indoctrinated mainstreamers for several years now - I'm glad I listened to what they had to say.

How many of you bugs on this thread follow Max Keiser, Gerald Celente, VisionVictory (Daniel on his Youtube channel), Marc Faber, Peter Schiff, Jim Willie, etc.?

Anybody have any additional "nutjobs" that would be good recommendations for me? Thanks in advance.

Things keep going the way they are, and there is going to be a genuine mini wealth effect from rising PM prices in the alternative/fringe/gloom and doom investment crowd. The one thing all of these anti-orthodoxy/mainstream economic gurus have in common is a love for the yellow and silver precious. I can just imagine a mini economic boom in places like New Hampshire as a result, lol. The “nutjobs†have done far better with their investments than indoctrinated mainstreamers for several years now - I’m glad I listened to what they had to say.

How many of you bugs on this thread follow Max Keiser, Gerald Celente, VisionVictory (Daniel on his Youtube channel), Marc Faber, Peter Schiff, Jim Willie, etc.?

Anybody have any additional “nutjobs†that would be good recommendations for me? Thanks in advance.

Keiser and Celente are entertainers. Marc Faber is no nut job. Marc Faber is probably the greatest economist living today. Schiff is pretty smart but a lot of his arguments are rhetoric rather than describing the actual process. That being said, I owe Peter a big one since he recommended to me to pick up Skyworth Digital 2 years back.

Maybe you don’t understand bonds. They are long term, and there is a huge risk of loss if and when interest rates go up (and or when much inflation occurs).

Yes and no. You only lose if you try to sell on the secondary market. You’re guaranteed the stated return on the bond.

With the interest rates being doled out by the bond market now, you are pretty much guaranteed a return damn close to 0.1% annually. When inflation comes alive, those returns become -1% or -5% annually in real terms. Buying a long term bond earning under 6% with the plan of holding it to maturity is suicide today. People piling into the bond market are nothing but your modern day condo flippers looking to unload their garbage on the foolish masses. In 4 years time, we'll have all kinds of experts on TV trying to explain why no one understood that a 10 year bond that earns 1% with no risk of default is not a good or safe investment.

Money market funds do not invest in bonds (AT ALL), they only invest in the shortest term securities such as 90 day treasury bills, or possibly commercial paper and other short term securities, but not bonds.

Money markets in fact do invest in long term debt, just not directly. You have to follow the chain to the ultimate debtor.

Just take a look at VMMXX. #2, #3, #4 holdings are short term mortgage securities. OK, short term.....but what are those securities backed by? Long term mortgage debt. The GSE is just another intermediary. Your "money market" cash is backed by a short term GSE security, which is backed by a 30 year mortgage.

Much of the rest is finance companies like GE, Toyota, and banks. What are their holdings in? Multi-year debt.

Money market funds provide a huge demand to the the bond market.

Money markets in fact do invest in long term debt, just not directly

When there is only six months left on a 20 or 30 year bond, then it is a short term security, that could be part of a money market fund. That is the one and only sense in which you are correct.

http://en.wikipedia.org/wiki/Money_market

http://en.wikipedia.org/wiki/Money_market_fund

Money market funds provide a huge demand to the the bond market

You're a smart guy, so sometimes when you make something up, it's going to be correct. But not in this case.

Your VMMX:

Characteristics as of 08/31/2010

Number of holdings 303

Average maturity 58.0 days

Weighted average life 116.0 days

Fund total net assets $107.8 billion

Portfolio composition

Distribution by issuer (% of fund) as of 08/31/2010

Prime Money Mkt Fund

Bankers Acceptances 0.0%

Certificates of Deposit 17.2%

Commercial Paper 17.7%

Other 0.0%

Repurchase Agreements 5.3%

U.S. Govt. Obligations 23.4%

U.S. Treasury Bills 16.8%

Yankee/Foreign 19.7%

Total 100.0%

I don't see the mortgages here, but a short term mortgages, say a mortgage with 9 months left on it is not really related (in price) to mortgages with over 20 years till maturity. And buyers of such short term mortgage securities are not putting a dent in the supply of long term mortgage securities that need to be sold. The backing has to do with how secure they are, not the price (the interest rate). Assuming low risk, the price is determined by comparison to other securities of similar risk and duration.

