Thread for orphaned comments

2005 Apr 11, 5:00pm 178,546 views 117,730 comments

by Patrick ➕follow (60) 💰tip ignore

« First « Previous Comments 8,131 - 8,170 of 117,730 Next » Last » Search these comments

What I see and hear a lot of in our neighborhood are the shops buying gold, not sure what their business model is. And tons of commercials for home loans at very low rates.

Not sure what to make out of it all.

Who want's a War?

96% of House Republicans and 98% of House Senators did, in 2002.

“Nessuna soluzione . . . nessun problema!„

And I was austricized both Left and Right, when I agreed with Richard Geer and the Dixie Chicks. Remember that huh?

Where was the Liberal media, Oh that's right, they were leading the angry Mob, to burn the Dixie Chicks at the sake, torches and all.

Dur unt ya, I vas tuned indo an Austrian. Hear me now and smell my breath lattah...

Not sure what to make out of it all.

Sheer desperation.

And in the mean time the Liberal press want's to go to the middle East and hold hand and sing Kumiya with the protestors, that are starving and increasingly getting emaciated everyday because we're all so damn proud of our Gold Bubble, while they scrounge for dog cakes and camel droppings.

Then we act surprised when they are whisked away by angry protestors and turned over to the very Government our Government says they are protesting.

Liberator or the man who shat on the worlds dinner plate?

You be the judge...

Yay Gold!!!

in a further demonstration of "fuck the constitution, lets simply do whatever we need to do for political gain"

This is a cut-throat political proposal, but it is constitutional, should the Dems go along with it.

It's up to We The People to figure out who's right in this, next November.

The American people made a serious mistake in the 1920s, and 1994-2004, so they may not fully come to understanding of the current crisis until a few more years.

If anything, given the immense amount of propaganda being generated with the Peterson Foundation, the Koch money, the Scaife media, the American people may not ever gain enlightenment on this. Just look at the several conservatives on this site, they're immune to reason and facts, and they want to keep it that way.

Wish I spoke Swedish. I took German in high school, mebbe I can go there when this country fails.

Sadly, it's extremely believable. Anything that allows plausible (or even implausible) deniability on the part of our elected officials is to be expected.

Democrats are in the minority and need Republicans to raise the ceiling with them in the House. Not to mention I am not sure if Pelosi and Reid are going to be eager to give the GOP an escape. They will want them to do the same.

This debt ceiling debate is a complete joke. Don't you people understand that Wall St., which controls the govt., is sitting on billions in T-Bills that woudl be worthless if the debt ceiling is not raised? NOBODY in Congress is crazy enough to vote against Goldman Sachs.

, is sitting on billions in T-Bills that woudl be worthless if the debt ceiling is not raised?

Nope, you don't quite understand. If this were an actual crisis, not increasing the debt limit would actually protect the debt already issued.

What the debt limit does is prioritize gov't outlays to servicing the debt as it comes due, then people with contracts.

Granny's SSI is legally at the end of the line.

http://www.frumforum.com/social-security-checks-are-not-guaranteed

There is no legal requirement to pay bond holders first. Obama could pull a fast one by not paying bond holders, allowing for default, and blaming the carnage on Republicans. It would be a HUGE gamble that woudl result in him either winning or losing in a landslide in 2012. As we saw in the GM bankruptcy, Obama knows a thing or two about ignoring bond holders.

Yeah, but we took away the power when Obama

really needed to do good. Sure he was messing

up in some respect. But how can you give him

only two years to fail him?

Ummm,, Social Security income is intended to be supplimental income. Besides that, they aren't going to be reducing the benefits (unfortumately). Only raising the age over time (weak).

Besides that, cat food really doesn't taste bad like they keep saying. Have you tried any?

I guess people quickly had forgotten that this

recession started during Bush administration.

Obama may not be doing the right thing. But

can we really blame him alone when it took 8 years

for Bush to do all the damage?

This recession started in the late 70's with minor blips along the way.

holy crap...Ron Paul really corned Bernanke today. It was pretty funny.

He just ended the dialogue and the conversation went sorta like this:

RP: "Do you think gold is money?"

Bernanke: "No"

RP: "It functioned as money for $6000 years, why do central banks still hold gold?"

Bernanke: "It's an asset"

RP: "Why not hold diamonds? That's an asset?"

Bernanke: "It's tradition"

it was pretty funny seeing Bernanke put on the spot and watching him pause, and lie

This recession started in the late 70's with minor blips along the way.

I don't think you understand how a recession is defined.

As per the National Bureau of Economic Research:

"a significant decline in [the] economic activity spread across the country, for at least three months, normally visible in real GDP growth, real personal income, employment (non-farm payrolls), industrial production, and wholesale-retail sales."

Not really a 40 year measuring tool. If a recession last "too long" it then becomes a depression.

Perhaps you are thinking of the growing wealth disparity that did begin around 1979 years ago.

I think the case can be made the recession started in the 1970s.

