patrick.net

An Antidote to Corporate Media

1,354,561 comments by 15,730 users - askmeaboutthesaltporkcure, GreaterNYCDude, RWSGFY online now

« First « Previous Comments 202 - 241 of 241 Search these comments

I am far from a sophisticated investor, I'm just a trader that will take the trades as they come regardless of what the gurus and experts have to say.

Aren't the gurus and experts just there to get on the mainstream news and herd the retail sheep? I don't really ascribe much value to the highly publicized experts' opinions because I don't believe that anything they do is in anyone's interest but their own. There have been some (apparent) exceptions, but I trust nobody.

Why do you think $350 is the bottom ?

I could go on about P/E. I could prognosticate with lots of charts. In this case I'm going on nothing other than that's about what I bought my first AAPL shares for back around the time the iPad1 came out.

Vicente says

Do the numbers support the Doomers?

They are not my #s so I don't have an opinion. I said about all I can say about my best "guess" as to what "I" see the possibilities.

I bought my first AAPL shares for back around the time the iPad1 came out.

My question for you is; did you take any profits since you bought, and if not "why"?

Seems like Samsung and Android in general will be dominating the mobile phone market by commoditization - unstoppable juggernauts.

My question for you is; did you take any profits since you bought

Yes several times over.

Seems like Samsung and Android in general will be dominating the mobile phone market by commoditization - unstoppable juggernauts.

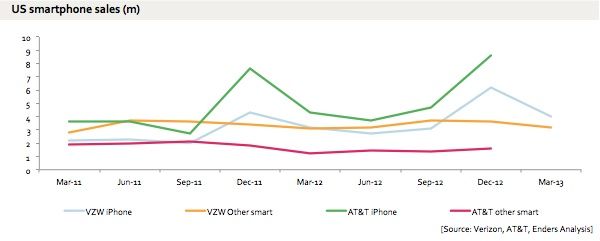

Based on what? I'm not saying you're wrong, but I haven't seen yet where Android sales have taken off, looks flat as a pancake.

Seems like Samsung and Android in general will be dominating the mobile phone market by commoditization - unstoppable juggernauts.

Based on what? I'm not saying you're wrong, but I haven't seen yet where Android sales have taken off, looks flat as a pancake.

http://techland.time.com/2013/04/16/ios-vs-android/

This is a decent overview and comes up as first hit when you search. While AAPL is still making more profits from their sales the trend by numbers (not profit) seems clear. I have no positions in either, I just think it is risky to buy back here as I think the general market is looking somewhat toppy (commodities not acting that great) here and there's some sideways/downside risk.

Too much competition from Android operating system (Samsung smart phones, Google tablets, Google chromebooks) and low-cost Windows 8 laptops are the main reasons to take Apple down a notch.

Apple just does not have a breakthrough product line like it did from 2000 to 2010 with the IMac, Apple Book, Ipod, Iphone, and Ipad.

Hence, even though Seekingalpha.com shows a forward P/E ratio of around 10, I see Apple having to readjust growth projections downward for the next year or two.

My question for you is; did you take any profits since you bought

Yes several times over.

Nice, good for you Vicente I see so many who let great profits disappear into just as great of losses. I never figured out the purpose they might have for doing so.. Just makes absolutely no since to me.

I just heard on the news, that Apple, instead of paying dividends out of cash .. they borrow the money to pay out dividends. Supposedly more corporations are getting back into borrowing again, money is so cheap that way, it's just hard to resist.

FFS, can't you folks badmouth AAPL harder?

I need it down to 350! And you guys are waffling on your job so it's stuck around 400. Hop to it!

An Apple Smartwatch? I haven't worn a watch in years. If I want to check on the time, I look at my Android based Smartphone.

i was looking for a smartwatch (before i knew apple was making one).

i want something that will let me keep track of various things and i'm too lazy to carry a phone or tablet all the time.

it'd mainly be for entering work items i've done, diet information (what did i eat), and exercise information.

the watch is the best form factor since it's always with me.

if it has an accelerometer i might be able to get rid of my nike fuelband.

if it has a camera i might be able to just take pictures of what i eat instead of typing data (then i can estimate if i pigged out just by looking at pictures).

if it's made by apple, there's a very good chance it'll look good. apple understands aesthetics are important.

some watches can be priced excessively high if they are considered jewellery which means high margins. i don't know if apple can pull it off, but if they can i can see them opening a new billion dollar market.

Friends of mine that are hardware engineers at Apple have been telling me that there is an exodus of employees right now. Engineers, leads, mid-level managers and some directors. They are going to Google, Lab 126 and Microsoft. The stock price dip has effectively halved the compensation incentive for working "Apple hours" and dealing with the pressure cooker environment there, and people are starting to walk. People there know what the competitors pay, and AAPL shares were a big leg-up for employee retention. Now that overall compensation is falling closer to what the competitors offer, Apple folks are thinking, "I can go work at X Inc. and make about as much money for fewer hours and less stress." Google is a little bit of an exception in that friends that have gone there say that the hours are long and the pressure high, but they compensate at least as well as Apple used to.