I don’t see the mortgages here

I think you're missing my point. No, I'm not saying money market funds own mortgages, but they do buy short term securities, which ultimately go to fund mortgages. I'm not making anything up.

https://personal.vanguard.com/pdf/hold0030.pdf?cbdForceDomain=false

#2 "Federal Home Loan Mortgage Corporation" $11 Billion

Freddie Mac, borrows funds short term, and lends them long term, much like any other other financial entity. Holders of VMMXX, a money market fund, are providing funds ultimately to long term mortgages. The money market fund is not buying mortgages that have 9 months left, it's buying short term notes issued by Freddie Mac (about 1/3 of Freddie Mac's debt is short term), and Freddie Mac is turning around and lending long term to homeowners.

More importantly there is also the commodity aspect, which is fairly independent of USD deflationary forces.

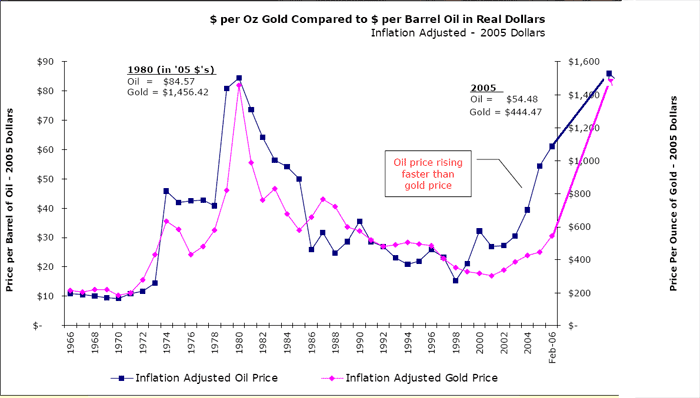

Just to elaborate this point, here is a comparison of gold and oil prices (I took the liberty of modifiying the chart to reflect present prices. Chart was from 2006, and noted that oil was rising faster than gold. Since them they are right about the same again)

Note that the chart is inflation adjusted so the spikes have nothing to do with inflation.

Gold price is mostly just a function of increased demand from BRIC countries for commodities. China now buys more oil from Saudi Arabia than the US.

It has not much to do with anticipating inflation, sovereign default, etc.

Mark,

Cool graph.

Inflation is a monetary thingee, not exactly the same thing as "rising prices" though it can (and often does) lead to higher prices. But not necessarily so.

We can have deflation and rising prices and I think it is happening.

it’s buying short term notes issued by Freddie Mac (about 1/3 of Freddie Mac’s debt is short term), and Freddie Mac is turning around and lending long term to homeowners

Okay. That's interesting. Freddie Mac ends up with a huge yield curve position, which they could hedge in the regulated derivatives markets (exchange traded financial futures and or options). So you were right after all about demand to long term securities (sort of, because the hedge undoes some of that- but let's not go there).

But weren't we talking about investors in Money Markets Funds ? All they are really getting, in terms of risk reward is an investment in short term securities. They are not taking on any of the price risk associated with investing in long term bonds. Which at least from my perspective was what we were talking about.

I say nonsense

And I would still say that gold is saying something. IT turns out that strength in the economy usually goes hand in hand with increased inflationary expectations. That is the reason why gold often goes up in tandem with industrial commodities.

Gold is bought in prosperous times as gifts and in jewelry and so on. But it is also a substitute for money. One that does not have monetary inflation risk.

So certainly part of gold's appeal is as an inflationary hedge, and more singularly as a possible BIG winner in the event of some sort of dollar crash, or inflationary crisis.

And I still say, my opinion is that gold and bonds are contradicting each other. Maybe that has to do with government involvement in the bond and mortgage markets. Or maybe it has to do with hedging, or people paying a premium for perceived safety. But if and when gold gets bubblishious (sp?), there will be inflationary inferences associated with that phenomenon.