We abandoned fiscal probity in 1983 or thereabouts, and have been living on credit and our reserve currency float since then. The current recession is a continuation of the tech recession which was a continuation of the 1991 recession which was the after party of the 1980s debt binge

I think the case can be made the recession started in the 1970s.

Maybe it is just semantics here, but I don't see today's recession starting in the '70s, but certainly policy changes starting back then have made large contributions in creating the environment for a recession today.

At any point along the way we could have changed our direction, and perhaps avoided the recession today. So, what "started" in the '70s could have been avoided by changes in the '80s, '90s or even '00s.

holy crap...Ron Paul really corned Bernanke today. It was pretty funny.

Yeah, Benny got really upset.

If gold is so unimportant, why do central banks go out of their way to keep it?

If gold is so unimportant, why do central banks go out of their way to keep it?

central banks all around the world are net buyers of gold. Clearly, even they are losing faith in their own fiat currency.

Yeah, Benny got really upset.

If gold is so unimportant, why do central banks go out of their way to keep it?

There really is no getting around that one. Not one person who argues against a rising gold price and gold as a monetary asset can explain why central banks all over the world insist on keeping all that gold locked in their vaults. I guess its just for the hell of it. Oh wait...we have central banks increasing their gold reserves now. Again, I'd like to have anyone explain this one if gold is indeed, not money, and not important.

What about all the unemployed inner city blacks and poor rural whites?

Farmers just don't want to pay free market wages.

Yep, that is a big part of the problem. That and Americans don't want to pay free market prices for their food.

This is great. Hopefully the democrats grow a pair and keep this pressure up. Let the republicans put their money where their mouth is and start making difficult cuts. Not tweaking a million here and a million there out of a multi trillion dollar budget, but real cuts.

They can cut the military, social security, or medicare. Everything else is minor and if they eliminated ALL of it (NASA, Dept of Ed and Energy, etc.), there would still be a big deficit.

Good luck trying not to cut any of those to a substantial degree without raising tax revenue. I don't believe it possible.

Where is the irrational exuberance?

See quote below.

All factors point an upward momentum for gold.

There is an old saying, "when the shoe shine boy starts giving you stock tips, it's time to get out of the market." Back in 2000, Anna Kuornikova, the hot tennis player, was making commercials advocating stocks. She was the shoe shine boy. Next, every shoe shine boy was talking about real estate. Today it's gold.

Sure, gold prices could continue to rise for years. But they could also reverse at any time. The reasons I think gold is in a bubble are:

1. Interest rates are so low that there are no other investments that money is chasing (except bonds to some extent).

2. Everyone is harping about how great gold is. Perfect shoe shine boy behavior.

3. The price of gold relative to other commodities like food, copper, and toilet paper is high. If inflation is solely responsible for the price of gold, then one would expect all commodities to rise more or less the same.

There are also 11 Signs That Gold Is In A Bubble That Is Going To Burst according to the Business Insider in sharp contrast to the idea that "All factors point an upward momentum for gold."

Motley Fool also warns that gold is in a bubble and has debated both sides of the issue.

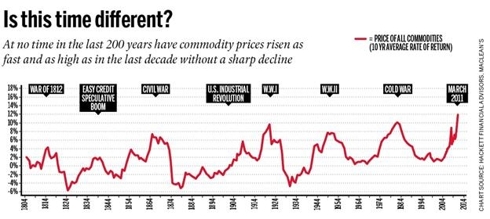

The gold bubble has been discussed in Seeking Alpha and the Wall Street Journal with scary graphs like

and conclusions like "Gold is a high-risk and potentially dangerous speculation. Anyone thinking of investing needs to do some serious thinking first."

There is even a Gold Bubble Blog -- not affiliate with Patrick.net.

Generally, by the time people start talking about a bubble possibly existing, it has already become prime to burst. Of course, I don't know when the gold bubble with burst, but I do know it will, and I am strongly against buying into bubbles late in the game. Sure, you could still make a lot of money, but that opportunity comes with high risk.

To be fair, some of the increase in the price in gold is justified. I just don't think the lion's share is.

You have to remember that gold isn't going up. Dollars are going down.

You have to remember that gold isn't going up. Dollars are going down.

The two are not mutually exclusive. I think that gold is going up AND the dollar is going down. That's why I think it's better to look at gold priced in terms of other commodities that are less subject to speculation. Commodities that are relatively abundant. For example, copper, semi-precious stones, labor, wheat, etc. Discount things that are subject to huge bull/bear markets like oil. Also discount things that by their nature depreciate rapidly due to technological advancement like computers, televisions, and other electronics.

The problem with Obama is that he is surrounding himself with some really bad people when it comes to job creation... people like Jeff Immelt. How the heck did the Secret Service let Immelt into the White House anyway?

1. Interest rates are so low that there are no other investments that money is chasing (except bonds to some extent).

Interest rates are artificially suppressed in Western Nations (such as United States) and they are artificially tinkered with in places like China and India to beat inflation. If the market was setting or at least had maximum control over dictating the interest rates, I would agree with you. But given the debt levels and given the fact that if the US raised its interest rates - it will be an outright default, this point is actually a positive for gold. So you just gave a classic case of why you should own gold.