With that in mind, how would you bet on Apple stock? Already has a large captured audience of iPhone users who will suddenly be wanting to upgrade as the wonders of 5G on a kick ass iPhone are revealed....

If I was a person who liked to short stocks, I would short Apple now. Samsung is coming out with a new phone that apparently is much better than the iPhone: Bigger screen, faster, removable battery, better screen clarity, etc. Apple is

442 right now.

Removable battery?

iPhone 12 will be 5G right? Sources say that this is a game changer, will enable all sorts of applications that wouldn’t have worked without 5G. Could be as significant as the switch from flip phones to smart phones in 2007 with the first iPhone.

With that in mind, how would you bet on Apple stock? Already has a large captured audience of iPhone users who will suddenly be wanting to upgrade as the wonders of 5G on a kick ass iPhone are revealed....

The limiting factor for enticing people to upgrade to 5g is there is almost no infrastructure for 5g. The number of locations that you might have access to 5g signal is currently extremely limited. It will likely be 5 years before 5g signal is close to 4g in terms of availability. The 5g signal requires more towers/infrastructure because 5g waves cannot penetrate buildings as well as 4g signals can.

I’m no where near being interested in upgrading for 5g device because there simply is no 5g signal in my area.

Phone 12 will be 5G right? Sources say that this is a game changer, will enable all sorts of applications that wouldn’t have worked without 5G.

I can't think of anything that would work with 5G and not 4G - well, 3G for that matter.

The real advantage of 5G is that it uses (paradoxically) less bandwidth, because it does faster transfers of data. It's not that it's good for you, it's good for your carrier.

I have no opinion betting on Apple stock. Their users are a cult, and that will evaporate overnight at some point. 25 years ago, people waited outside stores all night to get the new Windows 95. This seamed crazy to me, because I was already running a Linux workstation. Well, there are no real fanboys for MS like that around anymore.

I can't think of anything that would work with 5G and not 4G - well, 3G for that matter.

That’s more a failure of imagination than anything else. Perhaps I can help:

https://www.fool.com/investing/2019/03/20/3-exciting-innovations-made-possible-by-5g.aspx

That’s more a failure of imagination than anything else. Perhaps I can help:

https://www.fool.com/investing/2019/03/20/3-exciting-innovations-made-possible-by-5g.aspx

That's just marketing BS. VR I don't see being any or worse with 4G versus 5G - unless it's all rendered off site - self driving cars we could do right now, wireless home is an awful thing. Basically is just allows more intrusion with less control of what data is sent and received. All of you are getting telescreens into your home.

That's just marketing BS. VR I don't see being any or worse with 4G versus 5G - unless it's all rendered off site - self driving cars we could do right now, wireless home is an awful thing. Basically is just allows more intrusion with less control of what data is sent and received. All of you are getting telescreens into your home.

I agree with the substance but not the details.

1)VR has to be updated fast to keep up with the moving person. Imagine virtual advertising on walls only available to people with special VR glasses connected to 5G phones. The speed here is the key, which is ten times faster than 4G.

2)Self driving cars have stalled because of one problem: the endless driving situations make it impossible to code for every possible situation. What about a snow covered road with random homeless people wandering across it? What about faded or missing lines on the road or road construction? And which do you choose? Safety of pedestrians or safety of car occupants? There’s just too many issues that require the judgement of a thinking person to do correctly or perhaps morally. So what you REALLY need is an AI to drive the car for you. An advanced AI with quantum technology should be able to parse all of these situations and so a great job driving the car. But the problem is this: such an AI is expensive and also much larger in physical equipment than could be placed in a spare glove compartment. Also it would be wasted only driving one car occasionally. You’d want to connect the AI to thousands of cars at once, maybe even millions! And here is where the data transfer speed comes in. It’s GOT to be snappy. No latency or lag can be acceptable when fractions of a second are involved in REAL TIME. This is why they included self driving cars in the benefits of 5G.

Oh and I agree with you about the virtual homes or whatever. No privacy!

He left by his own accord, and didn't turn into violent hater, and was banned before he experience any TDS meltdown.

My old 5 is for international use.

Apple stock shares should bounce by the New Year or maybe before.

Apple products are not expensive; they just cost more than some people can afford.

Also it would be wasted only driving one car occasionally. You’d want to connect the AI to thousands of cars at once, maybe even millions! And here is where the data transfer speed comes in. It’s GOT to be snappy.

You really don't need any complicated AI if the cars are all wired up, and know the location of every other car. I'm not an expert, but i doubt we need high speed coms for it.