The last really big precious metal bubble(1980) peaked at a time of unprecedented inflationary expectations, along with the manipulation of the Hunt brothers.

So….If you think people are buying gold as inflation hedge, where are the people buying RE as an inflation hedge?

I have been talking about gold price increases being contradictory to what is happening in bonds. Okay, yes, it's also contradictory to what is happening in real estate. And yes there is leverage with real estate, as well as other aspects to the debt/credit component.

I don't claim to understand why gold is as high as it is. In fact, I see it as at least 50% chance that it will be lower in price one year from now.

Real estate is a MUCH better deal if you expect inflation

Real Estate, tied at least in part to wages, and to its utility, does well from actual long term inflation, although eventually I guess everyone starts to believe it only goes up. That shouldn't happen again for a while.

Gold on the other hand, can have a relatively rapid price spike based on expectations alone. That is, expectations of currency devaluation or inflation, or possibly other global crises.

Thanks rentalinvestor, I did try adwords for several years, but it never made much, anywhere from $300 to $900 per month.

Only one in 2,000 readers would click on an ad. I could be more pushy about placement, but I don't like doing that.

Adwords rates have been increasing since about 2008. So those rates could have increased; however, Adwords is best for generic sites and sites with few visitors. No overhead sales costs, all managed by google, and it brings in a little site cash to those sites, who would otherwise have no way to earn any income.

Something like Patrick.net requires selling fairly directed products. Targeted affiliate programs would be much more profitable. Letting google try and match up ads with the site is pretty weak. The rates are low, and match rate probably horrible (eg Realtors, or gold coin sellers). However, using affiliate programs, he could target bank financial services to viewers. His user base is coming here because they're looking for information on housing. If they're not buying a house, it likely means they're open to other financial services. Based on his user statistics available through quantcast, he has a fairly educated and highly paid user base. These users would best benefit from educated services, worth their time, not get rich quick schemes and sham gold sellers.

I'm back!

I don't have anything to say to Eightball that hasn't already been said above. That's all. Take care everyone.

"The latest changes in the Case-Shiller national index represent a three-month moving average -- for May, June and July. Sales in May and June were inflated by government tax credits that have since expired."

Here is what Calculated had to say today:

Case-Shiller Headlines

The headlines on Case-Shiller seemed contradictory this morning. Here are a few examples:

From the Financial Times: US home prices slip in July

From the WSJ: Home Prices Rose in July

From CNBC: US Home Prices Slipped In July And May Stabilize Near Lows

From MarketWatch: Home price growth slows in July

From HousingWire: S&P/Case-Shiller 20-city composite index rose 0.6% for July

The reason for the confusion is S&P Case-Shiller reports both seasonally adjusted (SA), and not seasonally adjusted (NSA) data. Because of concerns about the impact of foreclosures and government programs on prices, S&P switched to reporting NSA numbers in their press release, but many analysts are still using the SA numbers (I reported the SA numbers - see this post for the SA graphs from earlier this morning).

The important points are:

1) this is a three month average of May, June, and July. Seasonally this is the strongest time of the year for house prices.

2) sales collapsed in July, so the next report (for June, July and August) will probably show falling prices.

Date of sale in this context means date of closing the sale, not date of contract.

Case-Shiller is based on date of CLOSING the sale, which means that tax-credit transactions are distorting the market several months after the credit officially expired.

The tax credit is based on date of contract agreement, with some leniency as to when the sale closes.

What mthom said.

The delay between contract and closing, plus the 3-month moving average means that C-S will stay up until September's numbers are released on Oct 28, although sales already tanked in July.

This is Calculated Risk's prediction, and I think he is correct.

I'm betting we're more 1994 than 1995. A July decline would have been catastrophic -- an August decline less so... but still not good.

Easy mthom - this thread may make the Patrick.net book of world records.

This may be the first time that the Case-Shiller index was discussed without any name calling, or lashing out !!!!

This is a pleasant debate : )

SF 11.2% increase. Whew! Can someone back this up by some numbers coming from the field?