2. Everyone is harping about how great gold is. Perfect shoe shine boy behavior.

Most people that I know don't even own an ounce of gold. Moreover, they don't even know what value it brings to their portfolio. There was a graph that was done by Casey Research recently that showed how little of the investment money goes into the gold market.

3. The price of gold relative to other commodities like food, copper, and toilet paper is high. If inflation is solely responsible for the price of gold, then one would expect all commodities to rise more or less the same.

Another way to look at this is if gold were to be money (which it is, obviously otherwise why are central banks not selling gold right now?), then price all commodities in gold, that means the prices of commodities are all falling. So we are having a deflationary depression in gold, while the central bankers are printing away to an inflationary environment.

... poor rural whites?

Those ARE the FARMERS.

What do you want us the privileged to be AMEEEERICAN to work hard in the fields!!!!?

Yep, that is a big part of the problem. That and Americans don't want to pay free market prices for their food.

I'am an AMEEEERICAN, I'm entitled to everything subsidized: food, housing, healthcare, education. I do not care they all are "subprime" quality, just keep it cheap. Sell more debt to those Chinese succers and subsidize, subsidize, subsidize, meeeeeeeeeeeeeee!!!

A lot of currencies are overprinting and going down in value, not just the dollar. This is a worldwide event. Also there are currencies pegged to the dollar so these would be going down versus gold as well.

Those ARE the FARMERS.

Every family in rural America owns a few score acres? Who lives in all those trailer parks, then?

A lot of currencies are overprinting and going down in value, not just the dollar. This is a worldwide event. Also there are currencies pegged to the dollar so these would be going down versus gold as well.

Yes. Almost every large economy is indulging in money printing. Gold may be in a bubble but it will continue for a while yet. If Bernank Clown continues with yet another QE look for gold to go over $2000. It may do so anyway. What has been done in regards to money printing is unprecedented and what happens with gold will be unprecedented.

I agree. Old people vote. Anyone who compromises their ability to get their pills will get voted out of office. Old people have no tolerance for not getting their entitlements -- or their senior discounts -- and they can be damn nasty when they don't get their way. Trust me, I live in Florida.

I think it's cool that they shut the rag down, altho it's sad for the workers.

I remember when gold was in a bubble at $600 an oz and our March 08 "double top". Bubbles characteristically move up very rapidly. Gold, despite its increases, has moved up sluggishly over the past 10 years. Up and down....up and down.... Bubbles only go up without pullbacks. We had 20 years of gold going no where since 1980. It's entirely possible that gold has simply played catch up this entire time and will continue to play catch up as long as they keep doubling the monetary base.

When Gold and Silver crashed in the early 80s, the Stock Market had finally reached new highs and kept on climbing, unlike in the 70s when it moved sideways. In 1981-82 Volker killed inflation.

When these two events coincided, people got out of gold in order to take advantage of the Bull Market, fearing to miss out on a boom more than in potentially resurgent inflation.

Look at historical charts for the Gold Price, YoY Inflation, and the S&P 500 and you will see a clear correlation of these factors.

Until we see the S&P move above 1600 and continue to rise, there will be no gold bust, only corrections to an upward trend.

IMHO.

We abandoned fiscal probity in 1983 or thereabouts, and have been living on credit and our reserve currency float since then.

The debt binge is responsible for us kidding ourselves about the incredible growth of our economy from then until 2007. That is we kidded ourselves that manufacturing was no longer as essential as it had been and that we could run massive trade deficits forever, and have a huge economy built primarily on services.

I believe that the huge credit boom was a mistake in some ways, but that a significant part of the growth that credit bought us, is real. That is, there isn't any denying that the credit boom bought us incredible growth, so I don't agree with the notion that we have been in a recession since the 70s.

But, had we lived within our means since then, we would have taken more pain (via recessions) and we would have grown less and we would be more humble, healthy, and less corrupt than we are now.

Maybe we could have survived taking on huge credit, corresponding with the boomers entering the economy, but without overdoing it, with better regulations, and especially without overdoing the excessive mortgage debt, and government debt.

It's those two that did the most damage, although I know other consumer debt also got way out of hand.

More than anything else, I think gold has a strong inverse correlation to interest rates. Interest rates being high encourages capital accumulation and savings, so people are comfortable storing their wealth as cash, short term fixed income instruments such as CD's. Note that interest rates have to be higher than the rate of inflation as well, for encouraging capital accumulation . Given that interest rates are so low, and they will continue to be so as far as the eye can see, the environment is set up for a bullish gold market.

« First « Previous Comments 8,131 - 8,170 of 117,730 Next » Last » Search these comments

patrick.net

An Antidote to Corporate Media

1,240,487 comments by 14,817 users - DhammaStep, Dholliday126, Misc, Onvacation online now