I also, VERY STRONGLY DISAGREE with centralization. A mouse can navigate a path at high speed. A squirrel can. I would bet the computer next to me has enough transistors, and enough storage to have something that appears to be sentience. It's probably got more storage than I do, and the neurons work at about 10,000 times the speed my own neurons do. I'm just massively parallel, but your neurons are digital as well. It's just recreating the connections of the brain and running a small portion of it at a time.

The human brain has less than 100 billion neurons. My hard disk has 10,000 billion bytes. If you can represent a neuron, with storage, with 100 bytes, yeah, my computer can simulate my thinking process.

The 14-nanometer A10 Fusion iPhone 7 chip was the first Apple-designed SOC; it delivered 40% better processor performance and 50% better graphics than the one it replaced.

The 7nm A11 processor that followed unleashed a 25% performance boost in contrast to the A10.

Last year's A12 again unleashed significant performance gains over the A11.

The current A13 chips deliver 20% more performance and 40% better power efficiency than 2018’s A12.

Macs are moving to Apple silicon. Try to imagine how unfathomable that statement would have been when this thread was created in 2012. Macs transitioned to Intel processors in 2006 and in 2007 the first iPhone came out. In 2008 Apple purchased P.A.Semi and in 2010 Intrinsity. The rest is history.

It will require some sort of platform disruption to dethrone them as king of the hill. What comes after smartphones? What comes after silicon processors?

What comes after smartphones? What comes after silicon processors?

Something sideways, that no one was looking out for.

Facebook completely surprised Google, for example.

There may be some new non-cellular way to communicate over long distances, or maybe optical chips will replace silicon.

richwicks saysI can't think of anything that would work with 5G and not 4G - well, 3G for that matter.

That’s more a failure of imagination than anything else. Perhaps I can help:

https://www.fool.com/investing/2019/03/20/3-exciting-innovations-made-possible-by-5g.aspx

I'm with Rich on this one.

Please note that 5G could possibly go to 1 gigabit per second, but you're sharing it with others. And that's a best-case scenario. Funny thing is that many parts of the world enjoy fiber-optic to their house and 802.11 AC (which shipped in 2013); that combination can give you 1 gigabit that you don't even have to share with others. So, 5G will really only be giving you patchy, unreliable, shared network speeds that people have had in their homes since 2013.

In light of the above, the inspirational article notes:

• That article wants to use 5G to transmit video and other sensor information to a server farm to make life-and-death decisions of a self-driving car? Surely you jest. Or maybe you have never been through a tunnel. As for flashing a car's firmware ... you could flash at 5G speeds 7 years ago when the car is in your garage and connected to your home 802.11 AC network. Plus, flashing a car of 4G could be done at 3 AM when there's plenty of unused 4G bandwidth.

• The article says we can all enjoy 5G in our homes. Hmm. Or maybe they want 5G hotspots to replace wi-fi hotspots? Either way, many people in many countries have had 5G speeds in the home with great reliability since 2013. Wired networking allows far more multiplexing; I can't imaging 500 homes in a small area all connecting to a single 5G antenna and having better results than the existing copper wire solutions we are using now.

• Using 5G for "wireless VR" is the same concept as putting the computation for self-crashing cars in the cloud, although probably much less dangerous. We can pretty much do the same thing with fiber and 802.11 AC right now. Also, Apple's newest A14 "Bionic" chip — in all the new iPhone 12 models — has enormous hardware capability for VR, video processing, video acceleration, and neural algorithm processing. If anything, Apple seems to be going the other direction by putting these kind of processing capabilities into the phone itself.

The big bonus for 5G seems to be for the carriers. They can now theoretically serve more customers because each customer uses less of the existing bandwidth.

The limiting factor for enticing people to upgrade to 5g is there is almost no infrastructure for 5g.

It's not like most consumers know that. At this point it's all a marketing scam. I fucking hate the marketing efforts since they tend to ruin everything.

zzyzzx saysAround 170 now.

Good time to buy?

They forward split so it's actually at an all time high

https://spectatorworld.com/topic/the-golden-noose-around-apples-neck/

I bought APPL stock in 2009 when I got tired of my co-worker droning about it being "overpriced" and how Apple as a company "can't innovate".

I also bought TSLA when my BIL said in 2013 that the whole thing is bullshit and is going to come crashing down and disappear at any moment (he now drives a Tesla and raves about how the autopilot is a better driver than he is). I like to rub this one in anytime I get the opportunity. =))

$173.43/sh + $7.64 (+4.61%)

As of 11:17AM EDT. Market open.

« First « Previous Comments 202 - 241 of 241 Search these comments

Starting my New Year with a nice bump on the AAPL I picked up last year.

Consensus on AAPL to $500? It's testing 52-week high.