It's worth noting that the top tier ($621,684) in the SF Bay Area index continued to drop (again) this month from 149.1 to 148.5. It peaked in May at 150.07.

It’s worth noting that the top tier ($621,684) in the SF Bay Area index continued to drop (again) this month from 149.1 to 148.5. It peaked in May at 150.07.

I was just going to point that out. Seasonally adjusted is actually more dramatic, since these are normally the months when you get a bit of a boost in closing prices. Down 2.6% since the May number (149.4 to 145.55).

I don't want to extrapolate too much on the trend since it's only a few months old, but that's an 8.5% annualized rate of fall.

Low end seems to be holding up well.

Low end seems to be holding up well.

It makes sense due to tight restrictions on loan for higher amount.

To add to your points Bap33, if the now under $200k subprime disasters (which were selling for $650k-$850k in places like East Palo Alto and Antioch) have been sold off and are reducing in turnover, then logically, average sold home prices will go up, even if sales of more expensive homes stay flat or even go down a little. I believe C-S is supposed to track same-house sales over time versus aggregated regional sales because the former is more reflective of pricing moves, and the latter could be distorted by shifting inventory concentrations.

At the higher end I see plenty of homes in the area reducing prices and sitting on the market. For example, one near us was listed around that April 2010 timeframe first at $1.65M, then reduced eventually to $1.5M before closing last week at $1.42M. So in this case who cares about whether that was a rising asking price... the thing still didn't sell until 14% below asking. And that price is also lower relative to its peers' sales last year.

We are not even half way to

TERMINAL VELOCITY!

Brace for 1970s housing prices and catastrophic waves of arson and homeowner suicides as howling despair sets in and buyers realize they can’t flip for 2x in 12 months and the last-suckers-left-holding-the-bag sit watching the bank seizure crews kicking down the front door and raping their spouses and pets.

NA! Chill awhile! There was a world before the bubble.

Purely anecdotal observations follows: I really haven’t even been looking much in the last year in my area (Southern Sonoma County CA), as prices have been fairly sticky. The other day I went to realtor.com to see what was on the MLS. Fair amount of houses noted as foreclosures (this must now be a sales gimmick) but more interesting many many price reduced notices (also a sales gimmick). While a price reduced notice is clearly a type of advertisement it also opens the door to bids below asking and shows the weakness of the market. This market certainly does not seem to be rising in price and is still over priced IMO.

The low end is done crashing, the middle is halfway down, the top has just begun.

What concerns me now is those poor people who are putting down $200k on $600k properties (that are overpriced by $200k) thinking it's ok, best they'll ever do, maybe they'll make money on appreciation. Well actually, it doesn't concern me that much. ;)

What concerns me now is those poor people who are putting down $200k

200K cash down? Those people aren't poor. Or at least they weren't when they put down the 200K

I must have a sick since of humor because I find AF's posts hilarious.

Poor people put zero or less than that down (105% loans, and such). That was how ridiculous this all got.

We are not even half way to

TERMINAL VELOCITY!

Brace for 1970s housing prices and catastrophic waves of arson and homeowner suicides as howling despair sets in and buyers realize they can’t flip for 2x in 12 months and the last-suckers-left-holding-the-bag sit watching the bank seizure crews kicking down the front door and raping their spouses and pets.

It’s gonna get really deeply truly apocalyptic out there with commercial RE crashing; ALT-A resets kicking in; Section 8 program reductions due to budget reductions (speculators should at least be able to eat their S8 tenants) and continuing meltdown of an economy that has no jobs left that it can’t or hasn’t already shipped to China.

Plant potatoes. Teach kids and spouse to shoot, at close range and without remorse and full in the knowledge that cannibal anarchy means choosing who gets to be dinner - them or the starving psychopath climbing in through the kitchen window.

If I had a sister, I'd want her to marry you so we could sit and visit at Christmas and Thanksgiving. I love you man!

« First « Previous Comments 4,042 - 4,081 of 117,730 Next » Last » Search these comments

patrick.net

An Antidote to Corporate Media

1,261,459 comments by 15,062 users - clambo, DOGEWontAmountToShit, goofus, mell, Misc online now